Despite the COVID-19 backdrop, some individual stocks and broader indices have exploded to new all-time highs and retraced previous all-time highs, respectively. Since the depths of the COVID-19 induced sell-off in late March, the markets have experienced an uninterrupted resurgence. It’s easy to become complacent when markets are roaring higher. However, one must remain disciplined when managing risk, especially as it relates to options trading. Mitigating risk and maximizing returns is paramount as the markets rotate out of the depths COVID-19 sell-off. Options trading offers the optimal balance between risk and reward while providing a margin of downside protection and a statistical edge. Proper portfolio construction and optimal risk management is essential when engaging in options trading as a means to drive portfolio performance. The Q4 2018 and the COVID-19 pandemic are prime examples of why maintaining liquidity, risk-defining trades, staggering options expiration dates, trading across a wide array of uncorrelated tickers, maximizing the number of trades, appropriate position allocation and selling options to collect premium income are keys to an effective long-term options strategy.

An Effective Long-Term Options Strategy

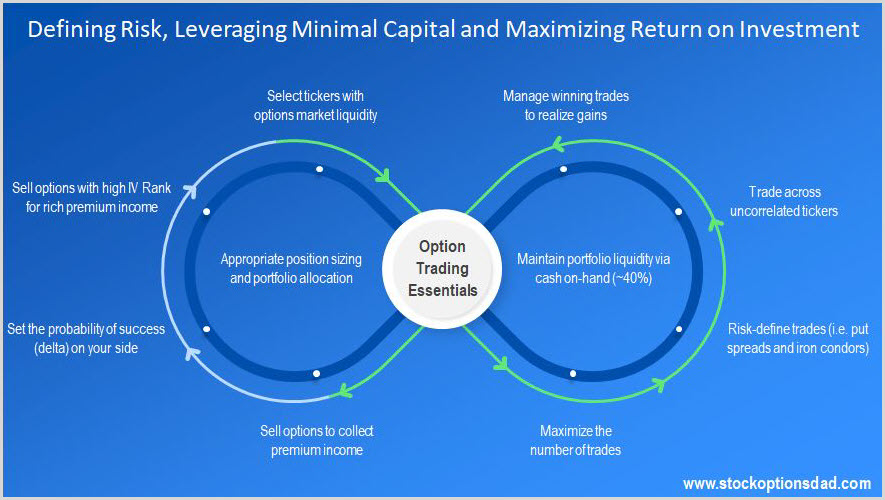

A slew of protective measures should be deployed if options are used as a means to drive portfolio results. One of the main pillars when building an options-based portfolio is maintaining a significant portion of cash-on-hand. This cash position provides the ability to rapidly adapt when faced with extreme market conditions such as COVID-19 and Q4 2018 sell-offs. When selling options and running an options-based portfolio, the following guidelines are essential (Figures 1 and 2):

- 1. Trade across a wide array of uncorrelated tickers

- 2. Maximize sector diversity

- 3. Spread option contracts over various expiration dates

- 4. Sell options in high implied volatility environment

- 5. Manage winning trades

- 6. Use defined-risk trades

- 7. Maintains a ~50% cash level

- 8. Maximize the number of trades, so the probabilities play out to the expected outcomes

- 9. Continue to trade through all market environments

- 10. Appropriate position sizing/trade allocation

Figure 1 – Defining the 10 rules that one must follow to appropriately manage risk and maximize returns when deploying options as a means to drive portfolio results

