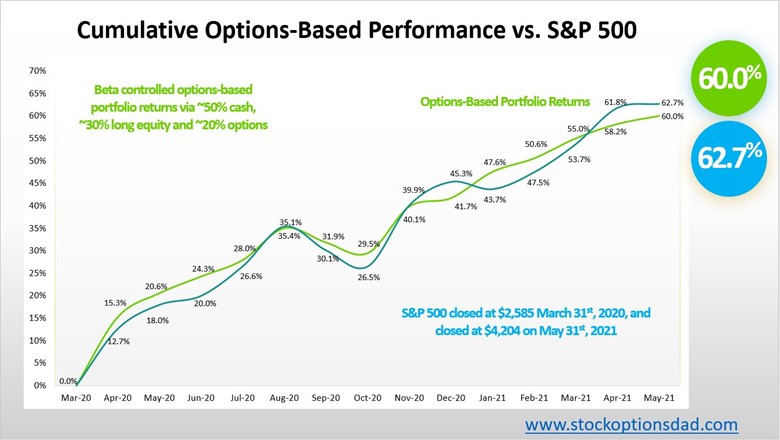

Controlling portfolio beta, which measures the overall systemic risk of a portfolio compared to the market, on the whole, is essential as these markets continue to break record high after record high with violent pullbacks. The month of June was a prime example as the markets pushed to new all-time highs early in the month, then suffered a Federal Reserve induced sold-off to only bounce back into positive territory to close out the month. Controlling beta while generating the same or superior market returns is the goal with an options-based portfolio. A beta-controlled portfolio can be achieved via a blended options-based approach where 50% cash is held in conjunction with long index-based equities and an options component. Options alone cannot be the sole driver of portfolio appreciation; however, they can play a critical component in the overall portfolio construction to control beta.

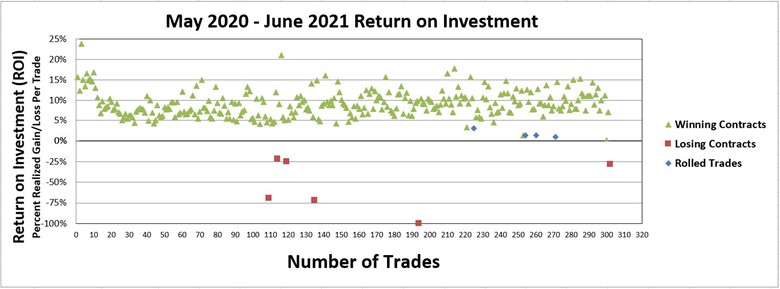

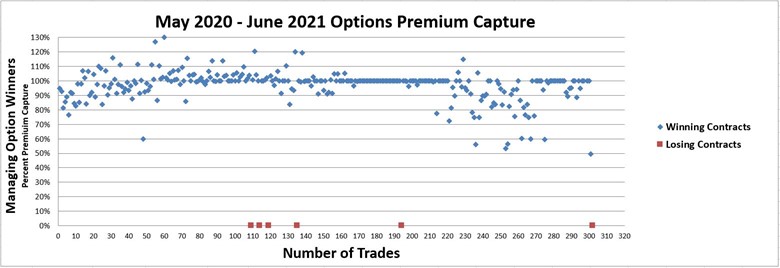

Generating consistent monthly income while defining risk, leveraging a minimal amount of capital, and maximizing return on capital is the core of this options-based/beta-controlled portfolio strategy. They can enable smooth and consistent portfolio appreciation without guessing which way the market will move, and allow one to generate consistent monthly income in a high probability manner in various market scenarios. Over the past 15 months (April 2020 – May 2021), 293 trades were placed and closed. An options win rate of 98% was achieved with an average ROI per winning trade of 7.0% and an overall option premium capture of 84% while moving in lockstep with the S&P 500. The performance of an options-based portfolio demonstrates the durability and resiliency of options trading to drive portfolio results with substantially less risk via a beta-controlled manner. The options-based approach circumvented September 2020, October 2020, January 2021, and May 2021 sell-offs (Figures 1, 2, and 3).

