Inflation – The Stock Market Achilles Heel

The stock market is a forecasting instrument that anticipates and prices-in future economic conditions. The confluence of rising interest rates, inflation, China Covid lockdowns, and the war in Ukraine has resulted in months of selling. The relentless, indiscriminate selling has pushed the Dow Jones and S&P 500 deep into correction territory while pushing the Nasdaq deep into a bear market. As such, the market appears to be factoring in a worst-case scenario that may result in a Federal Reserve induced recession as a function of over-tightening of monetary policy and/or its inability to combat inflation responsibly for an economic “soft landing.”

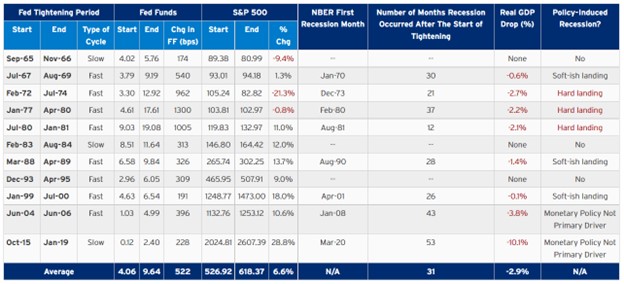

The markets are anticipating sequential rate hikes through 2023; however, if inflation has peaked and the tightening cycle turns dovish, then the markets will likely turn the tide on this relentless selling. If inflation has peaked and yields stabilize, these oversold conditions could easily reverse course. For April, market conditions have not been this bad for the Nasdaq and S&P 500 since the Financial Crisis and the Covid 2020 lows, respectively. With signs of inflation peaking, the markets may have fully priced in a worst-case scenario for an inflection point from these oversold conditions. During Federal Reserve tightening cycles, markets typically generate positive returns with an average of a 6.6% return over the tightening period (Figure 1).

Figure 1 – Market performance during periods of Federal Reserve tightening cycles

Signs Of Peaking Inflation

There are many areas of the economy where inflation is receding or has peaked. Although energy prices remain elevated due to the Russia-Ukraine conflict, other commodities and inputs into the CPI composite that contribute to inflation are falling. There have been pullbacks in used car sales, easing supply chains (China’s Covid lockdowns are prolonging the supply chain recovery), copper, steel, grain, soy, freight, lumber, and aluminum prices.

Inflation is assessed via two means, the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) index. The core PCE index removes the more volatile food and energy prices, and the latest data shows the PCE is pulling back slightly.

Through 2022, the core PCE climbed 5.2% through March. That reflected a minor deceleration from the 5.3% pace seen in February. The month-over-month reading was even more encouraging of a deceleration. Core PCE rose 0.3% through March, in line with the February pace and staying below the 0.5% increases observed in October through January.

Supply Chain Bottleneck Easing

The persistent inflation is largely a function of supply chain issues worldwide. Shipping delays, supply shortages, and production bottlenecks have yet to be resolved. This creates a supply-demand imbalance with subsequent price hikes to offset increased costs associated with these supply chain issues. Freight rates have been declining since September 2021 and seem to be in a downward trend. March also marked the third consecutive month of declines in average delays for container ships. Lower freight rates should translate into removing a major inflation pressure point.

