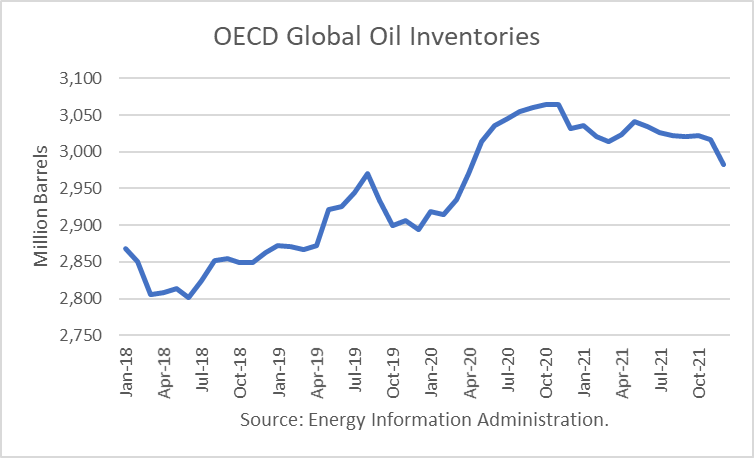

The Energy Information Administration released its Short-Term Energy Outlook for March, and it shows that OECD oil inventories likely bottomed last June 2018 at 2.802 billion barrels. It estimated stocks dipped by 5 million barrels in February to end at 2.914 billion, 44 million barrels higher than a year ago.

For 2020, OECD inventories are projected to build by 137 million barrels to 3.031 billion. For 2021 it forecasts that stocks will draw by 48 million barrels to end the year at 2.983 billion.

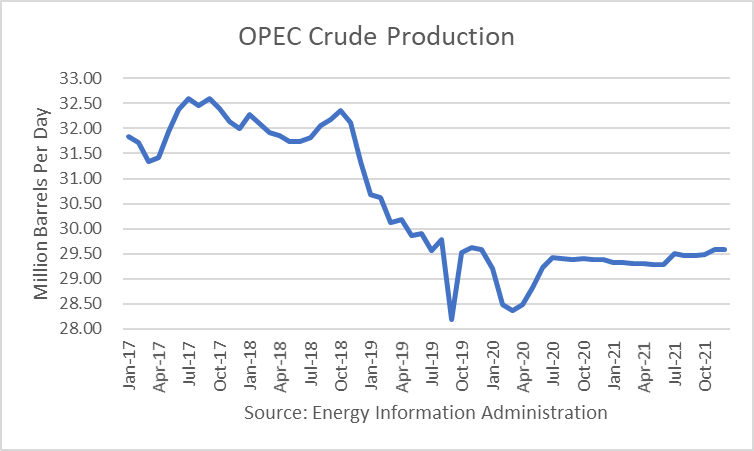

The EIA estimated that OPEC production dropped by 72,000 b/d in February to 28.49 million barrels per day. For 2020, it estimates that OPEC production will average about 29.08 million, about 720,000 b/d lower than in 2019. For 2021, it estimates OPEC production average 2.941 million. The EIA did not increase its estimates for OPEC despite the announcements by Saudi Arabia that it is pushing its production up to 12 million barrels per day and the UAE is increasing its production by 1 million barrels per day.

