This week we have a stock market forecast for the week of 6/13/21 from our friend Bo Yoder of the Market Forecasting Academy. Be sure to leave a comment and let us know what you think!

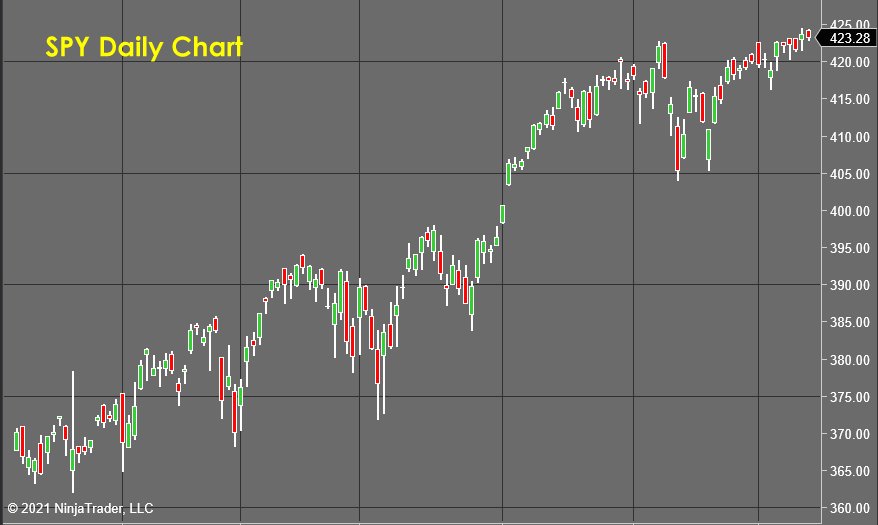

The S&P 500 (SPY)

It feels like a waste of time to even bother doing analysis on the S&P 500 (analyzed here using SPY) this week. This “dead and drifting” market behavior often precedes a big increase in volatility, and my forecasting tools continue to show that this bullish move up is unsponsored and likely to fail.

Having closed out a lot of positions in recent weeks, I think it’s time to start putting some risk back on in anticipation of increased bearish volatility next week.

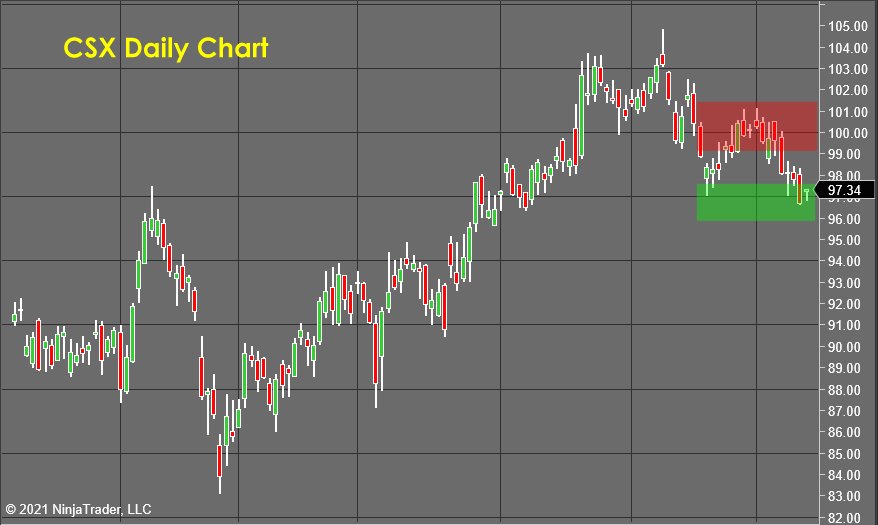

CSX Corp (CSX)

CSX has sold off nicely to retest the last major swing low, and unfortunately, this wave of selling hasn’t attracted as much bearish attention as I would like. The odds have shifted at this point, and it’s less than a 50/50 chance that we go lower, so this weakening of bearish resolve is my signal to take the profits I have and exit this as a winner on Monday.

