Over the past 12 months, I’ve managed an options-based portfolio and demonstrated how this approach can offer a superior alternative to traditional stock picking. An options-based approach is very similar to running your portfolio like a business where you manage risk and take profits. Alternatively, an options-based approach is much like an insurance company. You sell as many policies as possible to collect as much premium income as possible with a premium cost level that maximizes a statistical edge to your benefit.

An option-based strategy mitigates risk and circumvents drastic market moves. Selling options and collecting premium income in a high-probability manner generates consistent income for steady portfolio appreciation in bear and bull market conditions. This is all done without predicting which way the market will move. Sticking with dividend-paying large-cap stocks across a diversity of tickers that are liquid in the options market is a great way to generate superior returns with less volatility over the long term.

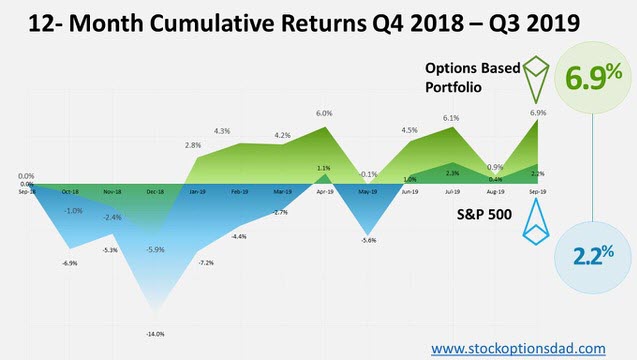

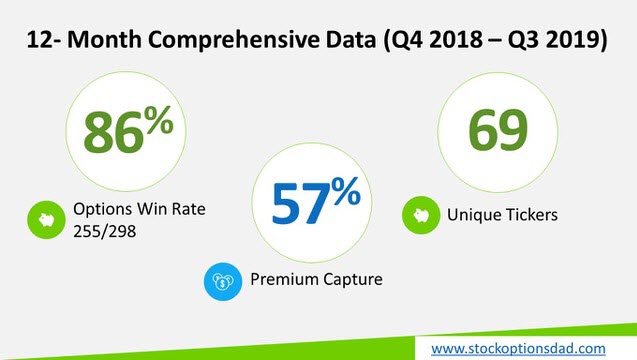

Over the past 12 months, 298 trades have been made with a win rate of 86% and a premium capture of 57% across 69 different tickers. When stacked up against the S&P 500, the options strategy generated a return of 6.9% compared to the S&P 500 index, which returned 2.2% over the same period. Options are a bet on where stocks won’t go, not where they will go, where high probability options trading thrives in both bear and bull markets.

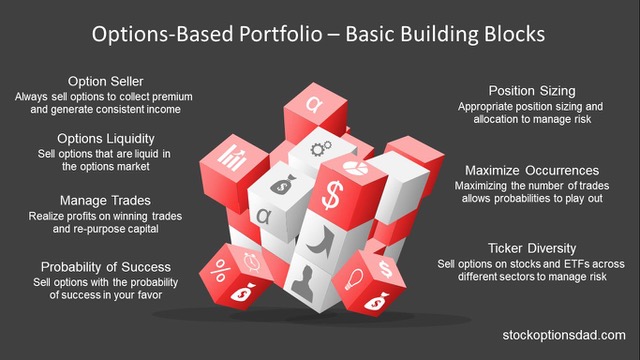

Figure 1 – Basic principles and building blocks of an options-based portfolio

An Options-Based Strategy Generates Alpha

“Alpha” (α) – A term used to describe a strategy's ability to beat the market. Alpha is also referred to as “excess return” or “abnormal rate of return,” eluting to the theory that markets are efficient. Thus there’s no systematic method to generate returns that beat the broader market’s returns. To illustrate this point, 92% of actively managed funds do not outperform their benchmark thus do not generate any alpha giving rise to the efficient market theory. Furthermore, over 26 years, from 1983 – 2006, the Russell 3000 index had 39% of stocks that were unprofitable investments, 64% of stocks that underperformed the index, and 25% of stocks were responsible for all the market’s gains. So effectively, there’s a 36% chance of picking a stock that will outperform the market, thus generating any alpha.

