By: Craig Turner

CORN:

The WASDE increased ending stocks to 903 million bushels for 2011-2012 corn, up from 851 previously. The USDA has the July Corn yield at 146.0 and cut demand over 1 billion bushels. It is important to note what the yield is as of July 1 for the USDA. One can make the argument that since July 1 we have lost more bushels and we are probably closer to a 140 yield now.

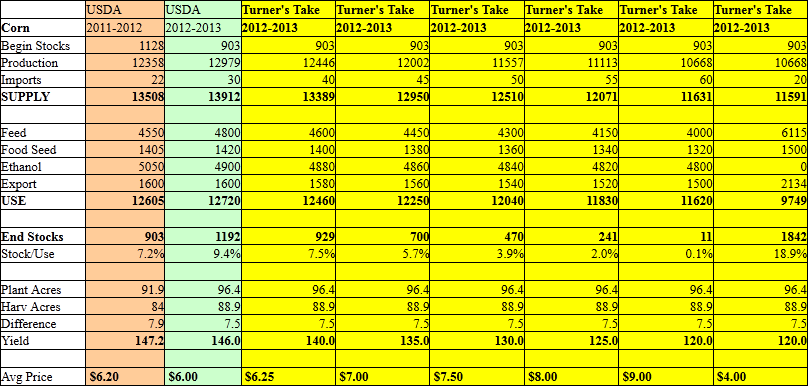

With a 146 yield and the reduction in demand due to higher price, the USDA has a carry out of 1192 million bushels. That puts corn prices around $6.00. As yields come down, prices increase, and demand is rationed. Below is my table for yield 140, 135, 130, 125 and finally 120. As you can see in the table below, as yields decrease, the US will start to import more corn where possible, feed use for corn decreases, ethanol slightly dips, and exports decrease. The worst case scenario is a yield of 120. A 120 yield would be considered a complete disaster. A 120 yield would go down in history as one of the worst US droughts for crops we have ever seen and corn could go to $9.00/bushel.

As the weather destroys crops and lowers yields, there is one big wild card everyone needs to understand. That wildcard is ethanol. At any time, the EPA can reduce the ethanol mandate and demand can be reduced drastically. Ethanol makes up about a 1/3 of all corn use for US production. The last row to the right of the table below shows a 120 yield with no ethanol mandate. If I take out all the ethanol, I can boost feed usage and exports to highs we have not seen since 2005. Ending stocks would be over 1800 million bushels and corn would probably be at $4.00. Just something to keep in mind as the weather continues to erode corn yields.

US Corn Supply/Demand Balance (Sept->Aug Crop Year) in Million Bushels

SOYBEANS:

I have good news and bad news. The good news is Soybeans can still be saved. We have about a four week window where the weather can improve. If we get much needed rain then it's possible the crops will stabilize. The bad news is there is no margin for error. Corn had a very big margin of error on the production side because we were expecting a record crop, due to an enormous amount of corn acres combined with a very high expected yield. Soybeans do not have that same margin of error. Soybean stocks are tight and they lost acres to Corn this year.

The WASDE has this year’s beans ending stocks at 170, which is a little higher than we expected. We have seen a lot of exports lately for Soybeans and we feel 130 to 150 are a more accurate ending stocks figure. The USDA lowered the Soybean yield to 40.5. This leaves us with an expected carryout for new crop at 130. This is very, very tight for Soybeans. We can’t lose acres or yield going forward. In my table below, I have yields for 40, 39, 38 and 37. A 37 yield for Soybeans reflects a severe drought for the crop. At 37 yield Soybeans are $17.00 and we have no beans for carry out. I had a hard time reducing beans under 1600 for the crush and was only able to price ratio for exports and then boost imports to keep the balance sheet from going “negative carryout” (which obviously can’t happen).

Turner’s Take was created to give traders and investors a window into the elusive world of LaSalle and Wall Street. Turner’s Take includes an in-depth analysis of the markets, trade recommendations, and access to Turner’s Technical Trading Systems. Subscribe to the Turner’s Take Newsletter!

As a farmer in IL and traveling in IL, IN, and MO, I don't expect it to make anywhere close to 120 across the board. Nor do any other producers I've talked to. The far north end of the corn belt will have record yields in some areas but can't believe they can carry the rest of us......I've seen a lots and lots of corn acres closer to -0- than 120. Soybeans have time but drastic weather pattern changes are needed to make much difference soil moisture is just too short and temps too high. That said I'm holding the dab of grain I have in inventory for maybe another month, end users can't afford grain at these prices and we (producers) expect demand to drop as inventories are depleted and cash mkt. to run out of gas. Futures no comment. ; ) Just my 2 cents worth