Hello MarketClub members everywhere. Today I have three energy stocks to share with you. I'll be analyzing all three and giving you my potential targets for each one.

WPX Energy, Inc. (NYSE:WPX): All Trade Triangles are positive.

Business Model: WPX Energy, Inc., an independent oil and natural gas exploration and production company, engages in the exploitation and development of unconventional properties in the United States. Its principal areas of operation include the Permian Basin in Texas and New Mexico, the Williston Basin in North Dakota, and the San Juan Basin in New Mexico and Colorado. As of December 31, 2014, the company had proved reserves of 583 million barrels of oil equivalent. WPX Energy, Inc. was incorporated in 2011 and is headquartered in Tulsa, Oklahoma.

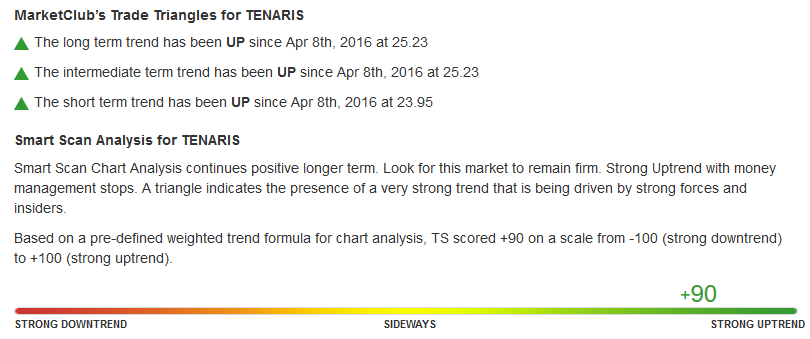

Tenaris S.A. (NYSE:TS): All Trade Triangles are positive.

Business Model: Tenaris S.A., through its subsidiaries, manufactures and distributes steel pipe products and other related services for the oil and gas industry, and other industrial applications. The company offers products for oil and gas drilling operations that include casings and tubings, premium connections, drill pipes, coiled tubing, hot-rolled and cold-drawn seamless tubes, non-tubular accessories, and devices, as well as technical consulting, pipe management, and field services. It also provides offshore line pipe products comprising top tensioned and steel catenary risers, export lines and flow lines, bends, corrosion resistant alloys, coiled line pipes, umbilical tubing, and coated pipes; seamless and welded tubes for onshore line pipe; various seamless steel tubes and pipes for refineries, petrochemical, and gas-processing plants; and tubular products for the power generation industry.

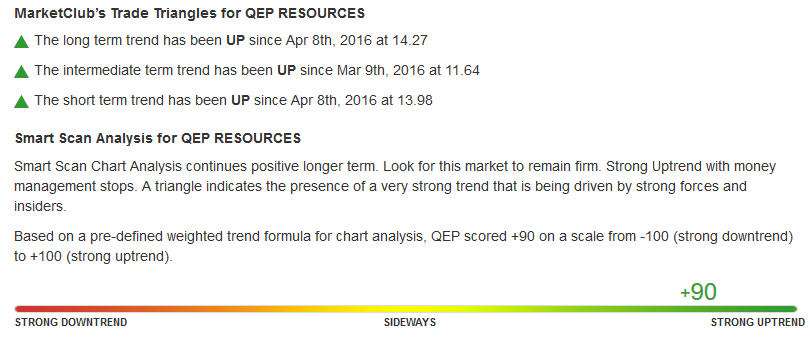

QEP Resources, Inc. (NYSE:QEP): All Trade Triangles are positive.

Business Model: QEP Resources, Inc., through its subsidiaries, operates as a natural gas and crude oil exploration and production company in the United States. The company conducts exploration and production activities in the Pinedale Anticline in western Wyoming; the Williston Basin in North Dakota; the Uinta Basin in eastern Utah; the Permian Basin in western Texas; the Haynesville/Cotton Valley in northwestern Louisiana; and other proven properties in Wyoming, Utah, and Colorado. As of December 31, 2015, it had estimated proved reserves of 3,620.2 billion cubic feet of natural gas equivalents.

While the crude oil market has not given a buy signal yet, I do believe it is beginning to build a base to move up. All three stocks I mentioned today have made a substantial base and all three are in uptrends according to the Trade Triangle technology.

As always caution must be used when buying any stock. As all three stocks are energy-related, I recommend that you choose one. If you decide to purchase all three make sure that your investment dollars equal the same dollar percentage of your portfolio as if you had just bought one of the three stocks.

Stay focused and disciplined.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

Good post..

so sorry by me to believe this kind of recommendation it's a pity waste time on this stocks three are over their beginning was march 01/2016 today are close to stop or get flat .