Figure 1 – Overall options-based performance compared to the S&P 500 from April 2020 – May 2021

Figure 2 – Overall option metrics from May 2020 – June 25th, 2021

Figure 3 – Overall option metrics from May 2020 – June 25th, 2021

Options Results

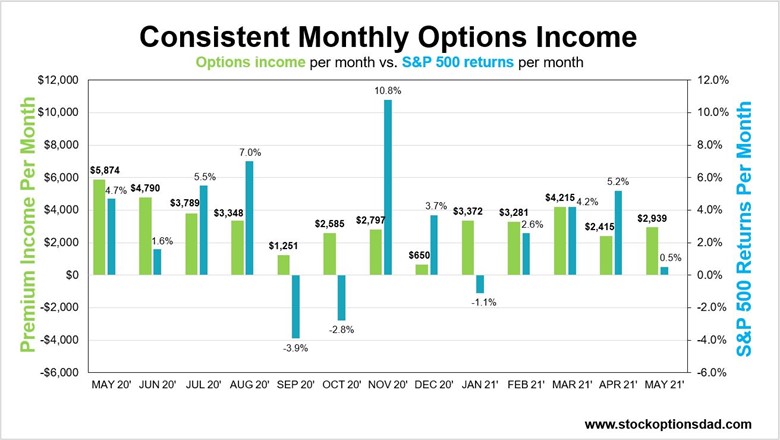

Compared to the broader S&P 500 index, the blended options, long equity, and cash portfolio has largely matched this index overall and outperformed during negative return months. In even the most bullish scenario post-pandemic lows where the markets erased all the declines and blew past previous highs via V-shaped recovery, this approach has matched the S&P 500 returns through June 25th, 2021, with substantially less risk (Figures 4 and 5).

Overall, from May 2020 through June 25th, 2021, 293 trades were placed and closed. As a result, a win rate of 98% was achieved with an average ROI per trade of 7.0% and an overall option premium capture of 84% while outperforming the broader market through the September 2020, October 2020, and January 2021 declines (Figure 1).

Figure 4 – ROI per trade over the past ~300 trades

Figure 5 – Percent premium capture per trade over the last ~300 trades

Consistent Income Despite September 2020, October 2020 and January 2021 Declines

September 2020, October 2020, and January 2021 declines provide a great opportunity to demonstrate the durability and resiliency of an options-based portfolio. A positive $1,251 return, a positive $2,585 return, and a positive $3,372 return for the options portion of the portfolio was achieved in September 2020, October 2020, and January 2021, respectively (Figure 6).

Figure 6 – Generating consistent income despite negative returns for the S&P 500 index in September 2020, October 2020, and January 2021

The positive returns were in sharp contrast to the negative returns for the overall market during these negative months. Generating consistent income without guessing which way the market will move with the probability of success in your favor is the key to options trading.

10 Rules for an Agile Options Strategy

Throughout the past 15 months of the post-pandemic rebound, a disciplined approach to an agile options-based portfolio has been essential to navigate pockets of volatility and circumvent market declines. A slew of protective measures should be deployed if options are used to drive portfolio results. When selling options and managing an options-based portfolio, the following

guidelines are essential:

-

1. Trade across a wide array of uncorrelated tickers

2. Maximize sector diversity

3. Spread option contracts over various expiration dates

4. Sell options in high implied volatility environments

5. Manage winning trades

6. Use defined-risk trades

7. Maintains a ~50% cash level

8. Maximize the number of trades, so the probabilities play out to the expected outcomes

9. Place probability of success in your favor (delta)

10. Appropriate position sizing/trade allocation

Conclusion

Controlling portfolio beta to reduce systemic risk in relation to the broader market while generating lock step returns can be achieved via a blended options-based approach where 50% cash is held in conjunction with long index-based equities and an options component.

A beta-controlled, options-based strategy has been key in circumventing the September 2020, October 2020, and January 2021 declines and reinforce why appropriate risk management is essential. An options-based approach provides a margin of safety while circumventing the impacts of drastic market moves as well as containing portfolio volatility. In the face of volatility, consistent monthly income has been generated while outpacing the S&P 500 during market downturns. Moreover, an options/cash/long equity hybrid portfolio demonstrates its durability even when compared to the most bullish conditions post-pandemic bull market.

Following the 10 rules in options trading has generated positive returns in all market conditions for the options segment of the portfolio over the past 15 months. Moreover, the positive options returns were in sharp contrast to the negative returns for the overall market in down months. This demonstrates the durability and resiliency of an options-based portfolio to outperform during pockets of market turbulence. To this end, portfolio agility is required to mitigate uncertainty and volatility expansion.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.