In this post, I would like to show you what happens to the structure of the crypto market over time as new stars join the universe with hopes of taking down the shining star, Bitcoin.

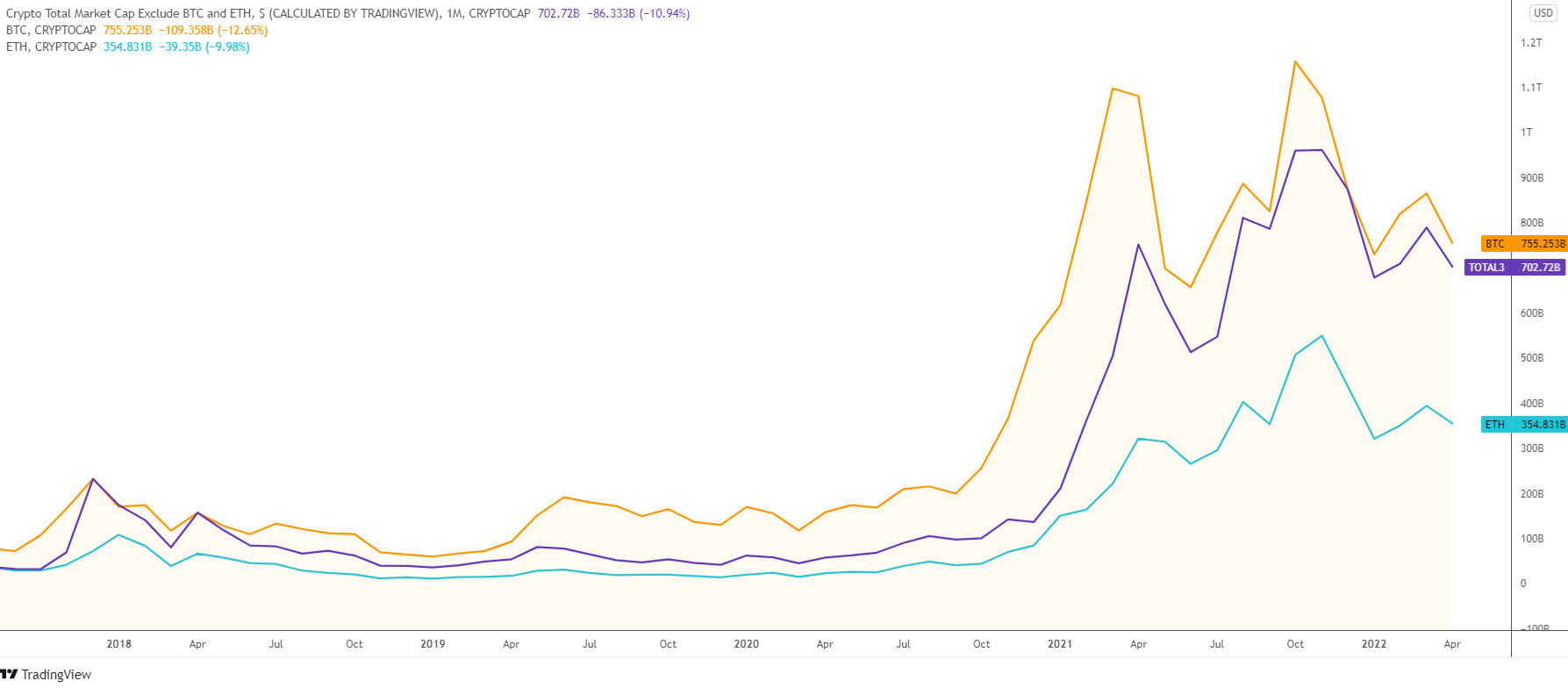

Chart 1. Market Cap Comparison: Bitcoin, Ethereum, and Altcoins

The chart above starts in September of 2017. Both altcoins and Ethereum had a market cap of around $30 billion, while the main coin had more than double that at $72 billion. The latter started to rally at once, reaching the top of $231 billion by the end of 2017. Altcoins followed Bitcoin with a delay of one month; however, the growth was more robust and the market cap caught up with that of the main coin rising more than seven-fold. It was that very rare moment when the market cap of altcoins could touch the “Sun” of Bitcoin in the considered period. Continue reading "Bitcoin Still Shines Like A Sun"