Fluor Corporation (FLR)

Fluor Corporation (FLR) is an engineering company that was hit hard in the news a few weeks back. It has gone through its first correction and is now turning lower to test down to what I am forecasting will be a lower low.

How much bearish energy surges as that occurs will determine how my target zone shifts, but I would expect to see the price test the $16.50 per share area for now. If there is a big surge in bearish order flow next week, there may be a lot more downside available once the lows are broken.

We will let the data drive the management decisions for this opportunity over the next few weeks.

Options Basics Boot Camp - Free

Learn how to use options to supersize your portfolio returns with Trader Travis' free training!

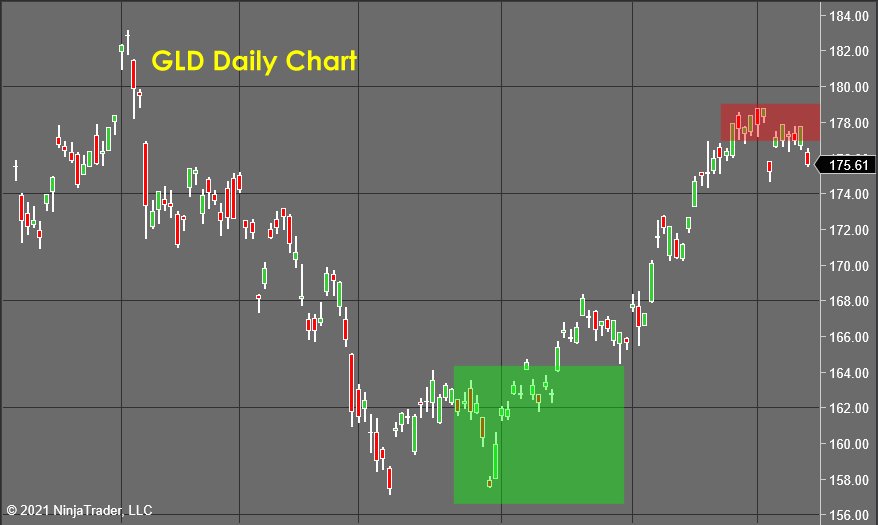

Gold (GLD)

Gold (analyzed here using GLD) confirmed the choice to take profits nicely, as it traded a few days up in the green (take profits ) zone and now has turned lower and is selling off in earnest.

This correction will take us down for a few weeks, and I hope that a high probability re-entry point will offer another good wave of profits to the upside.

International Paper (IP)

International Paper (IP) has been enjoying a solid bullish run in recent months. It began showing signs of distribution about 2 weeks ago, then rallied one more time to a new high for the year. Instead of seeing accelerating bullish demand into these highs, the bears took control very quickly, and now the stock is hovering near its recent range lows.

This offers a quick “cycle trade” opportunity to capture some short-term profits as that correction forms. I will be managing this trade based on the weekly observations I make on the forces of supply and demand, but I wouldn’t expect this to go much below the green zone near $58.

To Learn How To Accurately and Consistently Forecast Market Prices Just Like Me, Using Market Vulnerability Analysis™, visit Market Forecasting Academy for the Free 5 Day Market Forecasting Primer.

Check back to see my next post!

Bo Yoder

Market Forecasting Academy

About Bo Yoder:

Beginning his full-time trading career in 1997, Bo is a professional trader, partner at Market Forecasting Academy, developer of The Myalolipsis Technique, two-time author, and consultant to the financial industry on matters of market analysis and edge optimization.

Bo has been a featured speaker internationally for decades and has developed a reputation for trading live in front of an audience as a real-time example of what it is like to trade for a living.

In addition to his two books for McGraw-Hill, Mastering Futures Trading and Optimize Your Trading Edge (translated into German and Japanese), Bo has written articles published in top publications such as TheStreet.com, Technical Analysis of Stocks & Commodities, Trader’s, Active Trader Magazine and Forbes to name a few.

Bo currently spends his time with his wife and son in the great state of Maine, where he trades, researches behavioral economics & neuropsychology, and is an enthusiastic sailboat racer.

He has an MBA from The Boston University School of Management.

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation for their opinion.