Nothing. It’s what’s wrong with peoples’ expectations and perceptions that is the problem.

Once again I’ll quote NFTRH 208 from October 14 (that edition and a sample interim update can be reviewed here: Samples), not to be an ‘I told you so’ wise guy (I didn’t definitively tell anybody anything), but rather to highlight how important sentiment is to this sector and also I suppose to too the horn a little with respect to good risk management.

“Sentiment is over bullish in the precious metals. Public opinion is over bullish, Hulbert’s HGNSI is over bullish and the CoT data show that the little and big speculators are over bullish. This should be cleared out before we renew our bullish enthusiasm on a risk vs. reward basis. Broad stock sentiment is in a better state than in the precious metals. It is mostly neutral.”

The over bullish sentiment in the precious metals has been ground down to a current state of numbness at best, and full out despair at worst. Actually, it is the reverse; a state of despair is best for a contrarian opportunist.

I have received hate mail over the years for the way I poke at the gold “community” even as I am and have been a gold bull. That is because psychologically, this “community” fancies itself as the battlers of evil, the doers of good; and do you know what? Evil wins some pretty big battles along the way. I want neither NFTRH’s subscriber nor myself fighting that battle.

Rather, a calm perspective is required ALL the time; when a market is surging with bullish enthusiasm and when it is in the grips of despair. It is important to look around the next corner and be prepared. It’s what they taught me in Boy Scouts and it has never failed me.

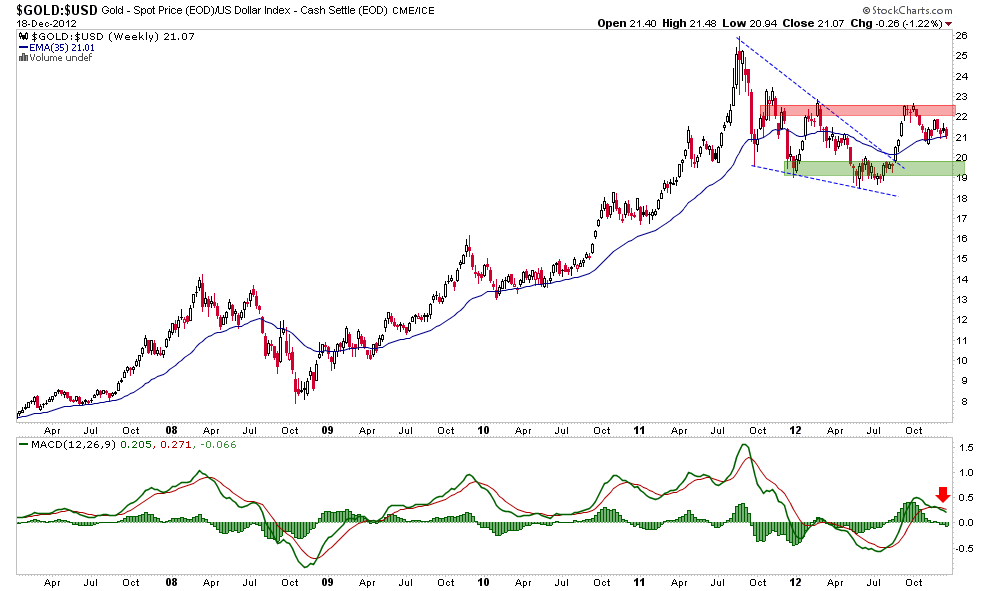

Putting lectures aside, let’s catch up on gold as measured in a few currencies after a look at the nominal weekly chart.