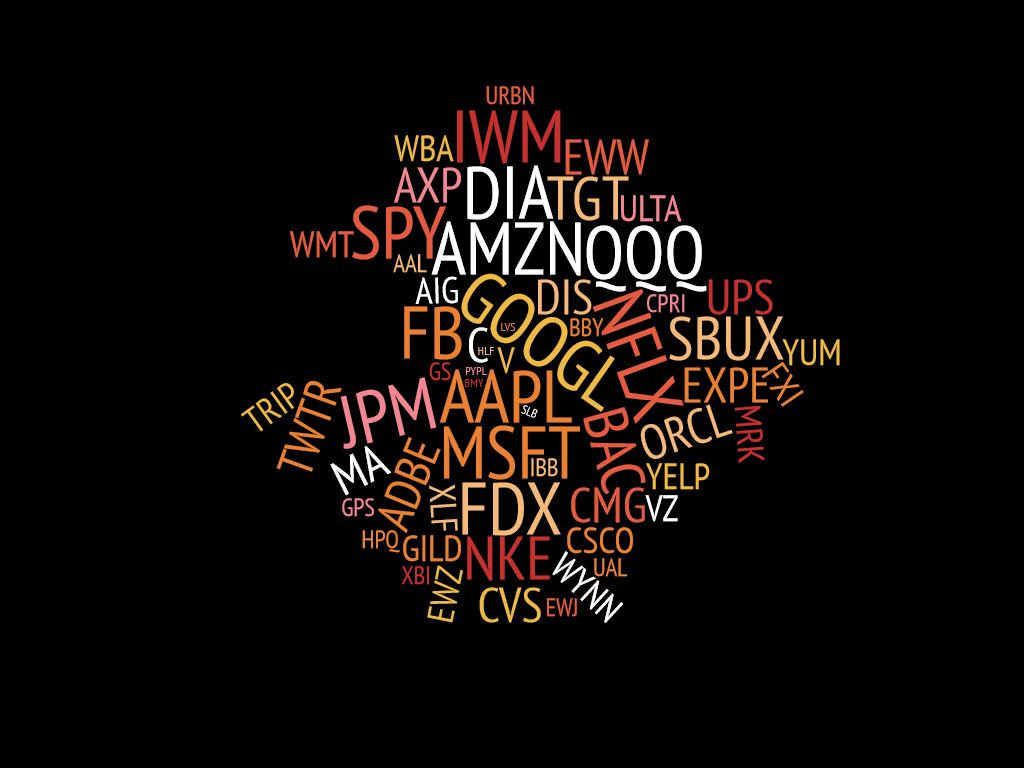

Figure 2 – A diversified array of ~80 tickers that can be used as a means to trade uncorrelated tickers across diverse sectors

Minimizing Risk and Maximizing Return

Leveraging a minimal amount of capital and maximizing returns with risk-defined trades optimizes the risk-reward profile. Whether you have a small account or a large account, a defined risk (i.e., put spreads and diagonal spreads) strategy enables you to leverage a minimal amount of capital which opens the door to trading virtually any stock on the market regardless of share price such as Apple (AAPL), Amazon (AMZN), Chipotle (CMG), Facebook (FB), etc. Risk-defined options can easily yield double-digit realized gains over the course of a typical one month contract. Additional measures of risk management include delta (a proxy for the probability of success) adjustments and strike width narrowing to minimize capital requirements (Figures 3, 4, and 5).

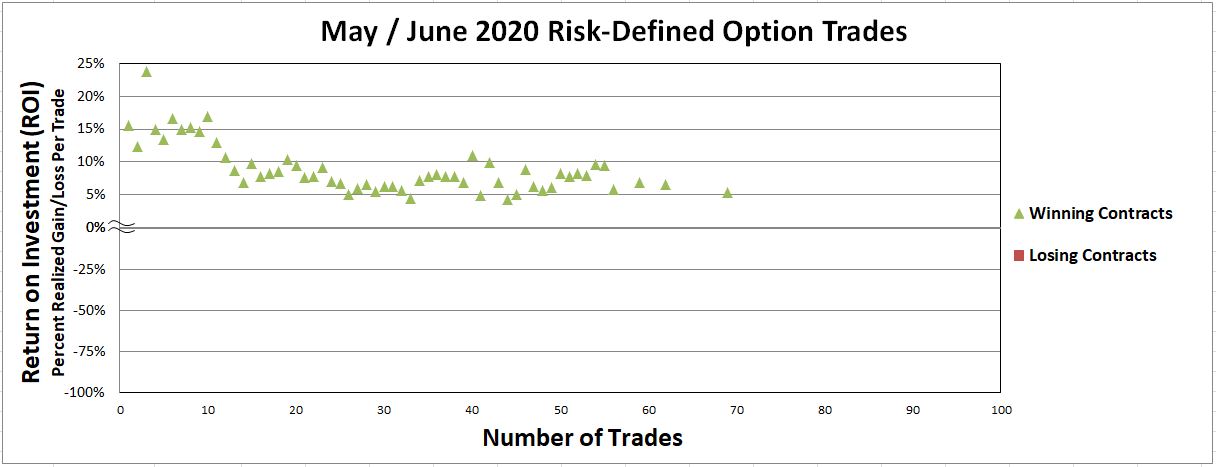

Figure 3 – Average income per trade of $209, average return per trade of 7.4% and 97% premium capture over 51 trades in May and June

Figure 4 – Options win rate of 100% across 25 unique tickers using put spreads and diagonal spreads with a current win streak of 59 consecutive trades

Figure 5 – Average return on investment (ROI) per trade of 7.3% using a risk defined strategy via leveraging a minimal amount of capital to maximize returns

Conclusion

Options trading is a leveraged vehicle; thus, minimal amounts of capital can be deployed to generate outsized gains with predictable outcomes. The Q4 2018 market downturn and the COVID-19 black swan event reinforces why appropriate risk management is essential while holding cash-on-hand. The overall options-based portfolio strategy is to sell options which enable you to collect premium income in a high-probability manner while generating consistent income for steady portfolio appreciation despite market conditions. This options-based approach provides a margin of safety while mitigating drastic market moves and containing portfolio volatility.

Options trading is a long-term game that requires discipline, patience, and time. The COVID-19 black swan event reinforces why keeping liquidity, spreading out expiration dates, maximizing sector exposure, maximizing ticker diversity, risk-defining trades, and continuing to sell options through all market conditions is essential. Continuing to stick to the fundamentals with defined risk trades via leveraging small amounts of capital to maximize profits is essential. Keeping a significant portion of your portfolio in cash is essential to the overall strategy.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.