“The following is an excerpt from Tim Snyder’s “Weekly Quick Facts” newsletter. Tim is an accomplished economist with a deep understanding of applied economics in energy. We encourage you to visit Matador Economics and learn more about Tim. While there, you can sign up for his completely free Daily Energy Briefs and Weekly Quick Facts newsletters.”

Brownouts and blackouts are terms that describe the gradient of power loss, from limited in scale and time and transitioning to total darkness, with no idea of when the loss of power will subside. Valentine’s Day week 2021, Texans were told that ERCOT had not prepared for the deep cold that centered on Texas, and reserves for fueling power plants either were stuck in frozen pipes or just were not available. As a result, 151 people lost their lives due to exposure or other related effects of that storm.

This week, as we begin the first full week of June, we hear those same words, but this time we’re hearing them for the entire country. We all are asking how can we be here again and when will it happen? We’ll address these today in this article.

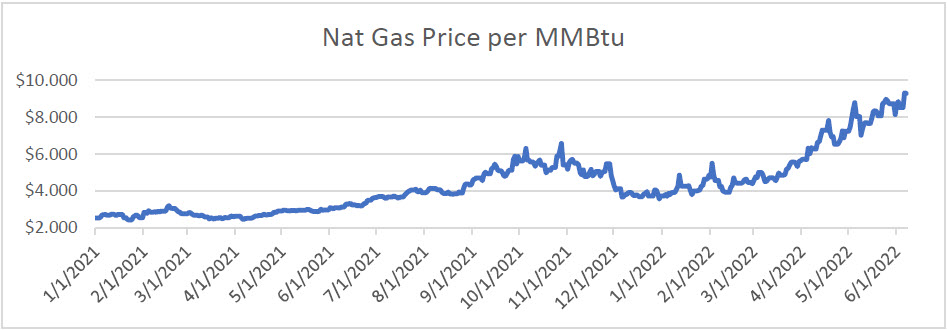

Let’s start with some perspective. On January 1, 2020, the futures price for Natural Gas was $2.1890 per MMBtu (million Btu). President Biden took office on January 20, 2021, and the price for Natural Gas was $2.5460 per MMBtu. On January 1, 2022, the futures price for Natural Gas was 3.7300 per MMBtu, and Tuesday’s closing price for Natural Gas was $9.293 per MMBtu.

Let’s look at a graph:

You can see in this chart that the prices for Natural Gas were beginning their climb steadily just after President Biden took office. So, the price of Natural Gas started a slow, steady climb, mostly attributable to the anti-fossil fuels policies of the Biden Administration. Prices spiked again just prior to the Russian invasion of Ukraine and have been running even higher since then.

More than likely, you have read all the reports about the EU embargoing Russian ship-bound crude oil and Natural Gas, but that won’t happen until the end of this year. You also may have read that the US was willing to supplement the loss of Russian Natural Gas by sending US LNG to the EU to cover their shortfall, but that, in many circles, is what has contributed to the thought that we have not replaced enough Natural Gas, to cover this added demand.

With that in mind, let’s see what the Baker Hughes Rig Count shows in terms of Natural Gas replacement rigs. In January of 2021, the US had 84 rigs working to pull/find Natural Gas. Today, that number is 151. That’s an increase of 67 rigs and a solid increase as the economy of the US continues to search for solid ground. If the number of rigs isn’t the problem, then what could be pushing prices higher. Let’s look at Natural Gas Inventories.

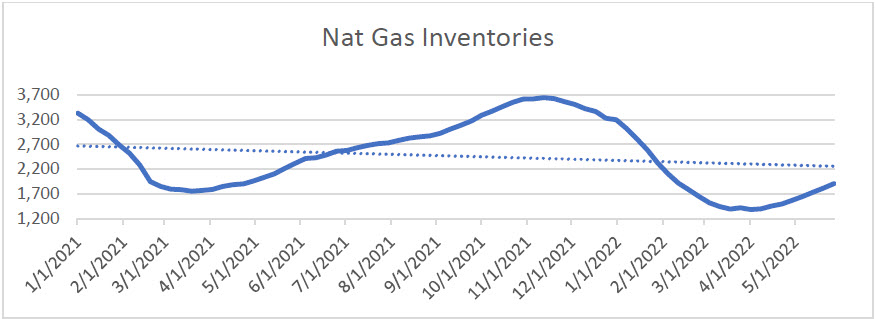

As we look at the chart for the lower 48 in the US, we see there looks to be a steady decline in Natural Gas Inventories. Most of this is due to increased demand from a recovering economy, but the trend since President Biden took office again shows lower inventories.

Look at this graph showing Natural gas Inventories:

If the US begins the exporting process for LNG to the European Union to take up the slack from an embargoed Russia, we will most likely see an accelerated decline in Natural Gas Inventories. Remember, President Biden promised to send US LNG to the EU to replace Russia’s Natural Gas. This we cannot sustain in the current production environment.

As we look to the last six months of 2022, economists like me are beginning to worry that the lack of attention given to fossil fuels production, prices, and supplies, could very well bankrupt more than just “Big Oil.” People are beginning to adjust their travel plans, and businesses are adding “Fuel Surcharges,” and all of this is avoidable.

It is important to remember that not being able to fire our power plants that still depend on fossil fuels to produce electricity in an effort to keep up with high demand drops the entire grid system into the laps of an ill-prepared renewable production infrastructure. This will do unrepairable damage to these power providers, overburden an inadequate system and kill the US Economy!

Timothy S. Snyder, Economist

Matador Economics

Who the hell are pulling the strings to undermine the US Economy? The most valuable assets of the United States are the Fossile Fuels, that are worth many trillions of dollars are being abandoned to placate the alleged global warming gurus. Wake up America before we are reduced to the biggest poorhouse on the entire planet.

A very well presented article. Thank you

Excellent overview on the status of natural gas supply and demands