Our continued research into the state and status of the Real Estate market continues to point to a process that is starting to unfold in the US which may put price and activity levels at risk. Within the past two segments of this research article, we’ve highlighted how market cycles and recent market data point to a Real Estate market that may be in the early stages of a downward price cycle.

Additionally, within Part II of this article, we highlighted the human psychological process of dealing with a crisis event which also suggests a deepening price contraction event may take place within the next 12 to 24+ months.

US New Home Sales Data Was Just Released

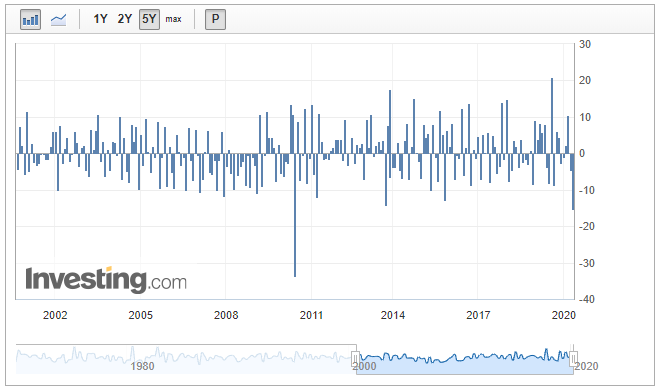

We believe the psychological process is just starting to become evident in the current data. For example, the US New Home Sales data was just released and it shows the sharpest decline in activity since June 2010 (nearly 14 months after the actual bottom in the US stock market in March 2009).

Our researcher team believes investors/traders and many consumers have become complacent with the current data and are simply in denial in attempting to relate future economic outcomes to the current set of circumstances. There has never been anything like this to disrupt global economic activity and consumer engagement over the past 100+ years. Not even the Great Depression or WWII was on this scale. Continue reading "Is Real Estate The Next Shoe To Drop - Part 3"