Introduction

Visa Inc. (NYSE:V) reported a great quarter that has subsequently propelled the stock to all-time highs. The Visa Europe acquisition is beginning to bear fruit for the company, translating into phenomenal transaction and volume growth. Visa posted great growth across all segments of its enterprise. Meanwhile the company continues to grow its dividends and engage in consistent share repurchases. Visa has continued to be a best-in-class large-cap growth stock and continues to make a compelling investment as a great long-term core portfolio holding. I feel that Visa is a great long-term holding that offers growth and stability independent of banks and/or interest rates. Taken together, the Visa Europe acquisition and major client wins will enable sustained and durable growth now and into the future.

Wrestling Market Share Away From Competitors

As many countries continue to make a secular transition towards cashless societies, the credit card transaction space will continue to reap the rewards of this trend via swipe fees and other services. Visa has been wrestling market share away from competitors, notably American Express via Costco, Fidelity and USAA (all previous American Express accounts). Visa has recently signed a partnership with PayPal which allows U.S. merchants with a Visa payWave reader to accept PayPal as a form of payment thus leveraging Visa’s payments network while benefiting Visa and merchants alike. Visa is unique in that it does not take on any financial liability as it serves as an intermediary to process payment transactions and capturing a fee for its payments technology/network.

Fiscal Q1 Results – Visa Europe and Enterprise Growth

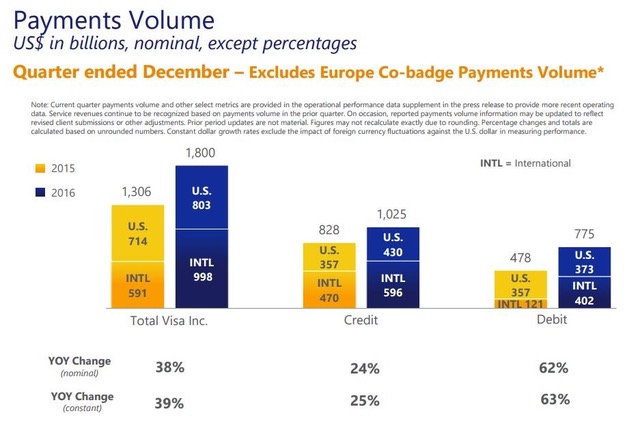

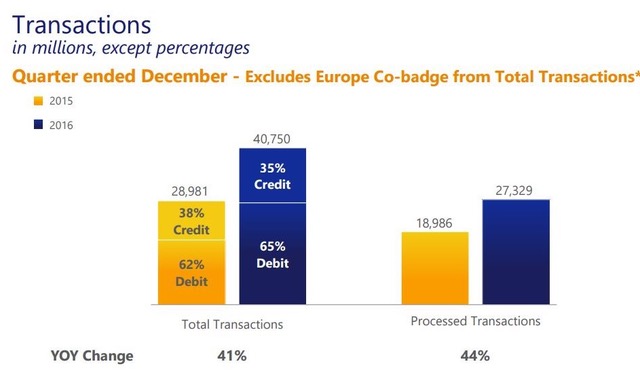

Visa posted a very strong fiscal Q1 quarter that beat on both EPS and revenue by $0.08 and $170 million, respectively. The latter revenue beat came in at $4.46 billion and a 25.3% year-over-year growth. Payments volume growth came in at 38% to $1.8 trillion (Figure 1). As Visa Europe is now fully integrated under the Visa umbrella, cross-border volume was up 140% year-over-year while total processed transactions increased 44% to 27.3 billion (Figure 2). Visa’s service, data processing and transaction revenue was up 17%, 28% and 44% (Figure 3). Visa maintained guidance for adjusted revenue growth of 16% to 18% for the fiscal year and logged $2.3 billion in free cash flow during the quarter while sitting on cash equivalents $13.2 billion.

Figure 1 – Payments volume growth primarily driven by Visa Europe

Figure 2 – Total transactions driven by Visa Europe

Figure 3 – Revenue growth across all segments

Share Repurchases

Visa repurchased 22.3 million shares in its most recent quarter at an average share price of $79.77 using $1.8 billion of cash on hand. During Q3 2016, Visa repurchased 21.7 million shares at an average price of $77.53 per share, using $1.7 billion of cash on hand. During Q4 2016, Visa repurchased 20.5 million shares in the open market at an average price of $80.76 per share, using $1.7 billion of cash on hand. Taken together, Visa has repurchased 64.5 million shares using $5.2 billion of its cash on hand over the last three-quarters. Visa has been very shareholder friendly via returning value to shareholders with consistent share repurchases and dividend increases.

Too Rich of A Valuation?

Its recent earnings report propelled Visa to an all-time high of ~$86.50 per share. This translates into a P/E ratio ~41 and a PEG ratio of greater than 2.1. This stock is richly valued and possesses a greater premium relative to other large-cap growth stocks and for good reason considering the growth rate. However any miss in future quarterly earnings could derail this stock as it seems priced for perfection. I’d look for any significant sell-off to initiate a position at a more reasonable price, sub $80 range. The Aggregate analyst rating currently sits at 2.1 out of 10 per Thomson Reuters. This stock trades at a premium even relative to other high-quality large-cap growth stocks.

Conclusion

Fundamentally, Visa Inc. (NYSE:V) sits in a unique position within the financial industry where no financial liability is taken while capturing fees on over 100 billion transactions globally. As many countries make a secular transition towards cashless societies, the credit card transaction space will continue to reap the rewards of this trend via swipe fees and other Visa-branded solutions. Visa has made efforts to wrestle market share away with the recent addition of major customer accounts with Costco, Fidelity and USAA. Visa now has a global presence with Visa Europe which has been a major driver of growth. With healthy accelerating revenue, dividend increases, share repurchases and strategic partnerships/acquisitions, Visa makes a compelling case to be part of a long-term growth portfolio.

Noah Kiedrowski

INO.com Contributor - Biotech

Disclosure: The author relinquished his shares of Visa and is waiting to initiate another long position or secured put position. The author has no business relationship with any companies mentioned in this article. He is not a professional financial advisor or tax professional. This article reflects his own opinions. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned. Kiedrowski is an individual investor who analyzes investment strategies and disseminates analyses. Kiedrowski encourages all investors to conduct their own research and due diligence prior to investing. Please feel free to comment and provide feedback, the author values all responses.

I am a visa holder and would like notifications on my holdings.

Good job

Hi Michael

Thanks for the positive feedback.