Citi is the latest to revise its estimates of the demand destruction from COVID-19. It said that it now believes inventories of crude oil could grow to 2 million barrels per day in February alone, which would put “even more sustained pressure on prices.” A week ago, the firm’s thought the potential build would be over one million barrels per day for the quarter.

Numerous sources have estimated China’s demand for crude had dropped between two and three million barrels per day since petroleum product consumption had dropped, and the profitability of running refineries had plummeted. But Goldman Sachs (GS) subsequently revised its estimate last week, that they now expect “a cumulative global stock build of 180 million barrels in 1H20, four times its pre-virus forecast.”

The Goldman forecast is based in part on an estimated hit in China’s crude oil demand of 4 million barrels per day. Goldman assumes that OPEC+ will deepen its cuts in 2Q by about 500,000 b/d.

OPEC’s Joint Technical Committee (“JTC”) met from February 4 to 6th and recommended “a further adjustment in production until the end of the second quarter of 2020” and “extending the current production adjustments until the end of 2020.” The cut would be an additional 600,000 b/d on top of the cuts announced in December.

But Russian Energy Minister Alexander Novak told reporters:

“If we’re talking about the timing of the meeting, there is now a common understanding that it is no longer advisable to bring it forward to an earlier date. The meetings that were scheduled, in my opinion, should be held within those dates,” he said. “There isn’t anything extraordinary enough to change the date,” he added.

By contrast, Saudi Energy Minister Prince Abdulaziz bin Salman equated the impact of the coronavirus on Chinese oil demand as a “house on fire.” He said you can either treat it with a garden hose and risk losing the building or call the fire brigade. Chinese refiners are processing 25% less crude than they were a year ago, according to numerous sources. Goldman Sachs (GS) estimates Chinese demand if off as much as four million barrels per day, the most severe demand destruction since the financial crisis of 2008-09.

The next OPEC+ meeting is scheduled for March 6. When asked what Russia’s position will be, Novak replied, “We’re not going to make the announcement yet, we still have two weeks. We will see how the situation develops, what will happen on the market, what forecasts there will be by this time. The situation is quite uncertain and is changing rapidly.”

It is not clear what assumptions Goldman is making regarding the return of Libyan production, which has dropped from 1.1 million barrels per day to just 180,000 b/d.

On February 23, a draft ceasefire agreement has been reached at the second round of the Libya military talks brokered by the UN at Geneva, UNSMIL reported today:

“UNSMIL reported that the second round of the 5+5 Libyan Joint Military Commission (JMC) talks to reach a lasting ceasefire and to restore security to civilian areas concluded on February 23 in Geneva.

“UNSMIL said that the two parties agreed to present the draft agreement to their respective leaderships for further consultations and agreed to meet again in March to resume the discussions and complete the preparation of the Terms of Reference of the sub-committees in charge of the implementation of the agreement.

“It renewed its call for both parties to fully abide by the current truce and the protection of the civilian population and properties and vital infrastructure.”

It could mean the resumption of about one million barrels of oil per day. This would come at a time when oil prices are weak due to the demand destruction as a result of Covid-19.

February 24

The energy sector recorded its largest one-day percentage drop (4.74%) since August 2015. News that COVID-19 had spread to countries outside of China, most notably Iran and Italy, heightened concerns that crude oil demand could be impacted throughout the world weighed on the sector.

Professor Mark Woolhouse, Professor of Infectious Disease Epidemiology of Edinburgh University, had said in a Guardian article published February 16, 2020. “There are so many huge unknowns about this outbreak. For example, we don’t know just how infectious people are before they show symptoms. That makes it impossible to predict what is going to happen.”

Conclusions

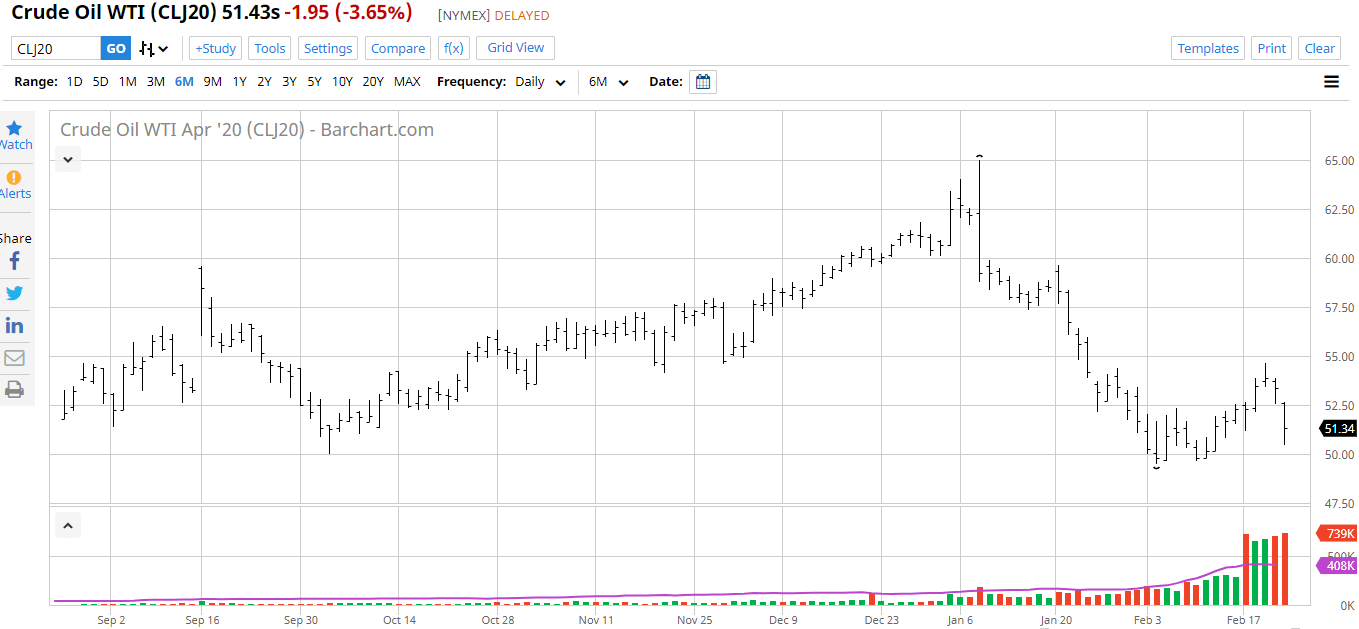

WTI Crude oil futures prices had recently held at just below $50/b. But with a continuing global oil inventory build, which is likely to increase with the return of Libyan barrels to the tune of one million barrels per day, and without a cutback from OPEC+, it seems doubtful that the price will hold above $50/b for much longer.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

It is hard to believe that the market has not discounted the demand disruption already. The real question should be "why is crude still holding above the $50 level in the face of such a barrage of bearish news?"