This week we have a stock market forecast for the week of 12/12/21 from our friend Bo Yoder of the Market Forecasting Academy. Be sure to leave a comment and let us know what you think!

The S&P 500 (SPY)

The S&P pump started again in earnest on Tuesday and basically hasn't done anything since. If we turn lower on Monday, it would solidify the lower high I have been forecasting. We are so close to the highs that I would suspect there will be some attempt at a breakout, even if it is short-lived.

So next week will be a pivotal one; if we turn, then things should begin to accelerate to the downside. If we break out, then I'm stuck back into a holding pattern as I wait for the energy to dissipate.

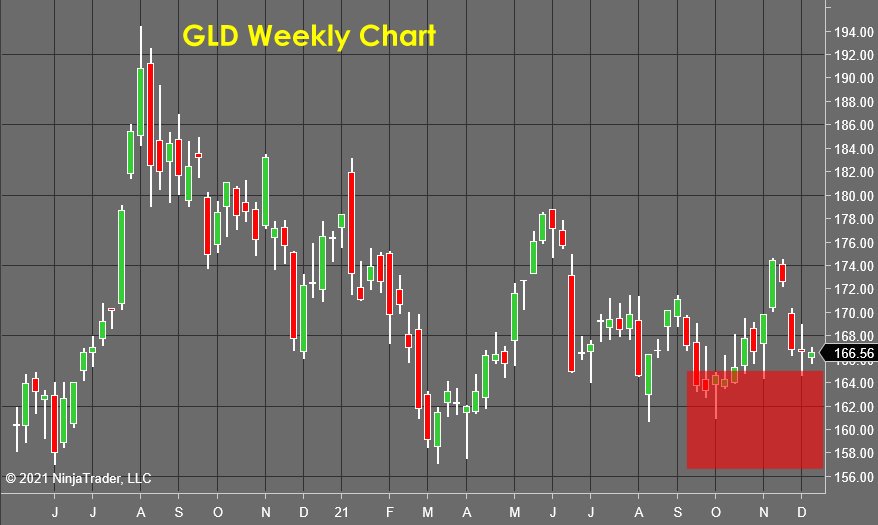

SPDR Gold Shares (GLD)

Gold spent a week in equilibrium and printed a very narrow ranged bar. This "coiling" effect tends to trigger increased volatility, so I'll be looking for some more significant movement in next week's session.

Goldman Sachs (GS)

GS rejected a bullish campaign early in the week that squeezed price back up to test the red zone, then closed some $10 per share lower.

This rejection offers a push to the bears and strengthens their positions... It's kinda like an invitation to a party, now we wait to see who shows up. Next week will be an important confirmation of this position if it can break lower and close as a red candle.

Ulta Beauty, Inc. (ULTA)

ULTA couldn't have looked more horrible on Tuesday as it followed the markets up and looked like it was definitely going to push out above the highs of the red zone to trigger stop losses... Then it turned and dropped hard.

That failure to break out really strengthens my bias and proves how critical it is to stick to your trading plan. I have had this happen to me over and over throughout my career. A trade looks awful, and I am convinced it's about to close out as a loser, then it turns and runs in the opposite direction!

It is these kinds of "mind in a blender" moments that make trading such a "Hard way to make an easy living"!

We all know that the discipline concept has been beaten to death, but that's with good reason. I have seen so many clients over the years turn a positive edge into a losing proposition just through emotionally impulsive action.

That constant issue was what sent me on a multi-year quest to figure out how to slay that demon and produce effortless discipline. About a year ago, I cracked the code, and Myalolipsis was born, which has allowed me to help clients get beyond these self-sabotaging and self-limiting behaviors by modulating the activity in the brain's "default mode network." This is the "devil on your shoulder" that produces that constant distracting and distressing internal dialog that can lead you into temptation!

Turn that activity down, and you stop having to fight with yourself when the stakes are high, and your objectivity really matters.

To Learn How To Accurately and Consistently Forecast Market Prices Just Like Me, Using Market Vulnerability Analysis™, visit Market Forecasting Academy for the Free 5 Day Market Forecasting Primer.

Check back to see my next post!

Bo Yoder

Market Forecasting Academy

About Bo Yoder:

Beginning his full-time trading career in 1997, Bo is a professional trader, partner at Market Forecasting Academy, developer of The Myalolipsis Technique, two-time author, and consultant to the financial industry on matters of market analysis and edge optimization.

Bo has been a featured speaker internationally for decades and has developed a reputation for trading live in front of an audience as a real-time example of what it is like to trade for a living.

In addition to his two books for McGraw-Hill, Mastering Futures Trading and Optimize Your Trading Edge (translated into German and Japanese), Bo has written articles published in top publications such as TheStreet.com, Technical Analysis of Stocks & Commodities, Trader's, Active Trader Magazine and Forbes to name a few.

Bo currently spends his time with his wife and son in the great state of Maine, where he trades, researches behavioral economics & neuropsychology, and is an enthusiastic sailboat racer.

He has an MBA from The Boston University School of Management.

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation for their opinion.