COVID-19 has become the black swan event that has materialized into a worldwide economic halt. The spread of the virus globally has crushed stocks and decimated entire industries such as airlines, casinos, travel, leisure, and retail, with others in the crosshairs. COVID-19 was the linchpin for the major indices to drop over 30% over the course of 22 days. This COVID-19 induced sell-off has been the worst since the Great Depression in terms of breadth and velocity of the sell-off while inducing extreme market volatility that hasn’t been since the Financial Crisis.

Although options trading provides a margin of downside protection and a statistical edge, no portfolio is immune from the wreckage when hit with a black swan event. Thus, proper portfolio construction is essential when engaging in options trading to drive portfolio results. One of the main pillars when building an options-based portfolio is maintaining ample liquidity via holding ~50% of one’s portfolio in cash. This liquidity position provides the ability to adjust when faced with extreme market conditions such as COVID-19 rapidly. Thus, an agile options-based portfolio is essential. The COVID-19 pandemic is a prime example of why maintaining liquidity is one of the many keys to an effective long-term options strategy.

An Agile Options Strategy

Risk management is paramount when engaging in options trading. A slew of protective measures should be deployed if options are used as a means to drive portfolio results. When selling options and running an options-based portfolio, the following guidelines are essential:

- 1. Trade across a wide array of uncorrelated tickers

- 2. Maximize sector diversity

- 3. Spread option contracts over various expiration dates

- 4. Sell options in high implied volatility environments

- 5. Manage winning trades

- 6. Use defined-risk trades

- 7. Maintains a ~50% cash level

- 8. Maximize the number of trades, so the probabilities play out to the expected outcomes

- 9. Continue to trade through all market environments

Figure 1 – A composite of ~75 tickers that can be used as a means to trade uncorrelated tickers across diverse sectors

Basic Options Strategy Framework

In high implied volatility environments, options traders can sell options and collect rich premium income in a high probability manner with a statistical edge. This set-up comes with expected outcomes given enough trade occurrences over time. Furthermore, options can be sold with defined risk to leverage a minimal amount of capital to maximize return on investment. Whether you have a small account or a large account, a defined risk (i.e., put spreads) strategy enables you to leverage a minimal amount of capital, which opens the door to trading virtually any stock on the market.

Cash Flexibility

Holding 50% cash as a protective measure is essential when faced with unpredictable outlier situations such as COVID-19. A cash position this high is possible because options are leveraged; thus, minimal amounts of capital can be deployed to generate outsized gains with predictable outcomes. However, even deploying all the protective measures outlined above won’t offer the protection required during a black swan event. All sectors and stocks homogenize and naturally correlate together in a downward spiral during these black swan market meltdowns. Cash is the safest way to immunize a portfolio from these types of market crashes. This cash position also provides optionality to go long stock in high-quality names when faced with extreme sell-offs.

