Achieving an options win rate of 98% requires following a core set of 10 basic rules supplemented by some general guidance. Following these rules while deploying an array of option types (i.e., put spreads, call spreads, iron condors, and diagonal call/put spreads) across a diverse large-cap ticker list is the foundation of this success. Staggering expiration dates, managing winning trades, keeping trade allocation in balance with overall portfolio size, and trading in tickers that are liquid in the options market are other critical components to this success. Sticking to high probability outcomes via leveraging delta as a proxy, layering in some basic technical analysis, and maintaining appropriate portfolio structure is essential while ideally maintaining a 50% cash in addition to a hybrid long equity/options approach.

Options Trading Framework - 10 Essential Rules

A set of trading fundamentals must be followed to run an options-based portfolio over the long-term successfully. Specifically, position-sizing, sector diversity, maximizing the number of trade occurrences, and risk-defined strategies are some notable areas that traders need to heed for long-term successful options trading.

The following option trading fundamentals must be exercised in every trade. Violating any of these fundamental rules will jeopardize this strategy and possibly negate this approach's effectiveness on the whole. Below are 10 option trading rules that provide a basic framework of options trading to maintain discipline and systematic trading mechanics (Figure 1).

Figure 1 – 10 rules for long-term successful options trading as demonstrated throughout these performance metrics

-

1. Trade across a wide array of uncorrelated tickers

2. Maximize sector diversity

3. Spread option contracts over various expiration dates

4. Sell options in high implied volatility environments

5. Manage winning trades

6. Use defined-risk trades

7. Maintains a ~50% cash level

8. Maximize the number of trades, so the probabilities play out to the expected outcomes

9. Place probability of success in your favor (delta)

10. Appropriate position sizing/trade allocation

Option Rules - Additions and Refinements

Continuously reflecting and refining the basic framework of options trading is encouraged to ensure continuous improvement and adjusting for lessons learned. The additional guidance will strengthen the initial set of rules to drive better outcomes over the long-term.

-

1. Avoid earnings-related events (these events can routinely cause strike prices to be heavily challenged and/or breached post earnings)

2. Avoid concurrent option trades on the same underlying ticker (if concurrent trades are placed, ensure an adequate gap between expiration dates and use different strikes)

3. Avoid strike widths wider than ~$5 (rolling trades becomes more feasible and will allow better opportunities for closing trades with narrow strike zones)

4. Use technical analysis to aid in trade selection such as RSI (Relative Strength Index) and Bollinger bands (this can help identify the trade type to execute, such as iron condors or directional trades such as put spreads or call spreads)

Potential Landmines and Anomalies

Following the 10 basic rules with the supplemental guidance cannot guarantee flawless results in the options trading space. One of the biggest threats to options trading is unforeseen stock price excursions, whether it be a black swan event or vertical moves up in the underlying share price that may jeopardize any directional options that are in play at the time of a drastic move. When these situations arise, rolling trades can be performed to reset the probability of success in your favor and allow more time for the price excursion to revert to its mean.

See This Week's Stock Pick

Our experienced analyst carefully scours financial publications, balance sheets, press releases, charts, live events, and more to locate the most liquid, undervalued, and overlooked stocks.

Option Results

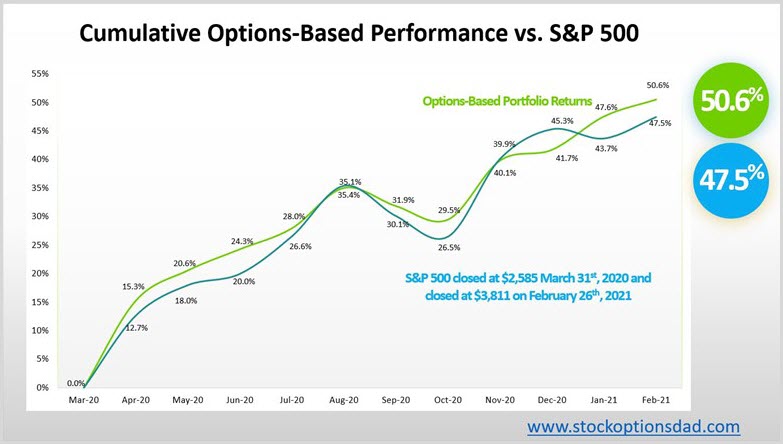

When compared to the broader S&P 500 index, the blended options, long equity, and cash portfolio has outperformed this index by a significant margin. In even the most bullish scenario post-pandemic lows where the markets erased all the declines via V-shaped recovery, this approach has outpaced the S&P 500 returns through 12MAR21 with substantially less risk (Figures 2-7).