Oil Price Implications

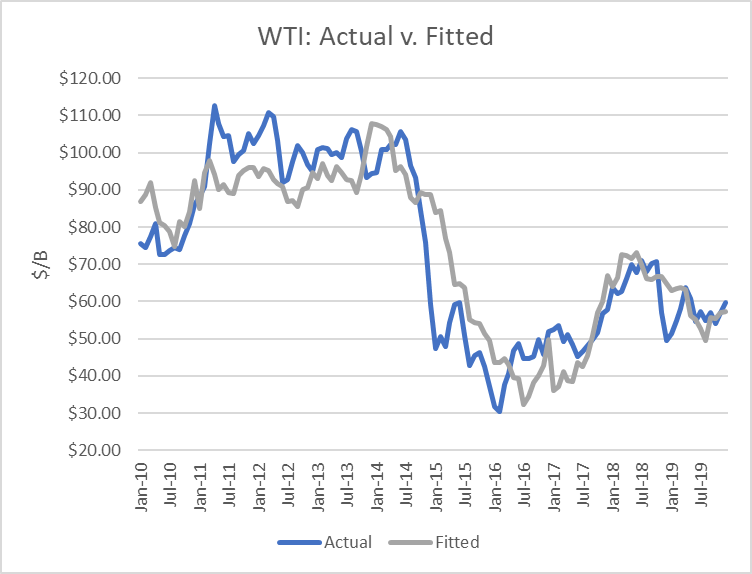

I updated my linear regression between OECD oil inventories and WTI crude oil prices for the period 2010 through 2019. As expected, there are periods where the price deviates greatly from the regression model. But overall, the model provides a reasonably high r-square result of 79 percent.

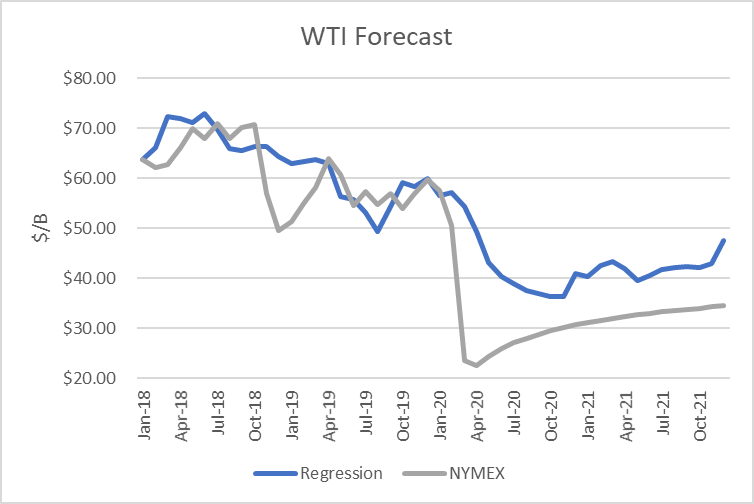

I used the model to assess WTI oil prices for the EIA forecast period through 2020 and 2021 and compared the regression equation forecast to actual NYMEX futures prices as of March 20th. The result is that oil futures prices are presently undervalued for the forecast horizon. However, the EIA estimates are grossly overestimating world oil demand and largely underestimating global production, given the oil price war underway.

Uncertainties

The 4Q18 proved that oil prices can move dramatically based on expectations and that they can drop far below the model’s valuations. The attack on Aramco’s oil facilities also proved they can rise above the model-derived price, as did the days following the killing of the Iranian general.

The two major uncertainties are how deep the demand destruction will be worldwide, how long it will last, and how much the oil price war will inflate production and how long it will last. A minor uncertainty, by comparison, is how much low oil prices will dampen non-OPEC oil production and when that will kick-in.

With many population centers in the U.S. and Europe not affected by Covid-19, and shelter-in-place orders going into effect, global oil demand can be expected to drop by a minimum of 10 percent and possibly 20 percent. That would translate into an unprecedented 10 or 20 million barrels per day.

At the same time, the Saudi-Russian oil price war is expected to add 3 to 4 million barrels per day of oil production. There is no historical comparison to the implied stock build that is developing and can be expected to take place.

Conclusions

Projections of demand destruction are highly uncertain, given the scope of the impact on the daily life of the virus on transportation, mainly gasoline and jet fuel. Likewise, a stock build of unprecedented size is likely to force oil prices very low. Moreover, the length of time it is going to take to turn the stock build around is likely to be many years into the future.

The Saudis and Russians are expecting low prices to destroy American shale production in response. However, the miscalculation may be the tenacity of the U.S. administration to protect the oil and gas industry from destruction.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Robert: always enjoy your articles on this and other forums. I disagree that dampening of non-Opec production due to low prices is a "minor consideration'. As a long-term oil and gas Operator, I believe that the drop in non-Opec production, in the US especially, will be THE major factor affecting oil prices within three months. Regards:

THE ARTICLE IS GOOD.

KAMLESHBHAI PAREKH