While the S&P-500 (SPY) has taken a beating over the past month, leaving the index 18% from its highs, the damage inflicted has been tame relative to the shellacking we’ve seen in the Gold Miners Index (GDX).

Not only has the GDX’s decline been double that of the S&P-500, but the most recent drop is one of the worst in a decade in terms of velocity. This is because the GDX was down 44% in just 95 trading days last Friday, translating to an annualized decline of 79%.

This decline, coupled with muted 10-year returns since the peak of the last bull market cycle (2011), and lifeless 2-year returns since the August 2020 peak, has led to despair in the sector, with many investors not even interested in looking at their portfolios if they hold precious metals stocks.

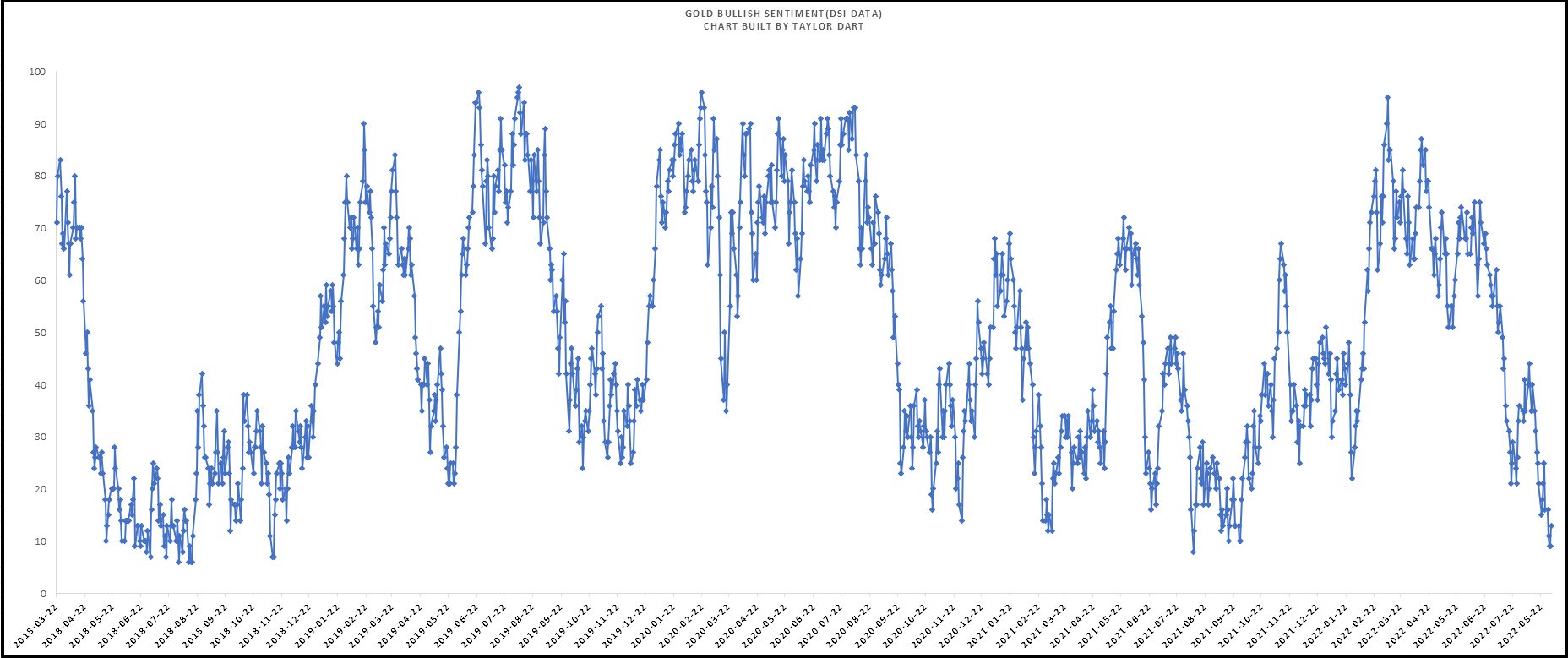

I believe this has bred conditions for a violent rally to the upside, especially with sentiment for gold (GLD) sitting at its lowest levels in 18 months, as most investors have also given up on the metal.