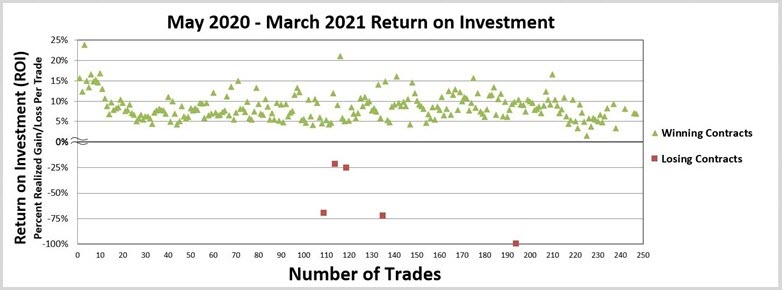

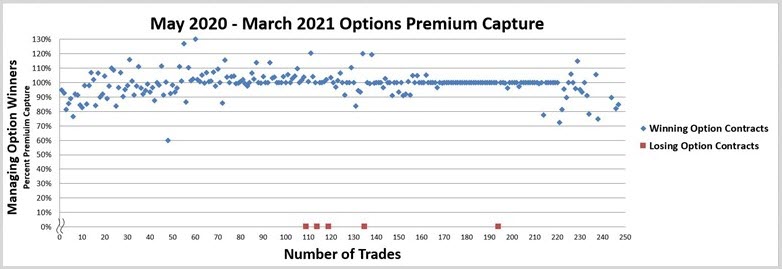

Overall, from May 2020 through March 12th, 2021, 231 trades were placed and closed. An options win rate of 98% was achieved with an average ROI per trade of 7.4% and an overall option premium capture of 84% while outperforming the broader market through the September 2020, October 2020, and January 2021 declines (Figure 2-7).

Figure 2 – Overall options-based performance compared to the S&P 500 from May 2020 – February 2021

Figure 3 – Overall option metrics from May 2020 – March 12th, 2021

Figure 4 – Overall option metrics from May 2020 – March 12th, 2021

Figure 5 – ROI per trade over the past ~230 trades

Figure 6 – Percent premium capture per trade over the last ~230 trades

Consistent Option Income Despite September 2020, October 2020, and January 2021 Declines

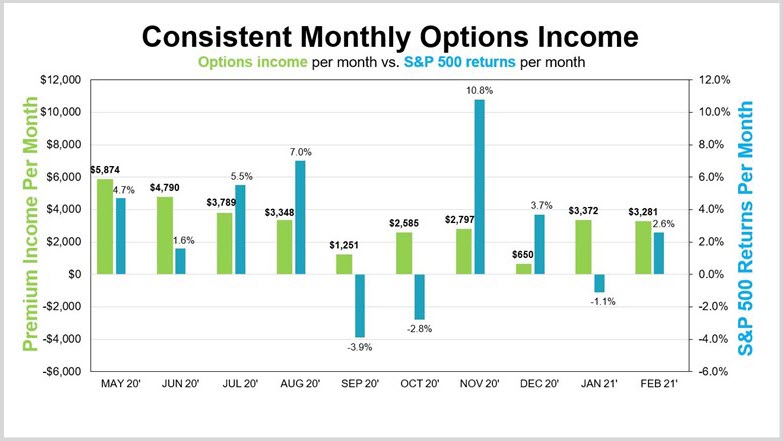

The September 2020, October 2020, and January 2021 declines provide a great opportunity to demonstrate an options-based portfolio's durability and resiliency. A positive $1,251 return, a positive $2,585 return, and a positive $3,372 return for the options portion of the portfolio was achieved in September 2020, October 2020, and January 2021, respectively (Figure 7).

Figure 7 – Generating consistent income despite negative returns for the S&P 500 index in September 2020, October 2020, and January 2021

Conclusion

Following a well-refined set of options rules are essential for long-term successful options trading. Continuously reflecting and refining these rules ensures continuous improvements are layered into your options trading strategy. The additional supplemental rules will strengthen the core rules to drive better outcomes over the long-term (i.e., avoiding earnings-related events and using basic technical analysis).

The September 2020, October 2020, and January 2021 declines provide a great opportunity to demonstrate the durability and resiliency of an options-based portfolio. Positive options returns were generated in all three negative months for the overall market, generating consistent income without guessing which way the market will move.

An options-based approach provides a margin of safety while circumventing the impacts of drastic market moves as well as containing portfolio volatility. Despite market volatility, consistent monthly income has been generated while outpacing the S&P 500 with 50% of the portfolio in cash.

An options-based portfolio provides the agility required to mitigate uncertainty and volatility expansion while circumventing market declines. Using the 10 rules as a foundation along with the supplemental rules will drive consistent options results. Heed all options trading rules; any violation of these rules may result in unmitigated portfolio damage with the potential for losses.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.