The recent recovery in Crude Oil has, partially, been based on increasing expectations of a global economic recovery taking place and the continued news that the US/China will work out a trade deal. Crude inventories. Just last week US Crude Oil inventories came in at +7.2 million barrels vs. expectations of -425,000 barrels (). Additionally, concerns in Syria and Libya are pushing prices a bit higher as well. Whenever there are supply concerns or uncertainty out of this region, prices tend to rise.

The facts remain very dynamic for Oil. The US is continuing to produce more and more oil and is expected to become a “net exporter” of oil this year. Economic issues will, eventually, resolve themselves, yet we don’t know the final outcome of these trade deals or how the economy will react to any milestones that are required within the final settlement. And, again, these continuing issues in Libya, Syria and near this region are likely to cause some increased levels of uncertainty over the next 60+ days.

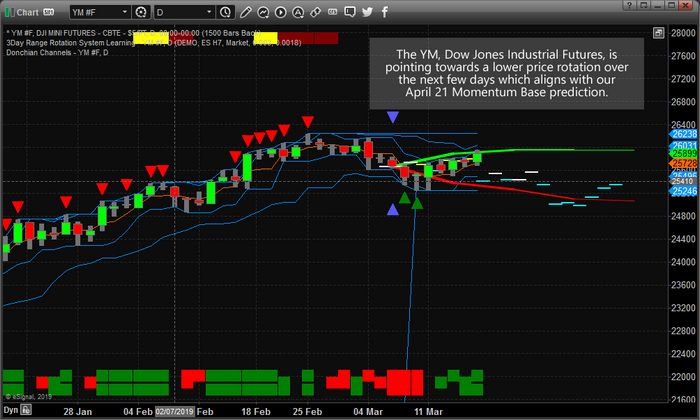

Our researchers believe the $65.00 level will act as resistance to this current upswing. We believe the upside price move may continue to levels near $67.50 before weakening and beginning a topping formation. We believe our expectation that precious metals will bottom near April 21~24 is key to understanding the dynamics of this move in Oil. As long as FEAR does not enter the market, then Oil will likely react to impulse factors exclusively related to Oil. Once Gold breaks out above $1500 per ounce, our belief is that Oil will react to fear factors related to some broader economic event driving investors into precious metals. Continue reading "Crude Oil Nearing Resistance"