In this update, we’ll look at two high-quality miners that have been thrown out with the proverbial bathwater:

Agnico Eagle Mines (AEM)

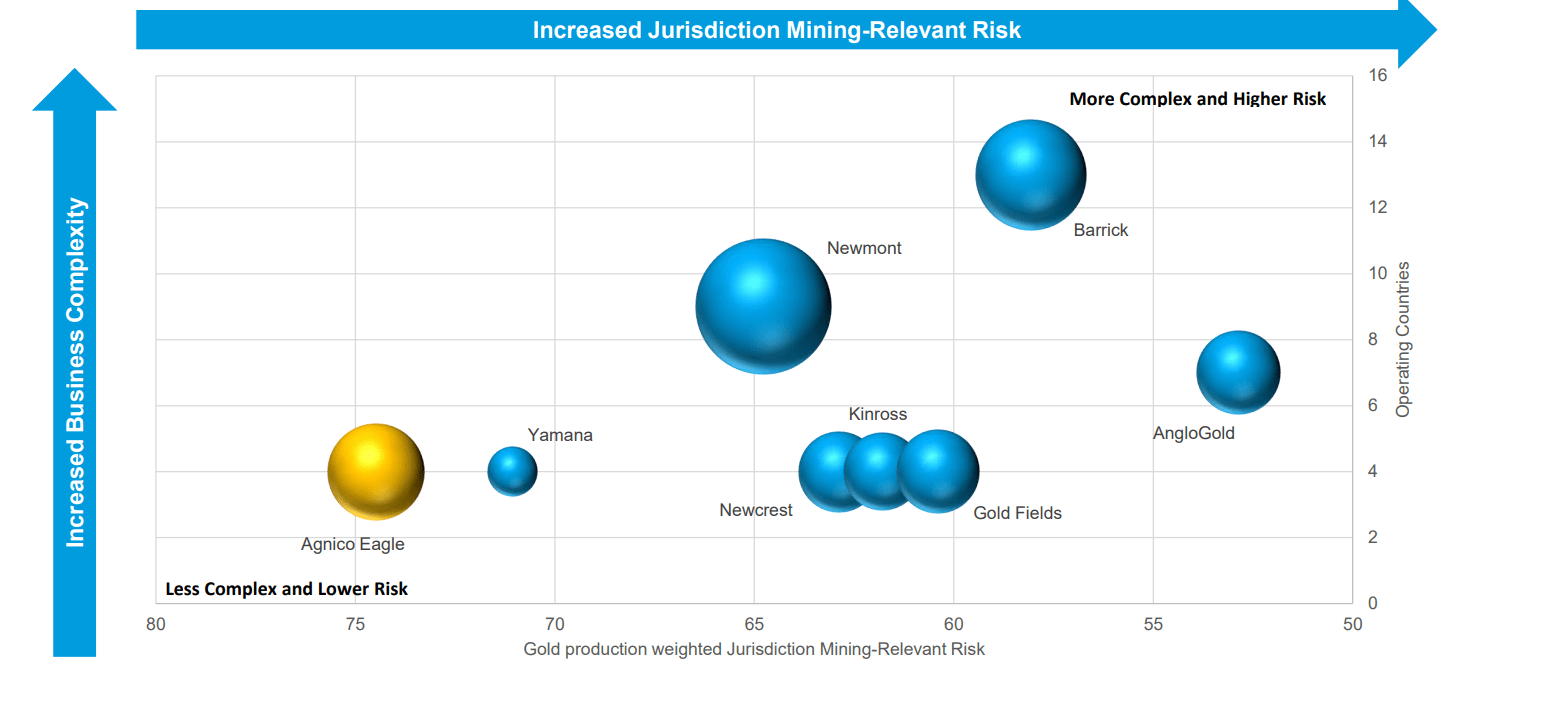

Agnico Eagle Mines (AEM) is the world’s 3rd largest gold producer, on track to produce ~3.3 million ounces of gold in 2022 from more than ten mines globally.

