The OPEC ministers are scheduled to meet December 5th in Geneva. Their non-OPEC partners will join them December 6th. As of this writing, reports are that Russia and Saudi Arabia are not yet pushing for deeper cuts in 2020 are likely to call for full compliance by all OPEC+ participants and extend the existing quotas scheduled to end in March through June.

However, developments in non-OPEC countries may require deeper cuts to prevent glut conditions. And a couple of surprises within OPEC may doom the group’s efforts. Saudi Aramco is promising a dividend payment to IPO shareholders in proportion to a $75 billion dividend for all Aramco shareholders and will pay the new shareholders their due regardless if it is unable to pay the government its share of the dividend in full. Therefore, the Kingdom may be faced with a major financial challenge in 2020.

U.S. Supply

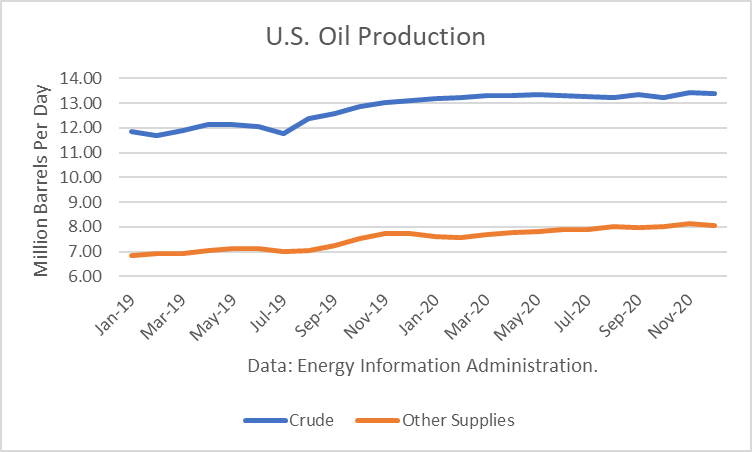

Higher production forecasts for the U.S. are coming under increased scrutiny and are subject to a wide variety of opinions. The base case of the Energy Dept. is a rise of 1.0 million barrels in crude production from 12.29 to 13.29 million barrels per day. It also projects an increase of 680,000 barrels per day in petroleum liquids, mainly NGLs.

The International Energy Agency (IEA) is projecting a US increase in crude production of 1.2 million. But Goldman Sachs revised its forecast down to 600,000 b/d. And HIS Markit is even lower at 440,000 b/d.

But demand growth projections have also been revised lower than the consumption has been growing. The Energy Dept. is looking for growth of 1.37 million barrels per day, but the IEA has revised its rise to just 980,000 b/d.

Non-OPEC, Non-U.S.

Much of the world’s production gains have been in the U.S. and, more specifically in the Permian Basin. However, in 2020, supplies in several more countries may even exceed U.S. gains of they are at the lower end of estimates.

Brazil’s production is projected to rise to 460,000 b/d, Norway’s to 440,000 b/d, and Guyana’s to 120,000 b/d.

Brazil’s offshore production potential is scaling-up. Production has climbed about 300,000 b/d, and total liquids have increased by 480,000 b/d year-over-year in August to a record 3.1 million barrels per day, an all-time high, with crude oil rising by 220,000 b/d in August. The IEA expects Brazilian output to rise to 3.22 million b/d by the end of 2019, and the South American country is expected to increase output by another 460,000 b/d by the end of 2021.

In Norway, the giant Johan Sverdrup offshore oilfield started producing October 5th, ahead of schedule and under budget. Its capacity in 2020 is rated at 440,000 b/d by the summer, but it is ramping up more quickly than predicted. Equinor now expects it to reach 400,000 b/d in December. And its expected operating cost at less than $2/b, thanks to power from the onland electrical grid, which uses hydropower from 937 dams.

First oil from Guyana is projected in December. It will take about three months to reach first phase production of 120,000 b/d. Apart from focusing on shale oil in the Permian Basin, ExxonMobil’s biggest growth area is Guyana.

Furthermore, additional gains are expected in all three countries in 2021. OPEC is looking at a declining market for its oil unless demand gains a very robust.

Call on OPEC

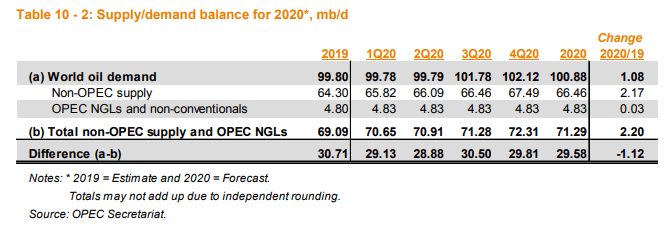

In OPEC’s Monthly Oil Market Report (MOMR) for November, the projected “call” (demand) for OPEC oil in 2020 is 29.58 million barrels per day, off 1.1 million from the 2019 level. And 2019 was down 900,000 b/d from 2018.

During the first half of 2020, demand for OPEC oil is expected to average just 29.0 million. OPEC reported that October production averaged 29.650 million, given the rebound in production by Aramco from September when it was attacked. And so if the cartel wants to prevent a large stock build in the first half of 2020, that means additional cutbacks are necessary.

In addition, there could be surprises next year from two OPEC producers who are subject to U.S. sanctions that have curtailed supplies. It is possible that the U.S. and Iran could reach an agreement which would result in the lifting of sanctions. Since 2020 is a U.S. presidential year, President Trump is motivated to make a deal which would give him a foreign policy win, and at the same time result in a flood of Iranian oil, which would like drive gasoline prices lower as voters decide on who to elect in November.

And Venezuela may surprise by lifting its production in 2020. PDVSA has budgeted for a 600,000 b/d increase next year. It may get help from Rosneft that could turnaround its faltering oil industry.

Conclusions

Russia has signaled that it is not interested in participating in deeper cuts. And so the burden for additional cuts will likely fall solely on Saudi Aramco. It will have to reduce its production to the low 9s and potentially much lower. At the same time, it will be on the hook to provide the full dividend payment to its new shareholders.

Reports are that there is no international demand for the Aramco IPO beyond the Gulf area. And as it appears, market conditions will deteriorate further in 2020. And so, Aramco’s plan for an international listing for the IPO appears doomed.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

I don’t have US millions of dollars I would so be in but can’t afford it I am sorry