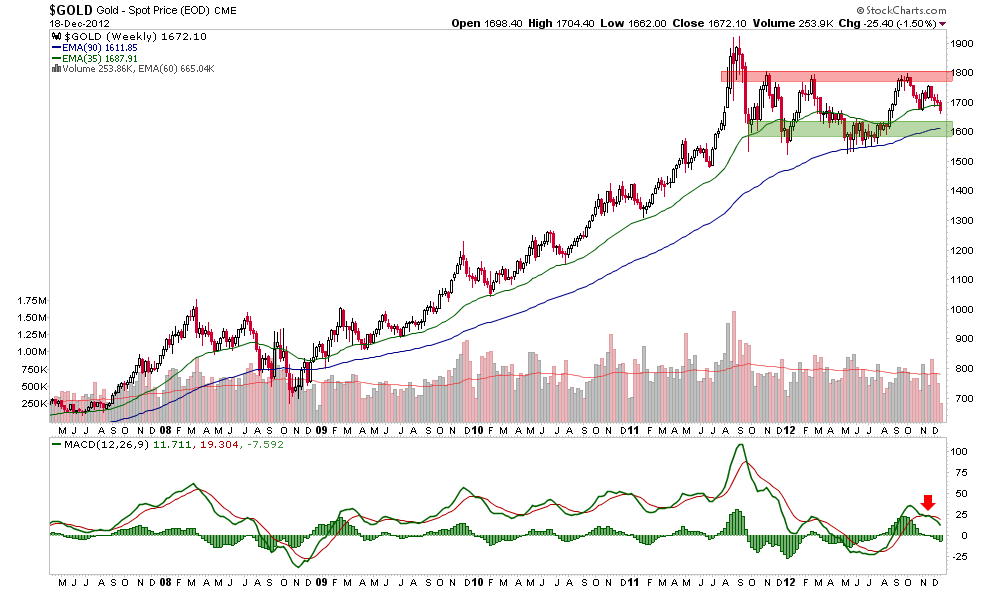

We have had the support zone in the low 1600′s on radar ever since that area formed as a bottom last summer. Add in the weekly EMA 90 (currently 1611) and you can see critical support for nominal gold. There is nothing abnormal happening here technically, although we are in a time when trend followers and rationalizers are coming out of the woodwork to tell you why gold is broken, it’s bull market is over, etc.

Weekly MACD has shifted the intermediate trend to up but today up feels like down. See how powerful sentiment is?

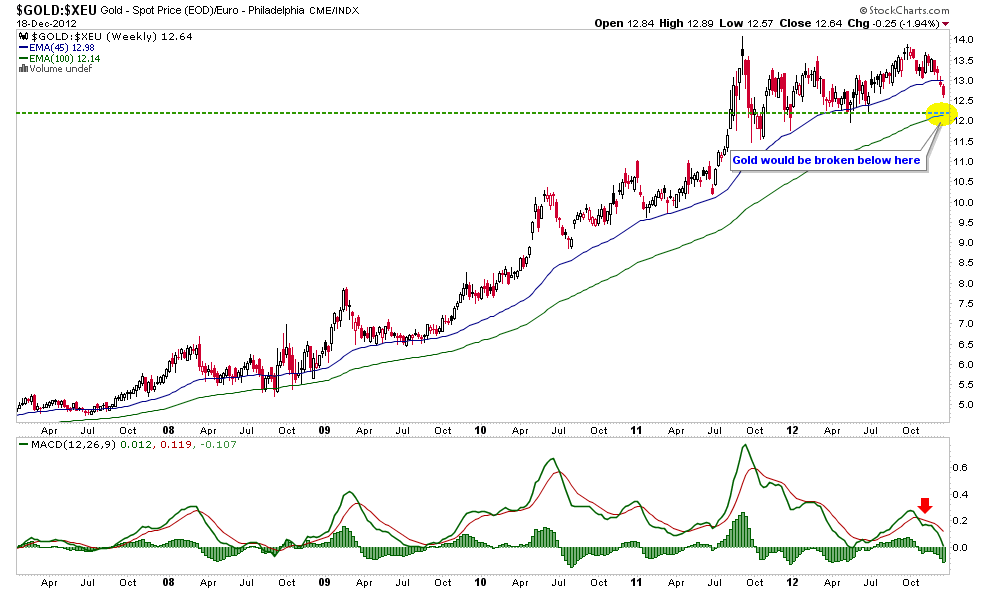

I am not going to pretend I like the chart of gold in euros. I do not care for it. But gold will be broken below the weekly EMA 100 and the green dotted line and not until.

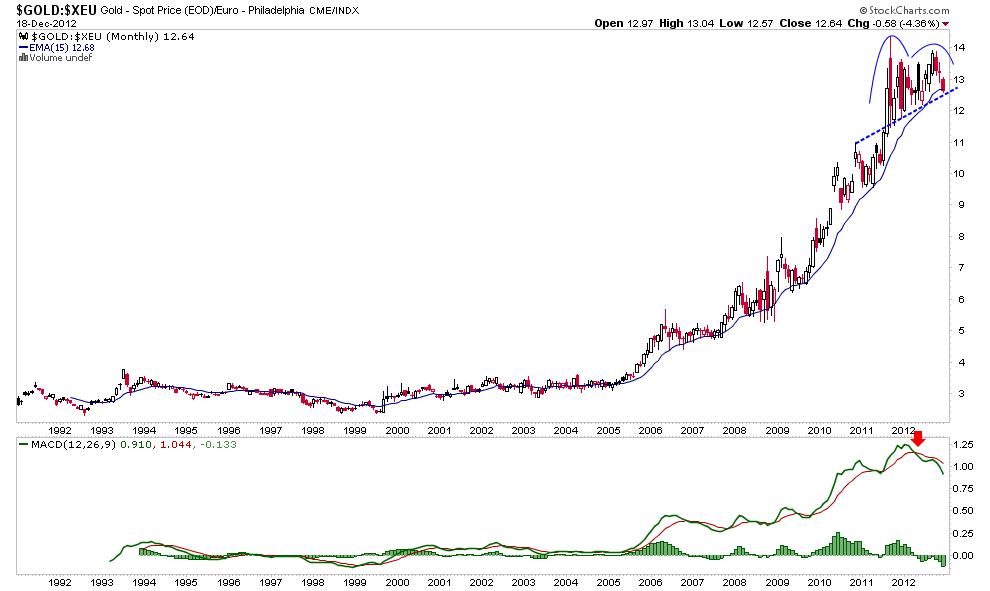

The monthly chart of Au in euros is not something I am in love with either. In particular, the toppy shape of MACD is concerning. According to noted currency analyst Ashraf Laidi:

“The recent damage in metals –particularly gold – is a result of the unwinding of this summer’s buying gold against euro as a flight to safety from Greek election woes. The unwinding of that long gold/short EUR began to unravel these past few weeks after the dissipation of Eurozone tail risk (Greece debt buybacks, Spain bank bailout and preliminary Banking Union).”

This is as good an explanation as any, and better than most. Again, wearing a tin foil hat and blaming evil entities for your troubles is not the way to manage markets. Is Europe fixed? Move along, pay no attention to that man behind the curtain? Nothing to see here? Gold in euros may have a lot more excess to digest than it does in other currencies. It’s a technical thing.

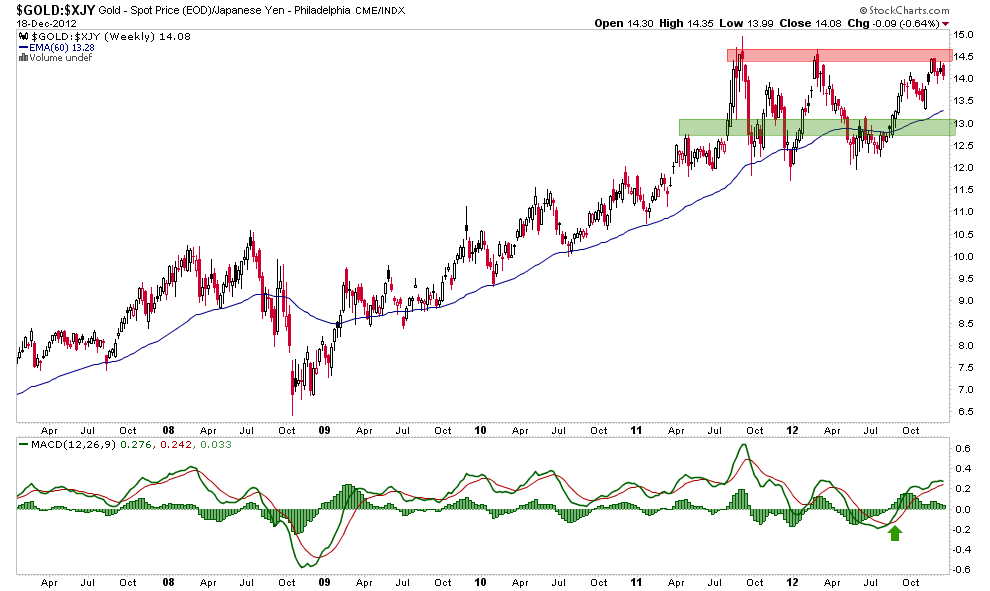

Gold in Yen for instance has been relatively strong in response to a new phase of ultra easy Japanese monetary policy.

Finally, we review gold in USD. There’s resistance, there’s support and there’s an ongoing consolidation within a new trend, which has gone intermediate up by weekly MACD.

Notice how the MACD’s are green on every chart above? That means that gold has not yet broken down, although many people’s expectations have. This is how markets work. There is only one definite in all of this; it is you against the market and the market makes all the rules.

So what is wrong with gold? Nothing, yet. There is a lot wrong with peoples’ perceptions and in many cases, egos, because they choose to fight something that just does not care. Gold is correcting in the face of world wide QE because gold is correcting in the face of world wide QE. Whether it is the unwinding of the euro risk trade or indeed the evil cabal so well documented by the gold “community”, gold is correcting.

Make the correction work for, not against you by being prepared at all times, especially those times of sentiment extremes. There is an extreme upcoming that is diametrically opposite to the over bullish one from late September and early October.

Regards,

Gary Tanashian

Biiwii.com, Twitter, free eLetter, NFTRH

Something does seem to be wrong, when everything that should be bullish does not matter one bit. The mining stocks have been in a bear market for over a year, that should tell you right there that something is very wrong when there is a huge non confirmation like that.

I personally think it is worse. GDX hit 55 back in 2007, when gold was 800 and the gold xau ratio is now back at pre bull market levels.