The Consumer

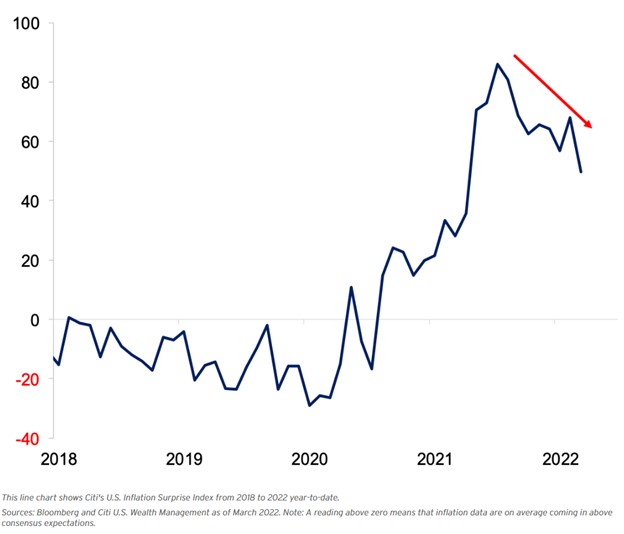

Consumers are not concerned about inflation worsening. Citi's US Inflation Surprise Index, which measures the degree to which inflation data surpasses or falls below estimates, has dramatically declined recently, signaling inflation expectations may have already hit their peak (Figure 2).

Figure 2 – Inflation sequentially dropping recently, indicating that inflation has likely peaked

The drop could be a harbinger of slower price growth. Analysts at UBS also said this month that they expect inflation will likely peak in March and then fall "sharply." These may be indicating that inflation may finally be reverting to pre-pandemic levels. Additionally, rising mortgage rates should cool the housing market and continue to put downward pressure on overall inflation.

Rates Hikes

The Federal Reserve increased interest rates by 50 basis points in early May, the biggest hike in two decades. This was on top of 25 basis points back in March, the first hike in more than three years. Powell said 50 basis point hikes might be needed at the next two meetings in June and July. Rate increases are also seen in the September, November, and December meetings. Powell did take the prospect of a 75 basis point rate hike off the table in an attempt to provide certainty and engineer a soft landing.

Conclusion

The confluence of rising interest rates, inflation, China Covid lockdowns, and the war in Ukraine has resulted in months of selling. The relentless, indiscriminate selling has pushed the Dow Jones and S&P 500 deep into correction territory while pushing the Nasdaq deep into a bear market. If inflation has peaked and the tightening cycle turns dovish, then the markets will likely turn the tide on this relentless selling.

Several inputs into the CPI composite that contribute to inflation are falling. There have been pullbacks in used car sales, easing supply chains (China’s Covid lockdowns are prolonging the supply chain recovery), copper, steel, grain, soy, freight, lumber, and aluminum prices. The Federal Reserve increased interest rates by 50 basis points in early May, which was on top of 25 basis points back in March. Powell said 50 basis point hikes might be needed at the next two meetings in June and July. Rate increases are also seen in the September, November, and December meetings. Powell did take the prospect of a 75 basis point rate hike off the table in an attempt to provide certainty and to engineer a soft landing.

Now that inflation seems to be abating and rates are rising to directly curb these inflation pressures, the markets may have priced in a worst-case scenario. As new data points enter the fray on the inflation front, the markets may be close to moving to an inflection point to move higher.

Noah Kiedrowski

INO.com Contributor

Disclosure: Stock Options Dad LLC is a Registered Investment Adviser (RIA) firm specializing in options-based services and education. There are no business relationships with any companies mentioned in this article. This article reflects the opinions of the RIA. Any recommendation contained in this article is subject to change at any time. No recommendation is intended to constitute an entire portfolio. The author encourages all investors to conduct their own research and due diligence prior to investing or taking any actions in options trading. Please feel free to comment and provide feedback; the author values all responses. The author is the founder and Managing Member of Stock Options Dad LLC – A Registered Investment Adviser (RIA) firm www.stockoptionsdad.com defining risk, leveraging a minimal amount of capital and maximizing return on investment. For more engaging, short-duration options-based content, visit Stock Options Dad LLC’s YouTube channel. Please direct all inquires to

in**@st*************.com

. The author holds shares of of AAPL, ACN, ADBE, AMD, AMZN, ARKK, AXP, BA, BBY, C, CMG, CRM, DIA, DIS, FB, FDX, FXI, GOOGL, GS, HD, HON, IBB, INTC, IWM, JPM, MA, MS, MSFT, NKE, NVDA, PYPL, QCOM, QQQ, SBUX, SPY, SQ, TMO, and V.