Shares of sporting goods retailer DICK’S Sporting Goods, Inc. (DKS) have declined 24.4% over the past year and 11.2% year-to-date. However, it has gained 4.2% over the past three months to close the last trading session at $102.17.

Recently DKS announced the launch of DSG Ventures, a $50 million in-house fund to invest in innovative sports-related companies like itself.

Ed Stack, DKS’ Executive Chairman, said, “DSG Ventures will enable us to give back and help support entrepreneurs achieve their dreams through our connections, experience, and support. We know that DSG Ventures (and our partners) will bring innovative products, services, and experiences to athletes worldwide.”

However, the macroeconomic headwinds could mar DKS’ business growth. Amid the sky-high inflation and rising recession possibilities, consumers are hesitant to spend on discretionary items even before the holiday season.

Leo Feler, the chief economist at market researcher Numerator, said, “It's food, it's medical care, it's housing and shelter costs. It's essential services such as veterinary care, and child care. All of these things come first before consumers buy holiday gifts."

Furthermore, U.S. holiday sales are expected to rise at a slower pace this year. The National Retail Federation (NRF) forecast holiday sales, including e-commerce, to rise between 6% and 8% compared to a 13.5% jump last year and a 9.3% increase in 2020 when supply chain issues and pandemic-related uncertainties weighed on.

Here's what could influence DKS' performance in the upcoming months:

Bleak Financials

DKS' net sales came in at $3.11 billion for the second quarter that ended July 30, 2022, down 5% year-over-year. Its gross profit declined 14.2% year-over-year to $1.12 billion.

Also, its non-GAAP net income came in at $318.50 million, down 36.4% year-over-year. Its non-GAAP EPS declined 27.6% year-over-year to $3.68.

Mixed Analyst Sentiment

DKS' revenue is expected to decline 3.4% year-over-year to $11.87 billion in 2023 but increase 2.4% year-over-year to $12.16 billion in 2024.

Moreover, its EPS is expected to fall 27.5% year-over-year to $11.38 in 2023 but rise 2.9% year-over-year to $11.71 in 2024. However, its EPS is estimated to decrease 7.9% per annum in the next five years.

Mixed Profitability

DKS' trailing-12-month gross profit margin of 37.12% is 3% higher than the industry average of 36.08%.

However, its trailing-12-month CAPEX/Sales of 2.59% is 13.5% lower than the industry average of 2.99%.

Lack of Momentum in Either Direction

With the raging inflation reducing consumers’ spending power, DKS is struggling to maintain its sales. The uncertain macroeconomic outlook and optimism over the holiday season contradict each other, leaving DKS without a clear direction.

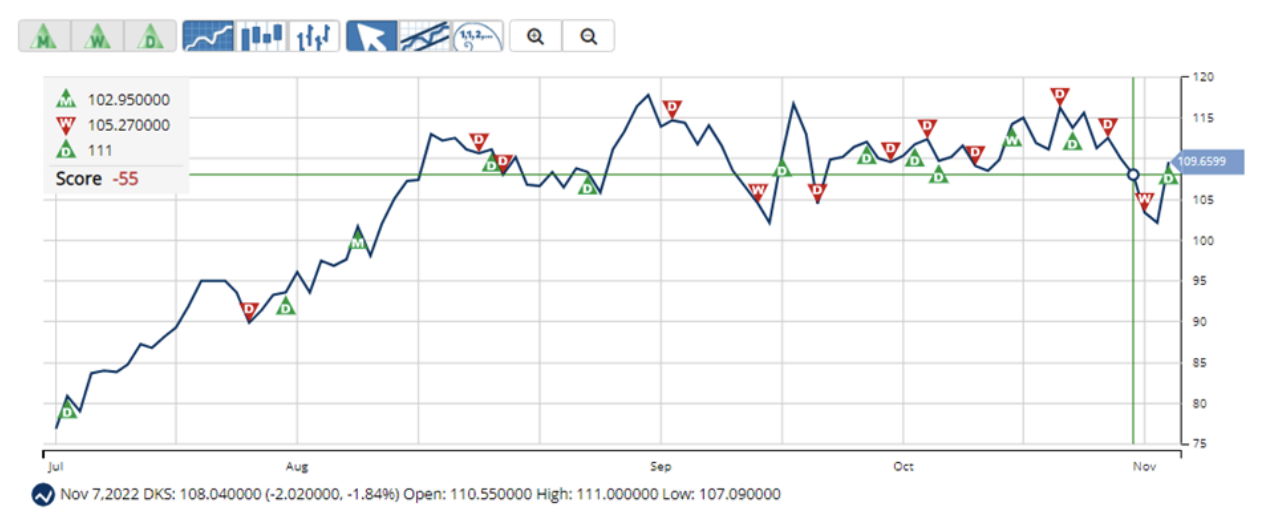

According to MarketClub's Trade Triangles, the long-term and short-term trends for DKS have been UP since August 8, 2022, and November 10, 2022. However, its intermediate-term trend has been DOWN since November 8, 2022.

The Trade Triangles are our proprietary indicators, comprised of weighted factors that include (but are not necessarily limited to) price change, percentage change, moving averages, and new highs/lows. The Trade Triangles point in the direction of short-term, intermediate, and long-term trends, looking for periods of alignment and, therefore, intense swings in price.

In terms of the Chart Analysis Score, another MarketClub proprietary tool, DKS, scored -55 on a scale from -100 (strong downtrend) to +100 (strong uptrend), indicating that the stock is struggling to gain momentum in either direction. It could be wise to sit on the sidelines until a clear trend is identified.

The Chart Analysis Score measures trend strength and direction based on five different timing thresholds. This tool considers intraday price action; new daily, weekly, and monthly highs and lows; and moving averages.

Click here to see the latest Score and Signals for DKS.

What's Next for DICK’S Sporting Goods, Inc. (DKS)?

Remember, the markets move fast and things may quickly change for this stock. Our MarketClub members have access to entry and exit signals so they'll know when the trend starts to reverse.

Join MarketClub now to see the latest signals and scores, get alerts, and read member-exclusive analysis for over 350K stocks, futures, ETFs, forex pairs and mutual funds.

Best,

The MarketClub Team

su*****@in*.com