I can't help but think gold and silver got ahead of themselves the last 3 years, but Gold stocks seem like they have a decline already priced in, yet I can't seem to shake what happened to the mining industry back in the 90s.

By the way, are you the same sparrows that use to post on the NEM board at yahoo, with CasualTechwatcher and the gang?

Gold, and all precious metals aren't worth anything anyhow. I'm sorry to burst all of your bubbles, but, if you can't buy basic necessities with Gold, it how much "value" traders place upon it. If / when the US dollar is threatened as the world's reserve currency, gold will shoot to the moon; but you won't be able to buy food or fill your car up with Gas with it, so what difference does it make?

What you talkin' 'bout Lewis?

You say you can't buy necessities with Gold? That is bologna! Unless you mean that you can't take a Gold coin into a store and buy food, nor can you send in a Gold coin to make your house payment (if you are making payments these days)? Is that what you mean?

Na........you can't mean that! Because if you meant that, it would just show your lack of intelligence. Because we all know you can't pay your house payment with a stock certificate, nor can you buy food with a stock certificate, YOU MUST FIRST EXCHANGE YOUR STOCK CERTIFICATE or gold into the local currency to buy the things you wish to buy.

Surely it would be too sophomoric to be making that argument!!! So what do you mean when you say gold and silver are worth nothing?

Ever read about the men on the Spanish Gallons risking life and limb for worthless metals? Ever watch those mining shows on TV where people spend 2000 to get 1600 worth of gold out of the ground?

That is why Gold is always worth something, it can't just be printed. The number of dollars you get for an ounce will change but an ounce of gold will most likely always buy you a months rent in most American cities.

Any way, I and other readers will be eagerly awaiting your explanation of how gold and silver are worthless when they have been valuable for the entire history of mankind.

This is quite strange Martin, because I didn't actually make this post. I don't know how it got to be on this page. It's not even something I would write so maybe there's a virus operating somewhere? Dunno how it happened.

Gold up after Christmas and we still have many years of up! Eventually it will go parabolic. There will be corrections along the way to shake the paper traders out. Hold on!

There is no longer any reluctance or pretense about using naked shorts to suppress the price of precious metals. The cartel banks have shorted 300 million ounces of silver, for example, which is the equivalent of 3 years of global investment supply! And they do not possess even a small fraction of this amount, there is NO SUPPLY. Yet the regulators and those running the markets turn a blind eye to this.

I suggest that investors start averaging in at these prices! That is, purchase physical metal NOT PAPER and TAKE DELIVERY, or else store it OUTSIDE the banking system. Allocated accounts are now fair game to banks, thanks to the Fascist Business Model, which is the operating system in the lawless USEconomy (thanks to Jim Willie).

Title of this article should be as "whats not wrong in Gold" because everything is wrong in Gold.

All may friends from INO Readers are well aware that Since $ 1800+++ Level, i was shouting and given many warning that something is going wrong in Gold, but nobody was ready to seriously consider my warning.

Now what happened actualy?

Still i again warn you that sharp and long bear face remains, and this is just begining of that.

Only highly optimists may retain their bull views on the hope to find some miracle, and in fact too, that will be just a matter of miracle only, if we found even $1750+++ Level again in near term.

Rasesh Shukla - India

and your basis for your premis?

Thanks for communication.

Sorry but i cant understand what you ask and what you want to know about this. Since 1997 i am watching Gold. My study is a mixed of technical as well of studying behavioral psychology of people, related with Gold Trade. All my views and predictions are the mix of this both. Please point-out, i am simply observer or analyst of market, neither i am trading or investing nor consulting in Gold Trade.

Please feel free to get more details.

Rasesh

Obviously you have no clue of the real function of gold in a monetary system. The problem with gold is that people insist on day trading it, which creates volatility. Add in the Goldman Sachs gang and JP and the boys with their paper shorts and there's your move. The biggest down days are always on low volume. We don't care about you screaming to INO readers. We're tired of guys like you. And I'm tired of this site censoring people who truly understand gold's function in favor of day traders.

I must start with clarification like, i am quite well aware of Gold Functioning, and its effects on economy or over the entire financial sector.However, since 1998, Pattern of Gold pricing, its trade and its markets changed in a very broad manner, so you just cant blame day traders or paper traders or shorters.

Please also point-out, i am simply observer or analyst of market, neither i am trading or investing nor consulting in Gold Trade, and Since 1997 i am watching Gold. My study is a mixed of technical as well of studying behavioral psychology of people, related with Gold Trade. All my views and predictions are the mix of this both. So don't blame me for screaming to INO readers.

People like you living and believing in Hopes, Hopes and Hopes only, without trying to understand Market Functioning and price rhythm, which is governing all or any trade in whole world.

Finally, market determinate "Buy" and "Sell " value only, and never bother any kind of any related functioning or factors, if it may be for Gold or any dam thing.