Just before the COVID-19 pandemic struck the markets, Ray Dalio was recklessly dismissive of cash positions, stating "cash is trash." Even Goldman Sachs proclaimed that the economy was recession-proof via "Great Moderation," characterized by low volatility, sustainable growth, and muted inflation. Not only were these assessments incorrect, but they were ill-advised in what was an already frothy market with stretched valuations prior to COVID-19 hitting the markets. The COVID-19 pandemic was a true back swan event that no one saw coming as far as its abruptness, scale, and impact. This COVID-19 induced sell-off was the worst since the Great Depression in terms of breadth and velocity of the sell-off.

The S&P 500, Nasdaq, and Dow Jones shed a third or more of their market capitalization through late March 2020. Some individual stocks lost over 80% of their market capitalization. Other stocks were hit due to the market-wide meltdown, and many opportunities were presented as a result. Investors were presented with a unique opportunity to start buying stocks and take long positions in high-quality companies. Throughout this market sell-off, I took long positions in individual stocks, particularly in the technology sector and broad market ETFs that mirror the S&P 500, Nasdaq, and Dow Jones. It was important to put this black swan into perspective and see through this event on a long term basis. Viewing the COVID-19 sell-off as an opportunity to buy stocks that only comes along on the scale of decades has proven to be fruitful. When using past recessions as a barometer, I started buying stocks when the sell-off reached 15% and continued buying into further weakness to improve cost basis.

Most Extreme and Rare Sell-Off Ever

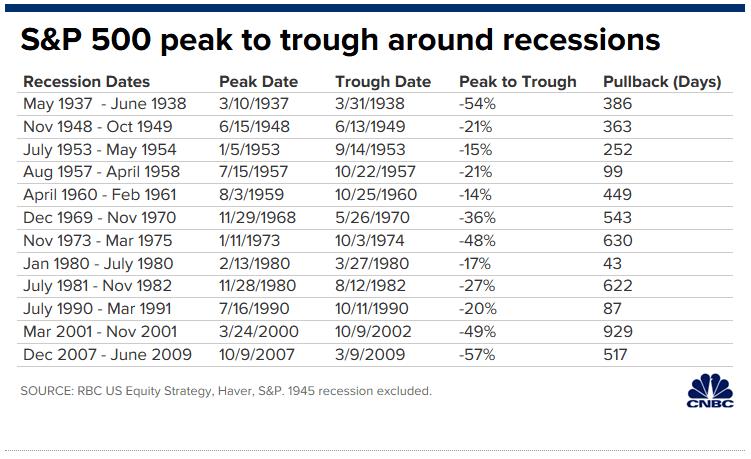

Out of the 12 recessions that have occurred since May of 1937, the average sell-off for the S&P 500 was -31.6% with a range of -57% (2008 Financial Crisis) to -14% (1960-1961). The COVID-19 pandemic has crushed stocks beyond the average recession sell-off of -31.6%. The markets didn't reach the most severe sell-off levels by historical standards despite the possibility for more downside potential. Regardless, at initial recession levels of 15% declines, I began putting cash to work as that was the prudent action for any long-term minded investor.

The abrupt and drastic economic shutdown and velocity of the U.S. market's ~30% drop within a month bring parallels to the 1930s (Figure 1). This sell-off has been extreme and rare in its breadth, nearly evaporating entire market capitalizations of specific companies. The pace at which stocks have dropped from their peak just last month from all-time highs is the fastest in history. The major averages posted their worst week since the financial crisis in March. These broader indices and many individual stocks were heavily suppressed and ripe for buying at the initial sell-off levels through the COVID-19 lows.

Figure 1 – Major market sell-offs and their corresponding peak-to-trough declines with the average sell-off coming in at -31.6%

Long-Term View

COVID-19 presented investors with a unique opportunity to invest in stocks and stay the course over the long term. Per Bank of America, looking at data going back to 1930, if an investor missed the S&P 500′s 10 best days in each decade, total returns would be just 91%, compared to the 14,962% return for investors who held steady throughout the ups and downs. Timing the market and trying to exit into cash during this time may have been more dangerous than staying the course.

The S&P 500 index (SPY) was trading at ~14 times earnings for 2019 when the index took a 30%-plus COVID-19 haircut. If next year recovers to the 2018-19 level again of $165 per share, the market would still at 14 times forward earnings, which is a discount to historic P/E multiples. The market traded at a P/E of 14.5 during the market meltdown in Q4 2018. Previous bottoms have seen lower P/E ratios in history with a P/E of 11 on March 9, 2009, the bottom during the financial crisis.

Getting started is easy! Test our tools with a 30-day trial.

At a certain juncture, an inflection point would occur, and potentially a big rally would mark the turn in this market. If you were to sell during the downturn, you would've been left on the sidelines, hurting your long-term returns per the data. That was an opportunity to buy and go long equities, not sell and exit equities.