Maximizing Trade Occurrences

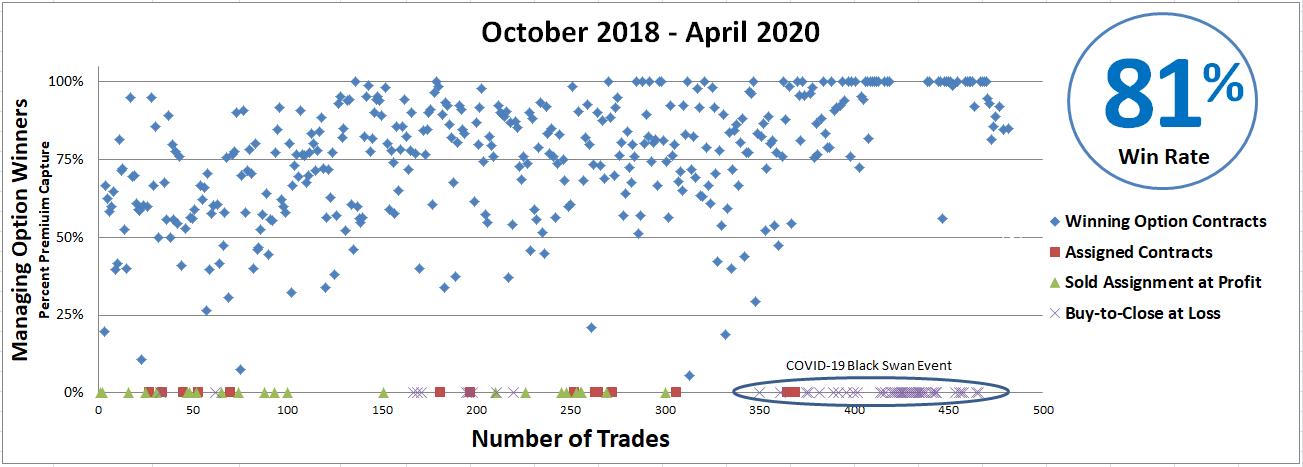

I trade at an expected probability of success of 85% and in high implied volatility environments where rich premium income can be realized while risk-defining each trade. Given enough trade occurrences, the expected outcomes materialize over the course of time and various market conditions (Figure 2). Placing only 10 trades or 50 trades over a given time period is simply inadequate for an options-based approach. Trading through all market conditions at a specific probability of success level, given enough trades and time, the probabilities will reach their expected outcomes. To achieve the expected probability level, hundreds of trades need to be placed and closed before the probabilities really begin to play out. As these trade data grow in size, plotting all of your trades over time, you’ll see the numbers align more and more with your expected probabilities. Taken together, trade as often as you can at your desired probability of success to achieve the win rate of interest (Figure 2).

Figure 2 – Dot plot summarizing 478 trades over the previous 19-month period highlighting the importance of maximizing trades and trading through all market conditions. An 81% success rate is demonstrated in the above dot-plot despite hitting a huge sequence of losses from the COVID-19 impact

Maximizing Return on Capital

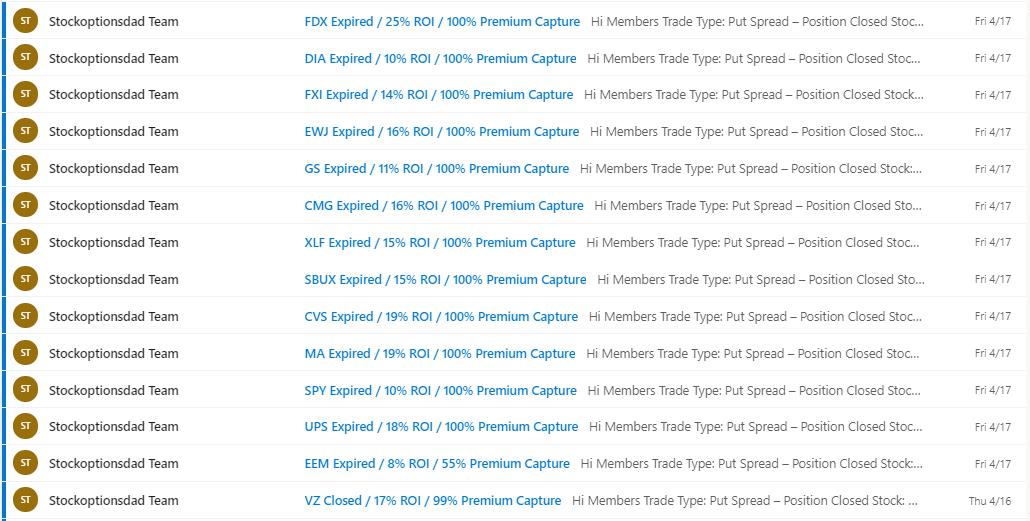

Risk-defined trades maximize return on capital; oftentimes, a double-digit realized gain over the course of a month-long contract. The required capital is equal to the maximum loss, while the maximum gain is equal to the option premium income received. Since the risk-defined approach has a max loss, the required capital is equivalent to the max loss. The maximum loss value only needs to be covered by the available account balance (Figure 3).

Figure 3 – Trade notification service example of a trade cluster that expired on a Friday

Conclusion

The COVID-19 black swan event reinforces why appropriate risk management is essential and has ample liquidity. The overall options-based portfolio strategy is to sell options that enable you to collect premium income in a high-probability manner while generating consistent income for steady portfolio appreciation regardless of market conditions. This is all done without predicting which way the market will move since options are a bet on where stocks won’t go, not where they will go. Options trading isn’t about whether or not the stock will move up or down; it’s about the probability of the stock not moving up or down more than a specified amount. This options-based approach provides a margin of safety, mitigates drastic market moves, and contains portfolio volatility.

Options trading is a long-term game that requires discipline, patience, time, maximizing the number of trade occurrences, and continuing to trade through all market conditions. Due to the black swan event, spreading expiration dates, maximizing sector exposure, maximizing ticker diversity, and continuing to sell options through all market conditions is essential. Continuing to stick to the fundamentals with defined risk trades via leveraging small amounts of capital to maximize profits is essential. Keeping a significant portion of your portfolio in cash is key to the overall strategy. An 81% win rate has been demonstrated over the past 19 months across ~475 trades despite the COVID-19 option losses.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.

There must have been huge losses back in March...