If you have been following my team’s research posts recently, we have highlighted some interesting new research related to Appreciation/Depreciation phases in the US stock market and how that relates to Gold. Today we will explore another method of identifying the different phases of market trends that appears to show very clear Appreciation/Depreciation phases and extended end-phase blow-off tops and bottoms.

My research team and I believe the current rally in the US stock markets represents an end-phase blow-off top after a 9.5-year Appreciation phase that began in mid-2009. We believe it is very important for traders to understand these larger Appreciation/Depreciation cycles and how the Blow-Off end phases often create extreme volatility and price rotation.

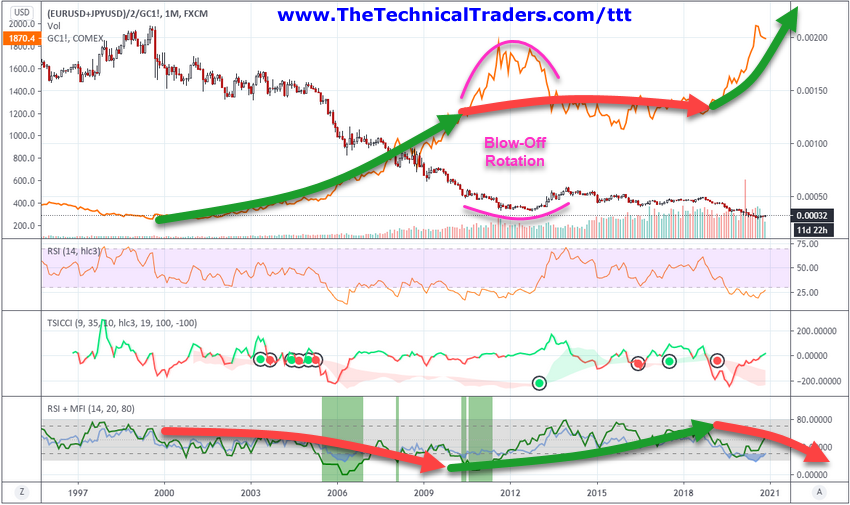

Below, we are using a custom EURUSD/JPYUSD index divided by GOLD as the base Candlestick chart and have applied the real Gold price levels on the chart for visual reference. Near the bottom of the chart, we are showing the RSI indicator, the TSICCI indicator, and the RSI + MFI Indicator that helps to highlight the broad market trends and cycle phases. We want you to pay attention to the GREEN and RED arrows we’ve drawn on this chart showing the Appreciation/Depreciation phases of Gold and the broader US stock markets in EUR/JPY currency form. This method of charting these phases takes a bit of patience and understanding. We are looking for correlations to US stock market trends in relation to precious metals, and we must consider the end-phase process.

The end-phase process, after any appreciation or depreciation phase, often includes a very volatile “blow-off” period where trends continue beyond the end of the actual price phase. This happens because the momentum of the previous price move has yet to realize the transitional shift in underlying appreciation/depreciation factors. Traders still want the rally in the stock market or metals to continue, so they chase after the excess phase rally until the momentum of the move fails.

These end-phase excess rallies can be quite exciting and volatile but often end in a certain type of setup. We believe it is important for all traders and investors to understand the end-phase setup and how it translates into opportunities for skilled traders.

Learn The Components Of An Excess Phase Peak/Breakdown

First, the Phase 1 Excess Rally must take place. This is usually an impressive upside price move that may last far longer than many people expect. For example, the 2014 peak in Bitcoin rallied from near $100 to over $1100 (over 1000%), then stalled.

The Second Phase of the Excess Blow-Off peak is the retracement of price followed by a FLAG/Pennant trend that appears to be a resumption of the original trend. This is important from a psychological perspective because it provides further technical price data that the excess rally phase has failed.

Looking at Phases 3, 4, and 5 on the chart below, we can see the Third Phase is the breakdown of the FLAG formation. When the FLAG formation fails, the price usually falls to a new lower support level, which sets up the final “exhaustion rally” before stronger selling pressure continues. This is usually a very good trend for short traders. The FLAG setup usually gives traders time to setup Put Options or setup short positions waiting for the breakdown of the FLAG setup.

The Fourth Phase is the identification/setup of the Support/Recovery Attempt. After the FLAG breakdown initiates, price starts to actively seek out fair valuation levels below the Excess Phase peak and the recent FLAG pattern lows. This process usually attempts to identify a near term support level that begins to act as a Price Floor for quite some time.

Lastly, the Phase Five Breakdown, as the momentum of the past rally fades and traders resign themselves to the fact that the excitement of the Excess Phase rally has ended. At this point, the price usually continues to consolidate near the Phase Four support level before finally breaking downward into the extended downside/bearish trend.

As we’ve stated near the top of this research post, our research team believes the current US stock market appreciation phase ended in mid-2018 and that we are nearly 2.5 years into an Excess Phase (blow-off) topping formation. We believe the next phase of the US market trend will be something similar to what we are showing you in these examples. It is important for all traders and investors to recognize these late-stage volatile price setups, particularly ones that are pushed to extreme limits because of Central Bank and US Fed interventions.

In Part II of this research article, we’ll share more examples of late Excess Phase peaks and breakdowns as well as share more insight related to the current market conditions. If our research is accurate, we are about to enter a very exciting phase of the market where big price rotation and wild trends will continue for the next 4 to 5+ years before a new US stock market appreciation phase begins again.

You don’t have to be smart to make money in the stock market, you just need to think differently. That means: we do not equate an “up” market with a “good” market and vi versa – all markets present opportunities to make money!

We believe you can always take what the market gives you and make CONSISTENT money.

Learn more by visiting The Technical Traders!

Happy Thanksgiving!

Chris Vermeulen

Technical Traders Ltd.

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation for their opinion.