Today, in 2022, there are 27 ongoing armed interstate and civil conflicts occurring; while there is a moral and ethical perspective to be had while analyzing the state of military affairs in the world, there is also an economic one. Fun fact: It costs $100,000 per year to maintain each soldier within the United States Armed Forces, and this number will only continue to increase as the push from the supply side and pull from the demand side increase this input. As it is already a fact that inflation and the commodity price rally have pushed costs higher from the supply side, one can make a good bet on the fact that the need for armaments will also increase as the volume and magnitude of conflicts grow.

In this arena, a name stands out from the rest...

The Lockheed Martin Corporation (LMT) is one of the largest defense contractors in the world. Some of their recent notable projects include; the F-35 Lightning 2, the F-22 Raptor, and the Stalker VXE Unmanned Aerial System. Their subsidiaries include helicopter manufacturer Sikorsky, R&D agency Zeta Associates, & technical services provider Sytex inc. Lockheed Martin is one of the few contractors trusted by the US armed forces and NASA, as it, through the Skunk Works division, has been working on black projects for the US armed forces since World War Two. Some of their previous successes include the SR-71 Blackbird and the U-2 Spy Plane.

Catalysts For The Industry And LMT

The ongoing conflict in Ukraine has not only devastated the region and the people who live in it, but it’s also broken the pattern of thought held by globalists and geopolitical experts across the world that conventional warfare was a thing of the past. Who could blame them for thinking like that? Yes, there has been kinetic warfare since the end of the Korean War, yet this is the first time that a major power has tested the Western security umbrella without the plausible deniability of using mercenaries. As a result, countries that once balked at the idea of buying fighter jets have rushed to do so, a prime example being Canada. This change in plans is not isolated to Canada either; countries who once refused to commit to the 2% of GDP requirement for NATO have now made spending increases a top priority, with Germany set to double their defense budget to €100 Billion ($112.7 Billion). Even Japan, which for the past 75 years has strayed away from large military spending, has increased its defense budget by roughly 14.5%, to the equivalent of $53.8 Billion due to ongoing tensions in the South China Sea.

No matter the outcome of the current conflict, the world has changed for the foreseeable future. Gone are the days of the unchallenged US hegemony; as such, there will be many challengers to the throne. As we return to a world of multipolarity, last seen in the early 1900s before the start of the First World War, regional powers will begin to vie for control of their corners of the world. These power struggles will require arms to fuel them, and in a likely scenario, the Western-backed factions within these regional power struggles will be supplied with Lockheed armaments.

Why Is NOW The Time For LMT?

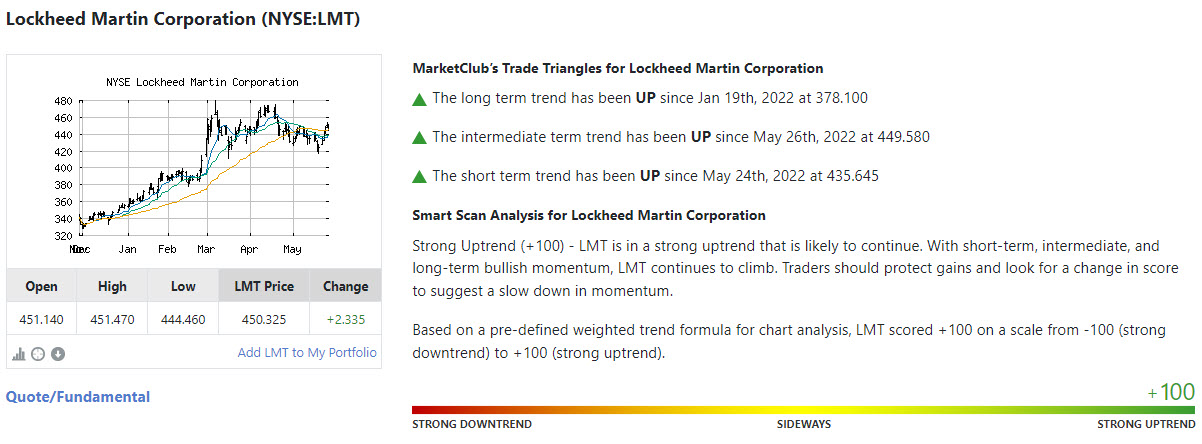

Having been in a strong uptrend since October, LMT crushed Q1 earnings in April, with an EPS surprise of about 4% - the stock became slightly discounted by the market due to its miss on revenue, creating an excellent buying opportunity for any investor looking to get in as LMT is now trading 6% from highs with no material change to their strategy or earnings opportunities.

Moreover, on a forward basis, LMT’s P/E is only 17! Far below all of their peer group and with solid growth opportunities both intrinsic to their firm specifically and within the industry on the whole. Strap in and get paid a 2.5% yield to wait for LMT’s takeoff!

Visit back to read my next article!

Peter Tsimicalis

INO.com Contributor

Disclosure: This contributor has no positions in any stocks mentioned in this article at the time this blog post was published. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.