Those who subscribe to the efficient market hypothesis believe that there’s no edge or advantage when picking stocks. Thus, stock picking is a binary event and boils down to a 50/50 probability or simply chance. Everything that can be possibly known about a stock is known, and all the available information, technical analysis, and fundamental analysis are priced into the underlying stock price. The efficient market theory may be the Achilles heel of professional money managers’ performance and their inability to outperform their benchmarks. If the efficient market theory is correct, is stock picking a useless endeavor? If stock-picking boils down to chance, is there a strategy that places the statistical odds of success in one’s favor to generate alpha consistently?

The short answer is yes, an options-based approach! The only way to consistently and reliably profit from this even distribution and market behavior is via options trading. Options trading allows one to profit without predicting which way the stock will move. Options trading isn’t about whether or not the stock will move up or down; it’s about the probability of the stock not moving up or down more than a specified amount. Options allow your portfolio to generate smooth and consistent income month after month for steady portfolio appreciation. Running an option-based portfolio offers a superior risk profile relative to a stock-based portfolio while providing a statistical edge to optimize favorable trade outcomes. Options trading is a long-term game that requires discipline, patience, time, maximizing the number of trade occurrences, and continuing to trade through all market conditions. Put simply; an options-based approach provides a margin of safety with a decreased risk profile while providing high-probability win rates. The basic building blocks of running an options-based portfolio include appropriate position sizing, diversity of tickers (stocks and ETFs), diverse sector exposure, trading through all market environments, maximizing the number of trades, managing risk, options liquidity, etc. taking profits early (Figure 1).

Results

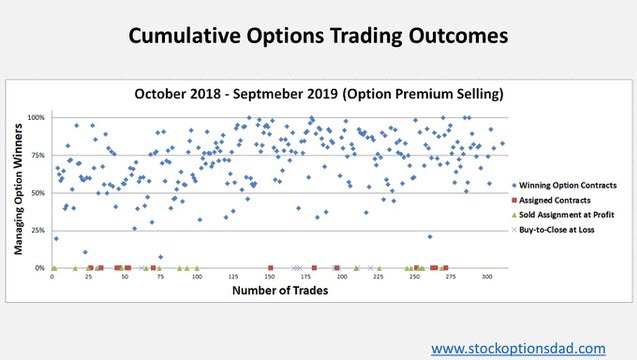

Empirical results demonstrate true alpha over the previous 12 months through bull and bear market conditions, outperforming the index by a wide margin (Figures 2 and 3). An options-based approach provides long-term, high-probability win rates to generate consistent income while circumventing drastic market moves. Over the previous 12 months, my win rate percentage was 86% (255/298) through both bull and bear markets. Over the same period, the options-based portfolio generated a 6.9% return relative to 2.2% for the S&P 500, outperforming the index by a wide margin (Figures 2-4).

Figure 2 – Options based portfolio return (6.9%) in comparison to the S&P 500 return (2.2%) over the past 12 months through both bear and bull market conditions. S&P 500 closed at $2,913.98 on September 30th 2018 and closed at $2,976.74 on September 30th 2019

Figure 3 – Comprehensive options metrics over the previous 12 months

Figure 4 – Dot plot summarizing ~300 trades over the previous 12-month period

Conclusion

Maximizing the number of trade occurrences, position-sizing, diverse sector exposure, trading stocks, and ETFs and managing winning trades is essential for an options-based portfolio to succeed in generating true alpha. Markets are efficient, and 92% of actively managed funds are unsuccessful at beating their benchmarks over the long term. Taken together, there’s only a 36% chance of picking a stock that will outperform the broader index. There’s no edge in stock picking, hence the efficient market hypothesis. The only way to profit from this even distribution and market behavior is via options trading. Options trading allows one to profit without predicting which way the stock will move, allowing your portfolio to generate smooth and consistent income month after month. Options are a bet on where stocks won’t go, not where they will go, providing a statistical edge.

An options-based portfolio has allowed me to do something 92% of actively managed funds haven’t been able to accomplish, and that outperforms the broader index consistently despite the volatility in Q4 2018, May 2019, and August 2019. Selling options with a favorable risk profile and a high probability of success is the key. Options provide long-term durable high-probability win rates to generate consistent income while mitigating drastic market moves. For example, I’ve demonstrated an 86% options win rate over the previous 12 months through both bull and bear markets while outperforming the S&P 500 over the same period by a wide margin producing a 6.9% return against a 2.2% for the S&P 500 with a lower risk profile. Taken together, options trading is a long game that requires discipline, patience, time, maximizing the number of trade occurrences, and continuing to trade through all market conditions with the probability of success in your favor.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.