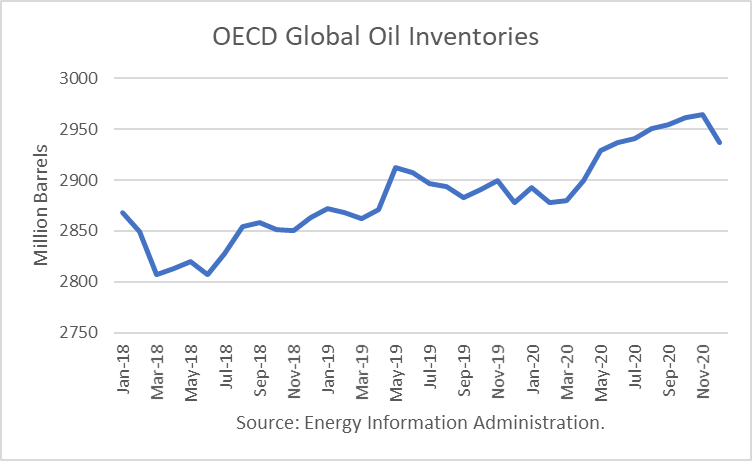

The Energy Information Administration released its Short-Term Energy Outlook for October, and it shows that OECD oil inventories likely bottomed last June 2018 at 2.807 billion barrels. It estimated stocks dropped by 11 million barrels in September to 2.882 billion, 24 million barrels higher than a year ago.

For the balance of 2019, OECD inventories are projected to rise, on balance. The third quarter seasonal stock draw was 26 million barrels. And stocks are projected to rise by 6 million in the fourth quarter, ending the year at 2.878 billion barrels, 15 million more than at the end of 2018. For 2020, EIA projects that stocks will build by 59 million barrels to end the year at 2.937 billion.

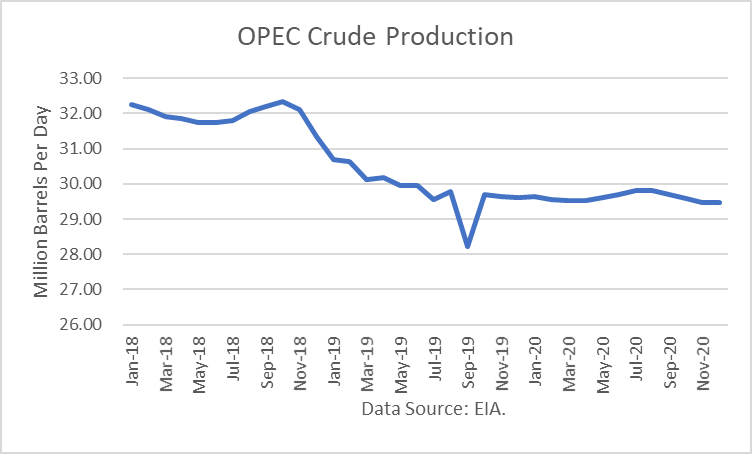

The EIA estimated that OPEC production fell by 1.55 million barrels per day in September, most of which was in Saudi Arabia due to the attack on its oil facilities. It is estimating that OPEC production will average about 29.69 million in October, due to the rebound by Aramco. For 2020, it estimates that OPEC production will average about 29.62 million, above the call (demand) for OPEC oil in 2020.

