Wall Street capped off one of the most volatile years in history. The Dow Jones and S&P 500 ended the year at all-time highs, posting returns of 16.3% and 7.3%, respectively, for 2020. At the same time, the Nasdaq posted a return of 43.6% for the year. These unprecedented returns were achieved despite the S&P 500 nosediving over 30% earlier in the year due to the coronavirus pandemic sweeping the world. In this market environment harnessing options can allow traders to define risk, leverage a minimal amount of capital, and maximize returns.

All-time highs have been reached with the confluence of election certainty, improving vaccine prospects across the globe, and massive stimulus out of Washington. These positive developments have been priced into the markets. The broader indices are richly valued as measured by virtually any historical metric via stretched valuations, options put/call ratios, broad participation above 200-day moving averages, and elevated P/E ratios. Collectively, these may be potential warning signs of near-term pressures. Heeding these frothy market conditions via risk mitigation may be best served with risk-defined options trading.

Options: Margin of Protection and Defining Risk

Harnessing options in frothy markets allows one to define risk, leverage a minimal amount of capital, and maximize returns. Options can be structured to allow a margin of downside and/or upside stock movement while collecting income in the process. In these richly valued markets, allowing a margin of downside and/or upside stock movement may be a great strategy to heed potential market volatility.

Bearish Tilt Framework - Call Credit Spreads

With markets at all-time highs and many of the positive developments priced into the market, a bearish tilt option strategy can be deployed via call credit spreads. This strategy allows the underlying stock to still appreciate further without having any downside stock movement consequences.

This strategy involves selling a call option and buying a call option while collecting a credit in the process. When selling the call option, a premium is collected and simultaneously using some of that premium income to buy a call option at a higher strike price. The net result will be a credit on the two-leg pair trade with defined risk since the purchase of the call option serves as protection.

By selling the call option, you agree to sell shares at the agreed-upon price by the agreed-upon expiration date. By buying the call option, you have the right to buy shares at the agreed-upon price by the same agreed-upon expiration date. Thus, the risk is defined, and capital requirements are minimal.

Defined Risk

A credit spread is a type of options trade that risk-defines your trades and involves selling and buying an option. Let’s review a step-by-step call spread as an example below.

Selling an option, you sell a call option, and you agree to sell shares at an agreed-upon price by an agreed-upon date in exchange for premium income.

Buying an option, you buy a call option using some of the premium received from selling the option above, and you now have the right to buy the shares at an agreed-upon price by the same agreed upon date in exchange for paying out a small premium.

Taken together, an option spread is where you sell an option and also buy a further-out-of-the money option for upside protection. The difference in the premium received, and premium paid out is the credit spread income collected.

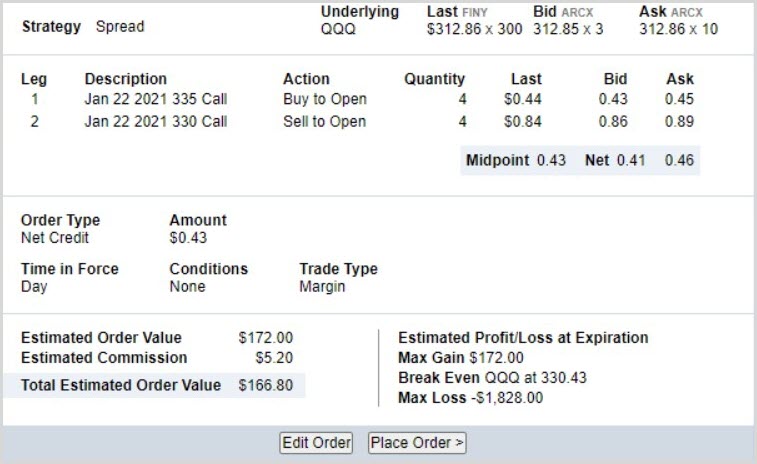

For example, if you sell a call option at a strike price of $330 in exchange for $87 in premium, you can use some of that premium income to buy the $335 strike call option for $41 to net $43 on the trade ($87 - $44).

In this manner, you agree to sell shares at $330, and you also have the right to buy shares at $335. This will cap your losses at $457 ($500 strike width less premium received). If the stock breaks above the $335 strike protection leg, you would be assigned at $330 and exercise your right to buy shares at $335 per share. The $4.57 per share loss is the max loss you can incur, and factoring in the $43 of net premium income, the net loss is capped at $457. The stock can shoot up to infinity per share, and your loss is still capped at $457 (Figure 1).

Figure 1 – Opening a call credit spread via selling a call and buying a call while taking in net premium income during the process. Capital requirement is equal to the strike width, and risk is defined to maximize return on investment

Options can be leveraged in a high-probability manner to generate consistent income while circumventing drastic market movements (Figure 2).

Figure 2 – Overall option metrics from May 2020 – December 31st

Potential Outcomes and Scenarios

A normal call spread with the same expiration dates will expire together worthless with defined risk. If the option expires between the strikes, then losses will incur, and if the stock moves above your protection put, then max losses will occur at expiration. In a raging bull market, clusters of options trades can incur max losses and jeopardize your profit/loss statement. My goal is to limit the losses and not absorb any max losses to optimize risk management.

Options Example

Sell a call strike @ $330 22JAN21 and buy a call strike @ $335 22JAN21 to net $43 in premium

-

A. If the stock stays below $330 at expiration, then you net the $43 in premium, and both option legs co-expire worthless with 100% premium capture

B. If the stock trades above $330, then you begin losing money, but the $335 strike leg caps any losses above $335. If the stock falls between your strike width at ~$332 at a loss of $2 per share, less the premium received of $0.43 per share will be your realized loss ($200 - $43 = $157 loss per contract).

C. If the stock trades above the call protection leg of $335, losses are now capped at your strike width of $5 per share. If you were assigned at $330, you would then exercise your $335 strike option and buy shares at $335 to cap losses at $5 per share less premium received of $43 resulting in a max loss of $457. Even if the stock was to rise to infinity, you have the right to buy shares at $335, so any losses above $335 are prevented.

Conclusion

Stocks are ostensibly overextended with stretched valuations with P/E ratios exceeding that of the Roaring Twenties, options put/call ratios at the lowest in 20 years, and 93% of S&P 500 stocks are above their 200-day moving average. These may be potential warning signs of near-term pressures, and heeding these frothy market conditions via risk mitigation may be best served with risk-defined options trading. As markets continue to pursue uncharted bullish territory, investors should be strategic with these historical comparators as 2021 comes into the fold. A bearish tilt via risk-defined call credit spreads may be the ideal mix of defining risk, allowing additional upside movement in the underlying stock, leveraging a minimal amount of capital, and maximizing return on capital.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.