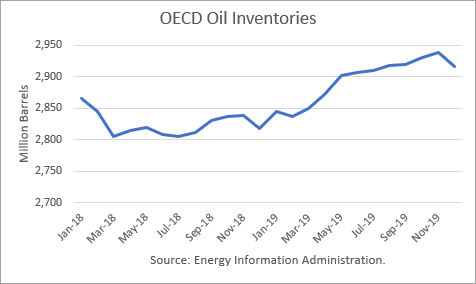

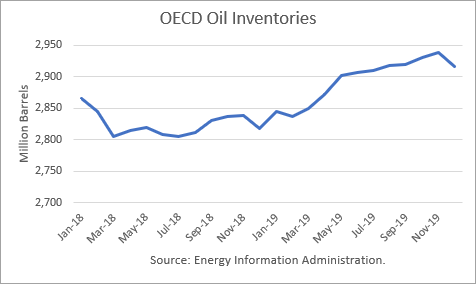

The Energy Information Administration (EIA) released its Short-Term Energy Outlook for October, and it shows that OECD oil inventories likely bottomed in July at 2.806 billion barrels. It shows inventories rising in the third quarter, contrary to the normal seasonal trend. However, it forecasts that stocks will drop in December to 2.817 billion after the Iranian sanctions are expected to go into effect.

Throughout 2019, OECD inventories are generally expected to rise, ending the year with 98 million barrels more than at the end of 2018. The expected drop in Iranian production, due to the U.S. sanctions, is forecast to be more-than-offset by increases from other producers, such as the U.S., Canada and the Gulf states of Saudi Arabia, Kuwait and the UAE.

Crown Prince Mohammed bin Salman of Saudi Arabia has recently stated that KSA can produce at least 12 million barrels per day. If it does increase output to that level, this would be a major “surprise” to world markets since its production has never exceeded 11 million.

The moment of truth is near: how much of Iran’s production and exports will be cut, and will that loss be offset? We will know soon, as the new sanctions go into effect in early November. If Vitol’s chairman is correct, there is an abundance of oil available, and the price escalation is fear-based.

Oil Price Implications

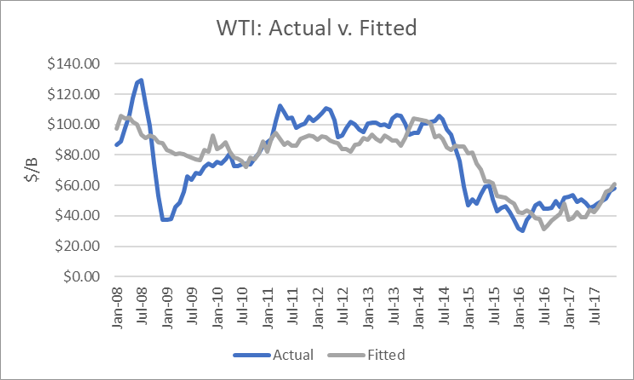

I performed a simple linear regression between OECD oil inventories and WTI crude oil prices for the period 2008 through 2017. As expected, there are periods where the price deviates greatly from the regression model. But overall, the model provides a reasonably high r-square result of 79 percent.

I used the model to assess WTI oil prices for the EIA forecast period through 2019 and compared the regression equation forecast to actual NYMEX futures prices as of October 12th. The result is that oil futures prices are overvalued. Later in 2019, oil prices would drop into the low $50s if these inventories are realized.

Conclusions

The outlook for production, stocks, and prices is particularly risky in both directions. However, current market conditions indicate no impending shortfall, and I expect the Saudis will fulfill their pledge to make up for losses from Iran’s production and exports.

Looking further into the future, I expect that the U.S. will renegotiate the nuclear agreement with Iran and receive the terms it has demanded because Iran’s economy is suffering and there is a risk of “regime change” to the current leaders should that occur. Such a development would put an end to sanctions and allow Iran to increase its exports once again.

I also expect that the NOPEC legislation in the U.S. will pass Congress and be signed into law by President Trump. The effect would be to make foreign oil-producing countries subject to the Sherman Antitrust Act, prohibiting restraint of trade or collusion on pricing or production, if they want to do business in the U.S. Such a development would effectively terminate OPEC’s ability to control production to achieve higher oil prices.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

There is only one major world oil discovery being developed right now and that is offshore Guyana.

The factor that the charts never show is that the Saudis want oil around $75 and they have the ability to keep the price from falling. Selling more oil for less money is in nobody's interests, including the Russians.

So, ultimately we ill run out.The question is when?And what replacement energy sources will be available?

COAL! America has at least a 200 year supply! Coal comes comes from some places that the sunshine does NOT shine.

Misleading headline, but the fact of the matter is that the world uses 100 million bopd now and that is going up next year, and the year after that, and the year after that, and . . . you catch my meaning. So the OECD inventories are less than one month's demand. However, that is not oil that is just "laying around" waiting to be put to work. It is the oil that is necessary to prime the pump that can spit out 100 million barrels of oil EVERY DAY. We the people have put tremendous faith in this global oil delivery system, and it has been well-placed for the most part. Probably we can continue to place our faith in it going forward. Tremendous effort goes into the planning, safeguarding, and execution of this delivery system. Aside from the everyday, run-of-the-mill hiccups that impact small amounts of the total global oil demand, if ever an event that impacted a large portion of this system were to occur, we would all then realize and experience the true value of a barrel of oil.