Seeking Alpha has only 3 entries under the ‘Gold & Precious Metals’ section of its most recent ‘Macro View’ email notice:

- Silver: Another Decade of 500% Returns is Possible

- Silver: Are We Ready Yet for the Rally to $60+?

- Silver is Set to Explode in 2013

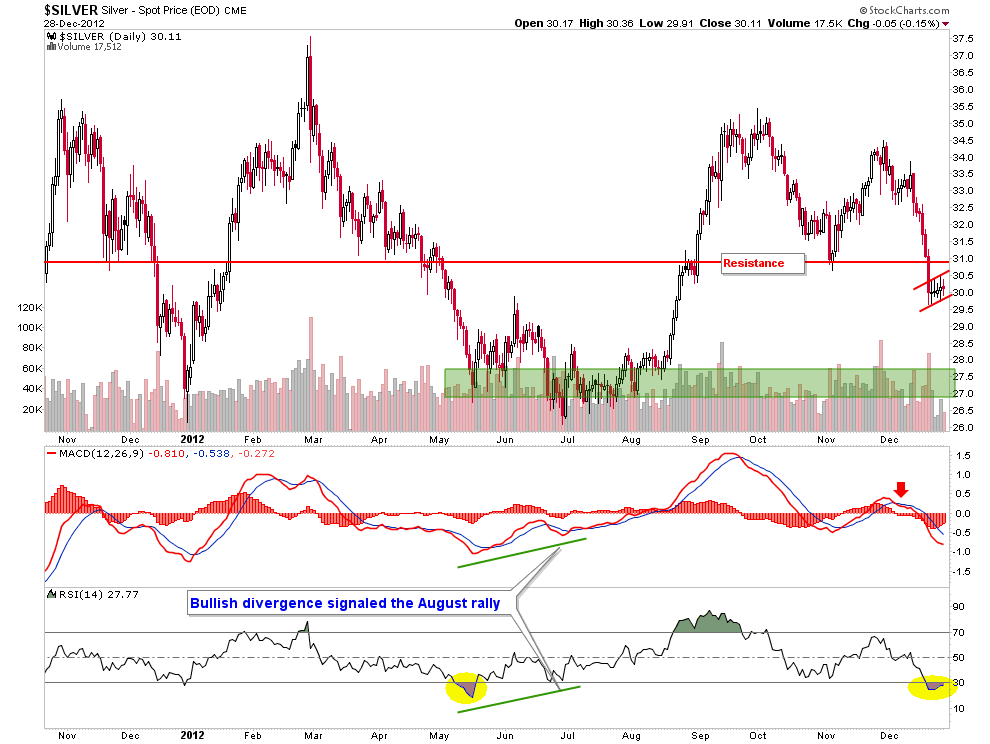

To be fair, the second article highlights lower near-term targets prior to a rally to $60+ and this brings me to my point; silver is in a bear flag. I too am bullish on Ag and Au in 2013, but the charts are the charts and silver’s daily chart targets 27-28 first, which we have been noting in the newsletter despite a recent change to a bullish risk vs. reward stance on the precious metals complex.

Bullish risk vs. reward (meaning gold and silver have notably more upside potential than downside risk) is one thing and short-term technicals are another. The short-term technicals say to be ready for a lame rise to the noted resistance level (31 had been important support before its failure) and the potential for a renewed decline to strong support in the 27 to 28 range.

I am sure the above noted articles are not the only three out there. When the silver bugs are beating the drum loudly and the technicals are not yet in line, it always pays to be cautious in the near term.

On the bigger picture using the weekly chart for example, silver’s technicals look fine. But that should include the potential for a drop to the mid-high 20′s because despite a bullish macro fundamental view and even longer-term technical view, the recent correction is not yet indicated to be over.

What might we look for? A final, dispiriting decline with sentiment bottomed out and the CoT structure going to a full bullish structure (it is moving in the right direction) and some positive technical divergence (like that noted on the chart from last summer) would be an excellent setup.

And if I am being too bearish on the short-term, we’ll know soon enough with a sustained rise above the noted resistance area at 31, which also includes the 200 day simple moving average (solid red line).

Just a word of caution and perspective from your friends at biiwii.com.

Regards,

Gary Tanashian

Thanks Jeremy... Looks good to me, made a few bucks last week, hope it is that good again tomorrow.

I like the way the way you layed it out on the chart.

I lost interest in Silver and other commodities when my own technical analysis suggested a sideways movement for the long term. The fundamentals would suggest that the big funds will keep moving in & out of safe havens over the long term whilst governments pump more money into the banking system. However, with a large baby boom retirement then consumer spending could shrink as retirees save which would cause deflation.

However, as the gold and silver market and other markets are moved by the big funds then the merry ride will continue... Up, down, up, down...EU crisis - markets go down - EU crisis averted - markets go up - US debt crisis - markets go down - US debt crisis averted - markets go up. And so on & so forth.

Up, down, up, down....

No deflation, come on, very few now actually think the CPI figures are anything but bogus. That is, anyone who actually pays bills and everyday expenses, knowing that each and every year prices are sure going up a lot more than 1.5%. The fraudulent CPI numbers place heavy emphasis on items that go down in price, and things that actually go up such as tuitions, health premiums, dentist bills, tires, auto care, groceries, clothes, you know.... things we actually need and use, are not weighted accurately. Using old CPI figures pre 1999, the rate would be closer to 5 or 6% right now.

No manipulation, it is just playing out the Elliot wave pattern. If stocks tank with the fiscal cliff, and interest rates rise along with a surprisingly strong dollar, of course, there is more downside for the metals, perhaps even margin liquidation. Buy all the way down.

Technical set ups are to to be trusted when the tape is being painted as in the silver and gold markets. There is the problem with t/a .

You are right about the bear flag on the daily chart - it is very easily seen! HOWEVER, what is missing in your analysis is that "stocks LEAD the commodity" (written by well known Technical analyst Martin Pring) - thus, in addition to looking at the commodity's chart, you should also be looking at a silver stock's chart - and the best one to use as a proxy for the commodity (in my opinion) is to use SLW (silver wheaton).

Thus, when looking at the DAILY chart of SLW, it can be seen that there had been a formation starting of a bear flag but that on Monday, that formation got negated when SLW jumped up in price. Also to note on this chart is that the MACD is pointing upwards and has just crossed the signal line. Also, full stochastics has just crossed the 20% line thereby giving a buy signal! Also, SLW went up on Monday on larger than normal volume - and higher than normal volume is another thing you want to see in order to confirm the price move is a valid one. Also, January historically speaking is a strong month for silver.

So, with all of this additional information, then it is suggestive that the bear flag on the daily chart will be negated - rather than play out as a bear flag (which means a further drop in the silver price).

I think you'll find this post from this morning interesting. http://biiwii.com/wordpress/2013/01/01/gold-silver-updated/

A bigger picture certainly does bring things into perspective. Thanks for the input. --Gary

Fundamentals shows their effects only, when Technical have all ready furnished it's game all most off.

In the highly-manipulated paper markets, technical analysis amounts to little more than justification of that manipulation. Comex contracts for gold and silver is a corrupt and rigged game. The smart money uses these contrived price corrections to accumulate physical metal (outside the banking system, which is also corrupt)

So it would be interesting to know whose analysis is correct regarding the present position of silver. I looked at the chart for silver and it seems to me that there is an advancing gap that most writers claim does not normally get filled as opposed to some that feel the it is inevitable to get filled. So what's the general opinion regarding the situation of silver for the next couple of months? I'd like to hear from some more commentators. Regards to all and have a great and successful New Year in 2013.