September 18, 2018

Exciting stocks in the technology field often get the most coverage by Wall Street experts. Breakthrough technologies and new products are tempting for any investor, but it's not always the best investment choice. Experienced investors know, truly exciting stocks are the ones that generate real gains in your portfolio.

Stocks that pay dividends aren't normally the kind of stocks investors look at unless they're looking to build an income-based portfolio. But high yielding dividend payers can also be great growth plays since they help boost overall returns when those dividends are reinvested. Combining a defensive stock with a high dividend payment can translate into a growth stock that's resistant to economic downturns.

Why Is Apple Giving This Tiny Stock A $900 Million Opportunity

There's a new type of "Apple" store coming to your neighborhood.

It's not owned by Apple, but it earns an incredible $3,750 per square foot. That places it in second place just behind Apple and ahead of Tiffany. Investors should take notice because this little-known company is planning to roll out 200 more of these 1,200 square foot "boutique Apple" stores. When they do, this small stock could see revenue rocket to $900 million dollars.

For one defensive stock, a high dividend yield and reliable earnings results equate to a value pick up for any portfolio.

A Best-In-Breed Utility Company for Every Portfolio

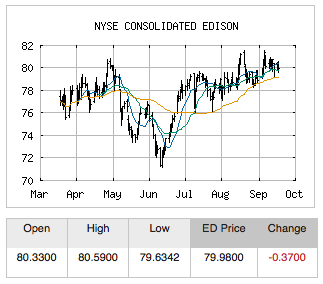

Consolidated Edison (ED) is a $24 billion electric utility company that also contains a steam and natural gas segment. The company operates primarily in New York City and parts of New Jersey with more than 70% of its revenues stemming from electric utility services. The company gets its namesake from famed investor and businessman, Thomas Edison.

The company reported a 2nd quarter earnings beat of $0.61 per share versus the $0.56 analysts had expected. Total revenues came in 2% higher than expected as well and 2.4% higher year-over-year. Despite the beat, guidance remained consistent in the $4.15-$4.35 range.

As a utility company, Consolidated Edison's strength lies in its reliable consumer base and consistent earnings. While the company may not be a fast growth investment, its dividend yield and steady returns offer investors a solid portfolio option. Considering that the stock is down around 5% year-to-date, investors have plenty of opportunity for profits heading into 2019.

Delving into the Financials

The stock trades slightly cheaper than the industry average at 18 times earnings compared to 20 times earnings. While the PEG ratio doesn't fall under 2, utility companies shouldn't be valued by that particular ratio since growth isn't the goal of utility companies.

The hefty 3.5% dividend yield is arguably Consolidated Edison's most attractive feature for investors. The low payout ratio of just 55% means that the company has plenty of room for dividend increases down the road. Considering that the company has been boosting the dividend by about 5% every year for the past 5 years, investors can expect a steady increase over time.

Based on Consolidated Edison's full-year EPS estimates, this stock should be fairly valued at around $90 per share - a gain of more than 12% from its current price level. Investors looking for a defensive stock that pays out a beefy dividend stream need look no further than Consolidated Edison for their portfolio.

Please note that ED may not stay a favorite for this entire week. Markets change and so do the recommendations on what to do with ED.

To get up-to-date buy and sell signals for ED and other analyzed stocks, take a 30-day trial to MarketClub today.