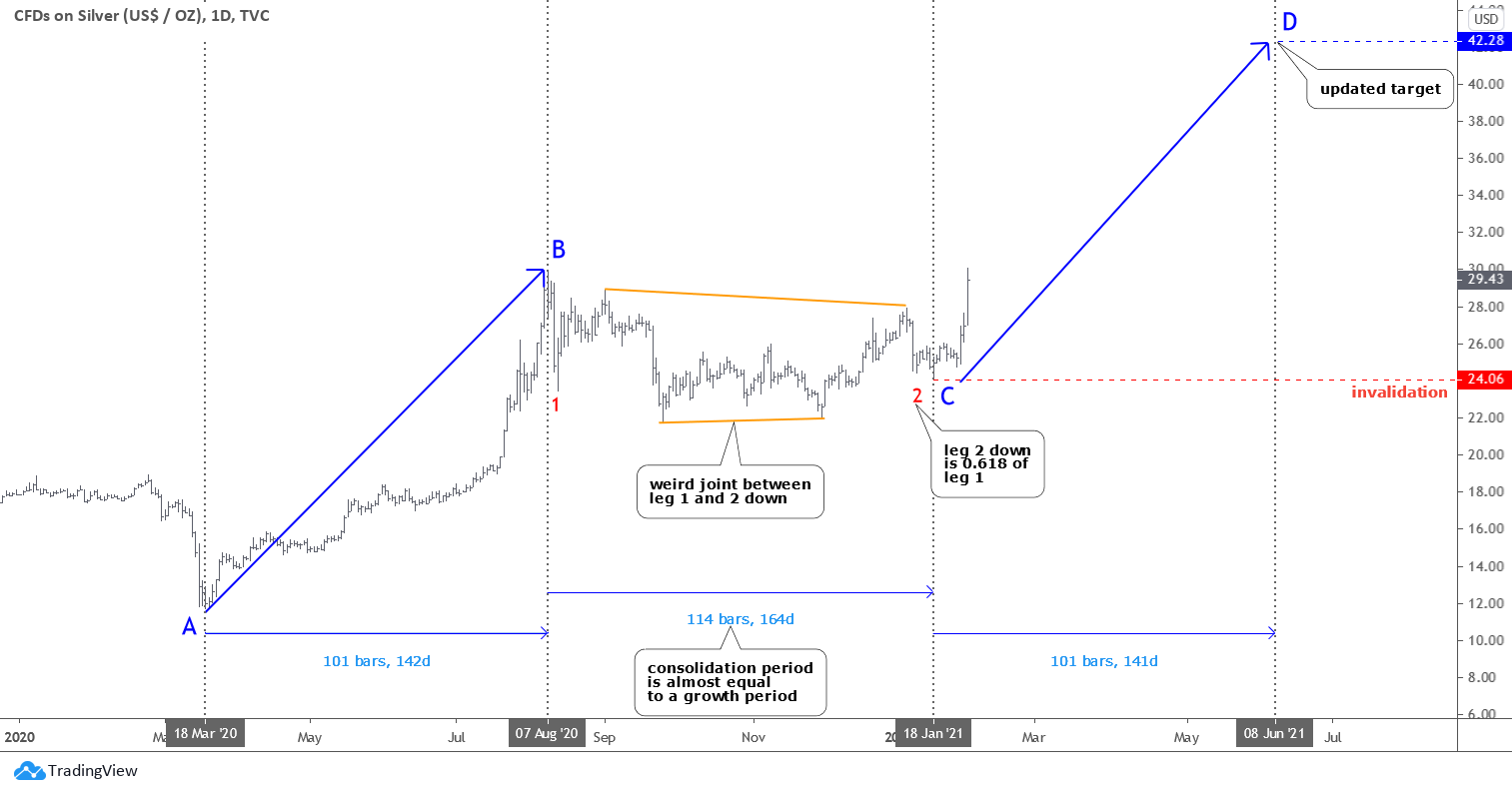

The benchmark 10-year Treasury yield spiked to 1.61% last week for the first time in more than a year. The U.S. dollar, aka “King,” fought back to the upside on this growth of the yield. Investors ran out of other assets, including precious metals, and its price dropped.

Let us see the updated structure of the U.S. dollar index (DXY) in the chart below.

It looks like the DXY moves according to your favorite orange path to the upside that was published last week. However, the sharp drop below the earlier valley eliminated both scenarios. Continue reading "Gold & Silver: The King Fights Back"