The major differentiator for the company relative to its peers is that it operates out of some of the safest jurisdictions globally (Canada, Australia, Finland) and boasts a margin profile that would make most producers salivate.

This is evidenced by its ~$1,010/oz operating costs in FY2022, giving the company 42% margins even at a $1,725/oz gold price. This figure compares very favorably to the industry average, with margins sitting closer to ~25% across a basket of 80 producers.

However, the other large differentiator that can’t be overstated is the company’s development pipeline and ability to grow production from existing mines. This is a big deal in an inflationary environment, and I would not be surprised to see AEM increase production to 4.1 million ounces by 2029.

This may not seem significant to investors unfamiliar with the sector, but when it comes to million-ounce producers, even holding the line on production is an achievement, given that grades are declining at most mines.

Just as importantly, AEM recently joined forces with another major producer in a merger of equals, projected to give it a benefit of $40/oz or more from synergies. So, while many producers are struggling to hold the line on margins, AEM should actually see its costs decline year-over-year ($975/oz vs. $1,010/oz).

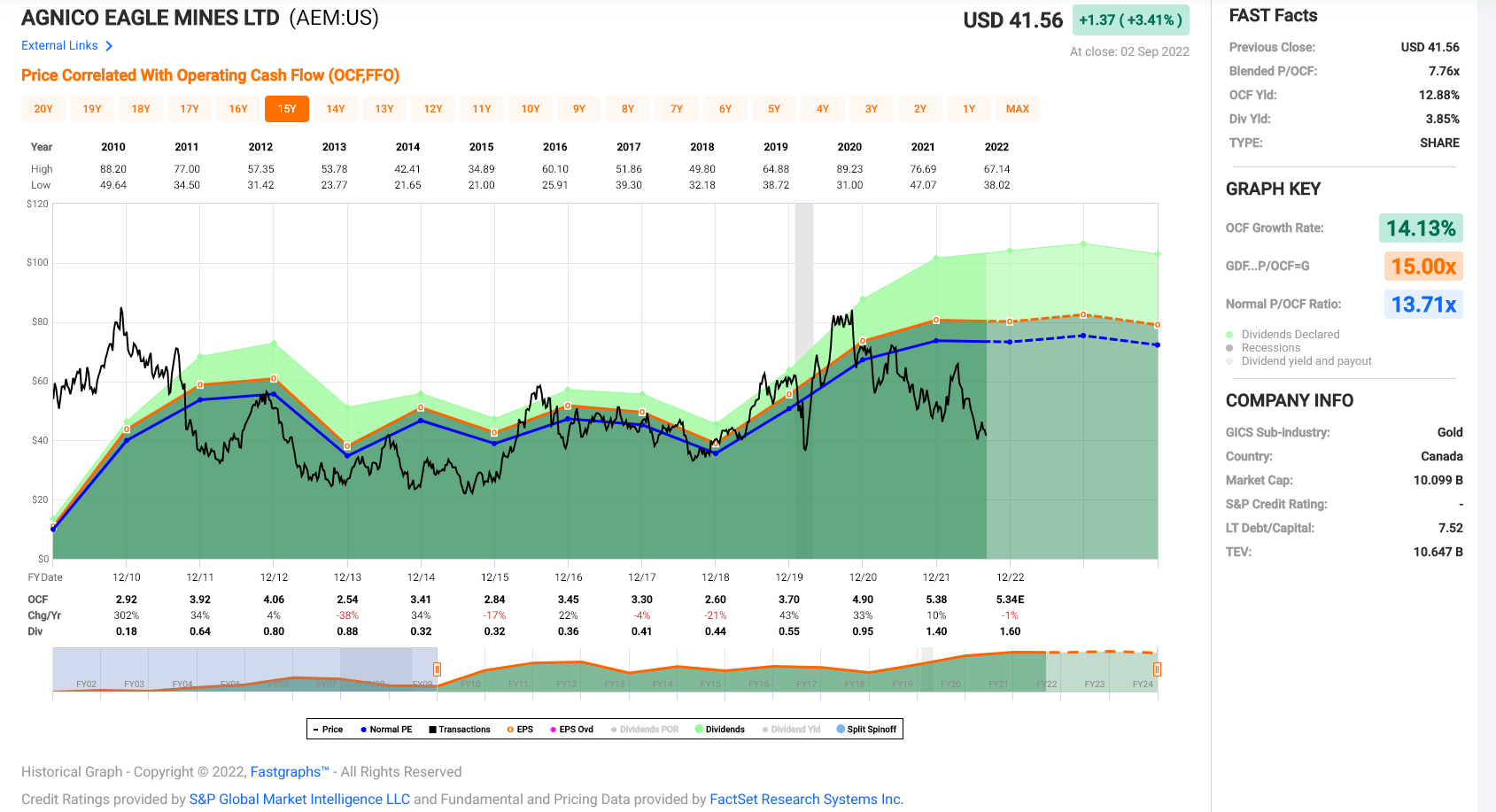

Agnico’s steadily rising production and lower costs will allow it to grow annual cash flow per share and EPS even in a flat gold price environment. In a rising gold price environment, I would not be surprised to see cash flow per share increase to $6.50 in 2024.

However, despite this key differentiator and the fact that it’s more diversified after adding three new mines following its merger, the stock trades at barely half its historical cash flow multiple. In fact, as of this week, AEM sits at 7.3x FY2023 cash flow (15-year average: 13.7x).

Given this deep discount to fair value, I see AEM as a rare mix of growth and value.

Osisko Gold Royalties (OR)

While Agnico Eagle is cheap and one of the most attractively priced names, especially given that investors are being paid to wait (~3.9% dividend yield), one small-cap gold name is as mispriced, if not more mispriced. This stock is Osisko Gold Royalties (OR), a $1.8BB market cap royalty/streaming company.

For those unfamiliar, royalty/streaming companies are a much lower-risk way to gain exposure to precious metals, given that they finance projects and mines up front and collect a portion of the sales from the asset over its mine life. The result is that, unlike producers, they are inflation-resistant and not subject to rising labor costs, materials costs, and energy prices.

In a sector with multiple royalty/streaming stocks to choose from, Osisko Gold Royalties stands out for several reasons.