Oil Price Implications

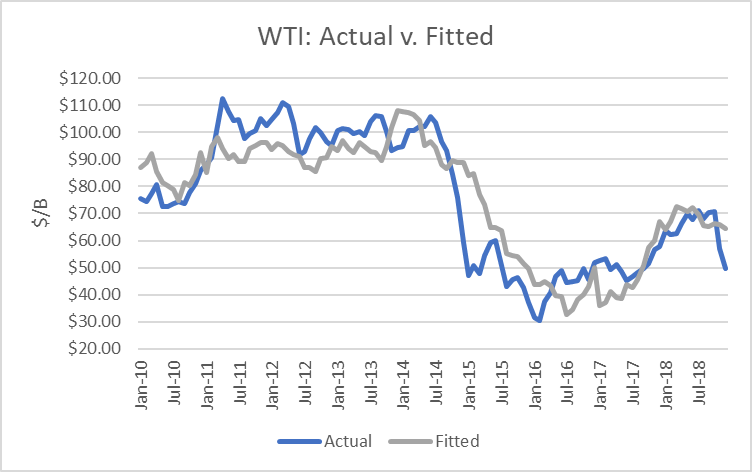

I updated my linear regression between OECD oil inventories and WTI crude oil prices for the period 2010 through 2018. As expected, there are periods where the price deviates greatly from the regression model. But overall, the model provides a reasonably high r-square result of 80 percent.

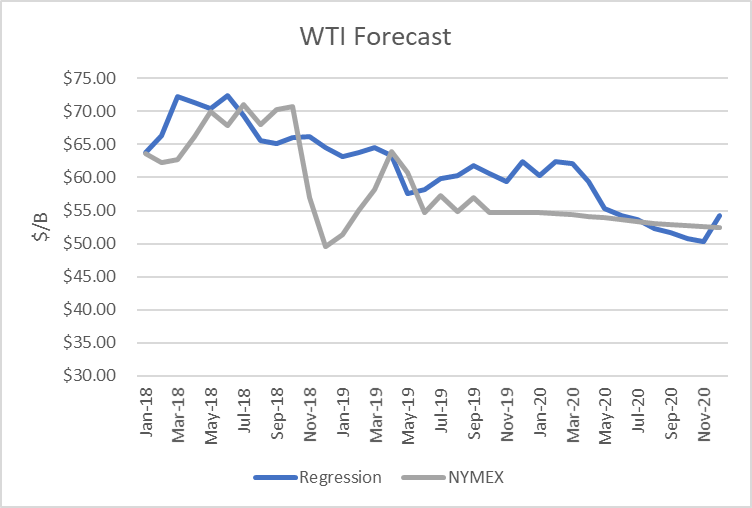

I used the model to assess WTI oil prices for the EIA forecast period through 2019 and 2020 and compared the regression equation forecast to actual NYMEX futures prices as of October 11th. The result is that oil futures prices are presently overvalued for much of the forecast horizon.

After April 2020, it shows the valuations dropping down to where NYMEX futures prices are below $50/b.

Uncertainties

The 4Q18 proved that oil prices can move dramatically based on expectations and that they can drop far below the model’s valuations. The attack on Aramco’s oil facilities also proves they can rise above the model-derived price.

The Saudi incident raised fears that oil supplies might be significantly reduced. However, the IEA SPR and American SPR were ready to fill the supply gap, but they were not necessary. Aramco sold barrels from inventory to prove to its customers that it is a reliable supplier, even on the face of military action. Furthermore, oil futures prices fell to their level prior to the attack, proving that traders were unwilling to price-in a large oil risk premium.

It was reported that both President Trump and Iranian President Hassan Rouhani agreed broadly on a 4-point French plan to revise the nuclear deal and pursue peace. The plan, if implemented, would result in the lifting of US sanctions against Iran. Such an outcome could put about 1.7 million barrels per day back into the market. That amount would likely be too far great for Saudi Arabia or OPEC+ to absorb with cuts. In that case, oil prices would likely collapse.

Another key uncertainty playing out is the trade war with China. With the presidential election coming in November 2020, it seems likely that China will just wait-to-see if Trump is re-elected before making any meaningful concessions. However, the drop in the value of the yuan has muted the impact of the tariffs on US prices of Chinese goods.

Finally, Venezuela remains a key uncertainty. EIA estimated its production at 650,000 b/d for September, 100,000 b/d lower than in August. However, it was reported that a Chinese firm has agreed to help the country restore its refinery operations in a trade for oil. The restoration is expected to take six to twelve months and again would frustrate U.S. attempts to bring that country to its knees.

Conclusions

Based purely on the model, oil prices are overvalued for much of the forecast horizon as of October 11th. The key uncertainty is a new deal with Iran, which could lead to the reduction or end of sanctions, flooding the market, and it appears traders are pricing in the downside risk.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.