COVID-19 ushered in the real possibility of widespread loan defaults, liquidity issues, ballooning credit card debt, and stressed mortgages. To exacerbate these COVID-19 realizations, a delicate balance between interest rates, Federal Reserve commentary, yield curve inversion, and concerns over a potential/scale of depression in late 2020 must be attained. The financial cohort is in a difficult space as the broader economic backdrop continues to dictate whether these stocks can appreciate higher. Ironically, in 2019 banks logged record share buybacks and increased dividend payouts stemming from successful stress tests. The initial shock of the COVID-19 pandemic resulted in the market capitalizations of many large banks to be cut by ~50%. Some of the largest banking institutions such as Citigroup (C), Goldman Sachs (GS), JPMorgan (JPM), and Bank of America (BAC) were sold off in the most aggressive manner since the Financial Crisis. At these depressed levels, are the banks investable in light of the COVID-19 backdrop?

Destabilizing Effects of COVID-19

COVID-19 has materialized into the black swan event that only comes along on the scale of decades. This COVID-19 induced sell-off has been the worst since the Great Depression in terms of breadth and velocity of the sell-off. This health crisis has crushed stocks and decimated entire industries such as airlines, casinos, travel, leisure, and retail with others in the crosshairs. The S&P 500, Nasdaq, and Dow Jones have shed approximately a third of their market capitalization, with the sell-offs coming in at 33%, 29%, and 36%, respectively, in late March. Some individual stocks have lost over 80% of their market capitalization and now run the risk of filing for bankruptcy.

The longer the COVID-19 economic shut down persists, the higher the unemployment will rise. More companies will run the risk of liquidity issues, access to capital, and potential bankruptcy. On the consumer side, massive unemployment will negatively impact the ability to pay mortgages, rents, student loans, and auto loans. Consumer demand will plummet as a function of rising unemployment. In the backdrop of all these destabilizing financial conditions are the large financial institutions. The banks underpin all the lines of credit and liabilities which appear to be in jeopardy after the COVID-19 pandemic.

Fed Unleashes Economic Stimulus

The Federal Reserve and the Federal government have unleashed fiscal and monetary measures, unlike anything seen in the past. On April 9, the Labor Department reported that another 6.6 million Americans filed unemployment claims. Over just three weeks, more than 16 million Americans, or 10% of the workforce is unemployed.

The Fed has issued a series of programs for businesses, households, and governments totaling $2.3 trillion in economic stimulus.

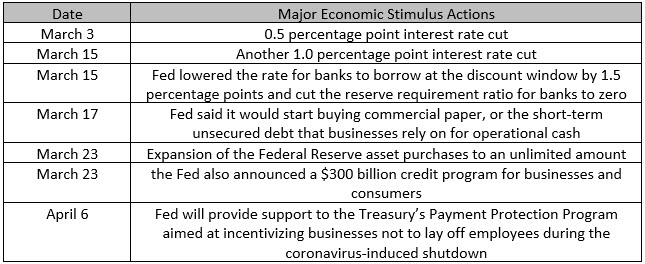

Over the past six weeks, the Fed has implemented a series of measures:

Collectively, these programs combine to provide more than $6 trillion of liquidity to the financial and business system. The government is being very proactive and providing ample liquidity aimed at keeping businesses afloat, lines of credit open, and consumers as whole as possible.

Banks Were Healthy Prior To COVID-19

The most recent annual stress test results came back overwhelmingly positive for the financials. 18 of the biggest institutions operating in the U.S. had to show they can survive an economic downturn while maintaining the ability to make loans and continue paying out dividends. That hinges on a bank’s capital, or the difference between assets and liabilities, which acts as a cushion to absorb losses. Every bank won approval to boost shareholder payouts under the capital plans they submitted. Collectively, the results showed a resilient banking industry compared to the financial crisis a decade ago, when the government had to bail out lenders. The banks have more than doubled the capital it has to absorb losses to about $800 billion, per the Federal Reserve.

The banks expanded share buybacks and increased dividends after passing the Federal Reserve’s annual stress tests. Goldman Sachs (GS) boosted its quarterly dividend and authorized a $7 billion stock repurchase program. JPMorgan (JPM) lifted its dividend and was authorized to repurchase up to $29.4 billion in stock under a new program. Bank of America (BAC) increased its dividend and was authorized to repurchase up to $30.9 billion in stock. Citigroup (C) boosted its dividend and was authorized to repurchase $21.5 billion in stock.

The big banks, specifically JP Morgan (JPM), Bank of America (BAC), Goldman Sachs (GS), and Citigroup (C), were coming off of record profits and revenue across the board. All of these solid numbers from the big banks were expected to continue until COVID-19 hit.

Investable Despite Systemic Risks

The banks are far stronger than they were during the 2008 Financial Crisis and have rigorous annual stress tests. Banks are well capitalized and working with clients and consumers on payments deferrals if impacted by COVID-19. The banks can assist in providing a financial bridge to those businesses and consumers negatively impacted by COVID-19. As this pandemic passes and economic activity rebounds, the banks will present value at these oversold and depressed levels. JP Morgan (JPM), Bank of America (BAC), Goldman Sachs (GS), and Citigroup (C) have lost a significant amount of market capitalization as a result of the COVID-19 impact and present compelling investment opportunities.

Figure 1 – JP Morgan and Wells Fargo posted Q1 earnings, and the companies added $6.8 billion and $3.1 billion to loan loss provisions/reserve builds, respectively, in response to the COVID-19 fallout.

Conclusion

The COVID-19 pandemic has undoubtedly had and will continue to have a negative impact on economic activity worldwide. COVID-19 has ushered in the real possibility of widespread loan defaults, liquidity issues, ballooning credit card debt, and stressed mortgages. To exacerbate these COVID-19 realizations, a delicate balance between interest rates, Federal Reserve commentary, yield curve inversion, and concerns over a potential/scale of depression in late 2020 must be attained. Despite this overwhelmingly negative backdrop, massive fiscal and monetary policies are being adopted quickly to blunt this economic fallout that amounts to ~$6 trillion in total stimulus. The banks are far stronger than they were during the 2008 Financial Crisis and have rigorous annual stress tests to show they can survive an economic downturn while maintaining the ability to make loans and continue paying out dividends. Some of the biggest banks, specifically JPMorgan (JPM), Bank of America (BAC), Goldman Sachs (GS), and Citigroup (C), were coming off of record profits and record revenue across the board prior to COVID-19. The banks are much more resilient and capitalized with unprecedented government stimulus coming into the fold. As the economy slowly reopens, these banks will likely appreciate back to previous levels while maintaining their dividend payouts. Many of the banks present compelling investment opportunities at these depressed levels.

Noah Kiedrowski

INO.com Contributor

The author holds shares in AAL, AAPL, AMC, AMZN, AXP, CMG, DIA, DIS, FB, GOOGL, GS, HQY, IBM, JPM, KSS, MA, MSFT, QQQ, SBUX, SLB, SPY, TRIP, UPS, USO and X. However, he may engage in options trading in any of the underlying securities. The author has no business relationship with any companies mentioned in this article. He is not a professional financial advisor or tax professional. This article reflects his own opinions. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned. Kiedrowski is an individual investor who analyzes investment strategies and disseminates analyses. Kiedrowski encourages all investors to conduct their own research and due diligence prior to investing. Please feel free to comment and provide feedback, the author values all responses. The author is the founder of www.stockoptionsdad.com where options are a bet on where stocks won’t go, not where they will. Where high probability options trading for consistent income and risk mitigation thrives in both bull and bear markets. For more engaging, short duration options based content, visit stockoptionsdad’s YouTube channel.