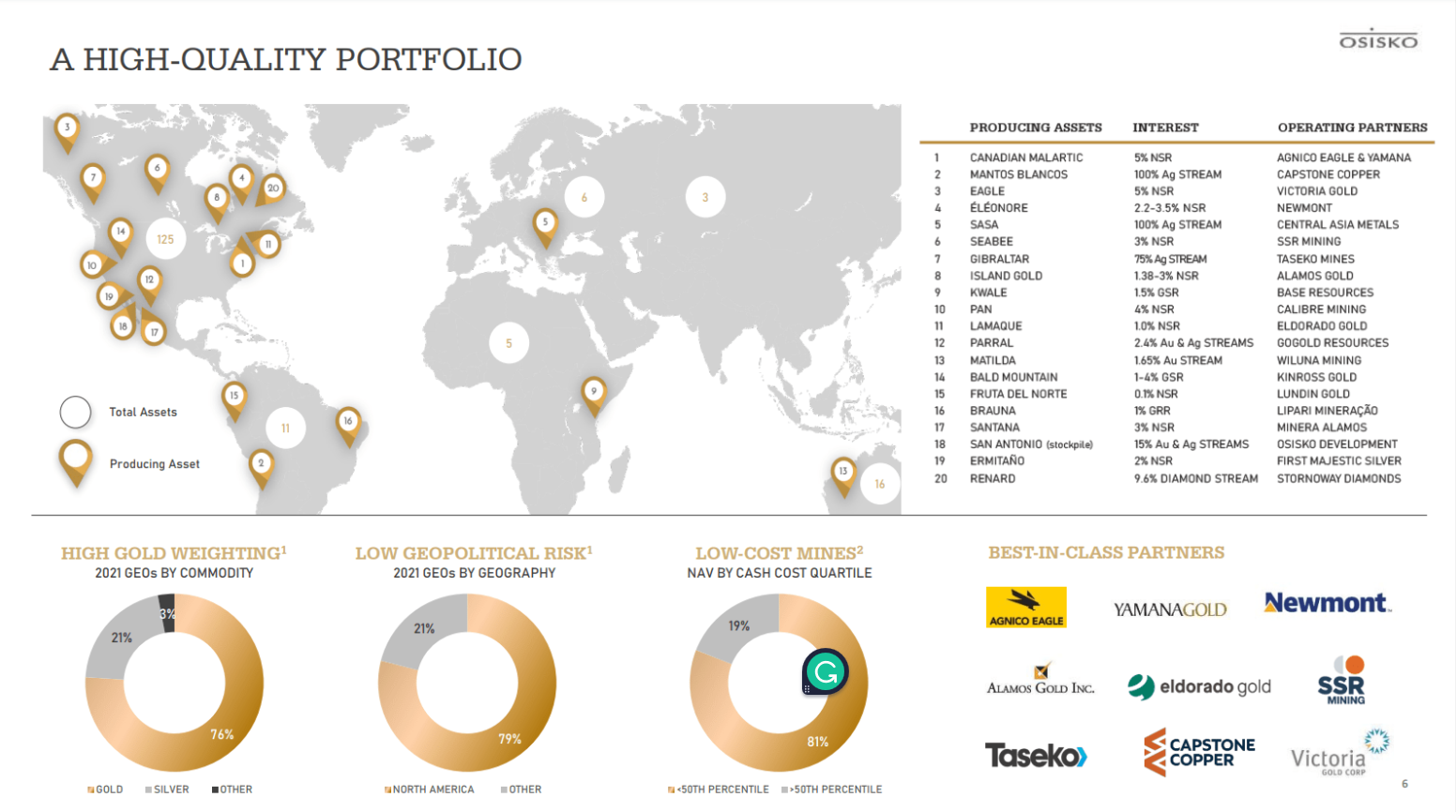

The first is that the company has the #2 growth profile in the sector, expecting to grow annual attributable production from 80,000 gold-equivalent ounces [GEOs] in FY2021 to 135,000 GEOs in FY2026. This means that even if gold and silver prices go sideways at $1,750/oz, its revenue will increase from $160MM in FY2021 to $236MM in FY2026, an 8.1% compound annual sales growth rate. If gold prices return to their highs, this growth rate jumps to 11.5%, giving OR one of the highest growth rates sector-wide.

The other key differentiator for the company is that its royalties/streams are in some of the safest jurisdictions globally, meaning that it’s not subject to repatriation risks in Kyrgyzstan, violence in Mali and Burkina Faso, and a shift to more leftist policies in South America. This makes the company’s growth much lower risk and lets investors sleep well at night with the comfort that the mines it has royalties on will remain in production without any negative surprises.

Despite this robust growth profile with an 8.1% revenue CAGR at conservative gold prices, and assuming the company does no additional deals on producing assets over the next four years OR trades at a massive discount to its peer group.

This is evidenced by OR being valued at just 0.80x P/NAV and less than 10x FY2024 cash flow estimates or ~8x cash flow after subtracting out its investment portfolio. The current valuation figure is 50% below the historical average of more than ~20x cash flow and 1.60x P/NAV or higher for the larger royalty/streamers.

As new assets come online and production grows from existing assets, I see the potential for a significant re-rating to more than $18.00 per share.

To summarize, I see the stock as a steal below $10.00 per share, and I believe the current valuation can be justified by just its six largest royalty/streaming assets (Malartic, Eagle, Mantos, Windfall, Island, Renard) and its investment portfolio, let alone its more than 100+ other royalty/streaming assets it’s not receiving any credit for in a market where fundamentals have gone out the window.

With the gold sector being the most hated it’s been in years, it’s easy to shy away from the opportunities, especially with many producers seeing a margin crunch.

However, these opportunities lead to forced selling of the best names, and OR and AEM are practically being given away due to despondency sector-wide. Hence, I see this correction in both names as a buying opportunity.

Disclosure: I am long OR, AEM

Taylor Dart

INO.com Contributor

Disclaimer: This article is the opinion of the contributor themselves. Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information in this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.