Per Bank of America, "the probability of losing money plummets to 0% over a 20-year time horizon." Time and again, bear markets have proven to be good buying opportunities; however, it can just take several years for the gains to be realized.

"Investors with longer-term investment horizons should remain invested in stocks," Goldman said, while Bank of America noted that "time is money for equities." The firm added that "for equity investors, the best recipe for loss avoidance is time: as time horizons lengthen, the probability of losing money in stocks has decreased."

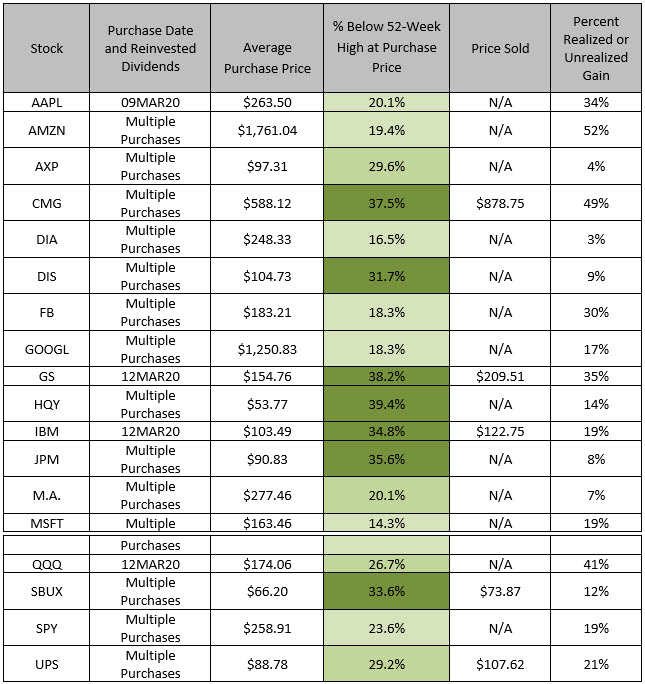

Initiating Long Positions

The S&P 500, Dow Jones, and Nasdaq were all off over a third from their highs. Throughout this stretch of market weakness, I started to buy long positions in names that presented compelling value and growth beyond the COVID-19 health crisis. These names are well-positioned to explode higher when the market inevitably rebounds. Many of these positions have been purchased well off their highs, and I've averaged down throughout this sell-off. Some positions were initiated too early in hindsight; however, I've scaled into these names over time with multiple purchases in small increments (Table 1).

Initiating Long Index Positions

I started to buy long positions in these indices to reinforce the foundation of my portfolio and see beyond the COVID-19 health crisis. These broad-based positions will serve as a foundation when the market recovers, and I'll reinvest the dividends throughout the process. I plan on holding the index positions to serve as an anchor to the portfolio.

Conclusion

After this epic sell-off, stocks were too cheap to ignore, and starting to buy at the historic recession levels was prudent. There was a wide array of high-quality names that were selling at deep discounts; some were off ~40% from their 52-week highs. When you sell during a panic, you may miss the market's best days as rapid sell-offs often lead to quick bounces. COVID-19 has sent shock waves through the markets, causing double-digit declines across all major indices. Selling has proven to put investors at risk for missing out on some of the best days ahead for the market. COVID-19 induced sell-off has presented an excellent opportunity to take long positions on high-quality names such as Apple (AAPL), Amazon (AMZN), Chipotle (CMG), Disney (DIS), Microsoft (MSFT), Google (GOOGL), Facebook (FB), Mastercard (MA) and Starbucks (SBUX) to name a few as well as the broader indices such as S&P 500 ETF (SPY), Nasdaq (QQQ) and Dow Jones ETF (DIA).

Laying down a foundation with broad-based ETF indices and/or reinforce your core portfolio holdings was the prudent move, especially if you'd like to avoid single stock risk. Rotating out of some of these positions as the market has taken a V-shaped recovery is also prudent. I sold my positions in CMG, G.S., IBM, SBUX, and UPS for realized gains of 49%, 35%, 19%, 12%, and 21%, respectively.

Noah Kiedrowski

INO.com Contributor

Disclosure: The author holds shares in AAL, AAPL, AMC, AMZN, AXP, DIA, DIS, F.B., GOOGL, HQY, JPM, KSS, MA, MSFT, QQQ, SPY and USO. However, he may engage in options trading in any of the underlying securities. The author has no business relationship with any companies mentioned in this article. He is not a professional financial advisor or tax professional. This article reflects his own opinions. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned. Kiedrowski is an individual investor who analyzes investment strategies and disseminates analyses. Kiedrowski encourages all investors to conduct their own research and due diligence prior to investing. Please feel free to comment and provide feedback, the author values all responses. The author is the founder of www.stockoptionsdad.com where options are a bet on where stocks won’t go, not where they will. Where high probability options trading for consistent income and risk mitigation thrives in both bull and bear markets. For more engaging, short duration options based content, visit stockoptionsdad’s YouTube channel.