News of the formal impeachment proceedings came just after the markets closed on September 24, 2019. The markets had already broken a bit lower most of the day after Consumer Confidence and Jobs expectations were weaker than expected. We had just authored a public research post about our belief that the Technology sector was about to breakdown and begin to move lower. Additionally, we pushed out a post about how Silver would become the “Super-Hero” of 2019/2020 based on our expectations of further gains.

We believe the new impeachment proceedings will result in a market that is very similar to what happened when the US invaded Kuwait in August 1990. At that time, the US launched a very fast invasion of Kuwait that prompted a massive news event and resulted in hours of new invasion video that drew millions of Americans into watching the news every night. This invasion was almost like an extended Super Bowl or an extended World Series event where millions of people are actively engaged in this event, stop engaging in the local economy and focus their attentions on the news cycle, content and political circus originating in DC. But first, be sure to opt-in to our free-market trend signals newsletter

What Does This Mean For Traders

For traders, it means we have to be prepared for just about anything. It means the news events will become even bigger drivers of market rotation and trends as well as the fact that we must prepare for weaker economic data over the next 13+ months. The impeachment process is going to be a dramatic distraction for many people and business ventures. Many will simply fall into a “protectionist” mode where new expenses, expansion and other facets of life/business will be put on hold until after November 2020 (or later).

Our research team believes the initiation of these impeachment proceedings will act as a process of muting or weakening the US economy over time. Starting out slowly at first, then gaining strength as the news cycle picks up more and more “dirt” while both sides posture and position for advantage into the November 2020 election cycle. The end result will be a decidedly weaker US economy as a result of this new impeachment process and we believe the final outcome could leave some career politicians bloodied and battle-weary.

NASDAQ Daily Chart

This NASDAQ Daily chart highlights what we believe will become the future breakdown of the technology-heavy NASDAQ as investors become sidetracked on the impeachment investigation and the political sideshow that is going on in DC. This type of chaos in DC tends to take the focus away from finance and business as the political theater, the pending US presidential election and the never-ending news cycle fill the void. Weakness and volatility could become a standard operating environment for skilled technical traders over the next 12+ months.

S&P 500 Daily Chart

This S&P 500 Daily chart highlights the same setup and weakness that we expect to settle into the US markets over the next 12+ months. The previous Double-top formation in the SPX near 3026 could become a major point of resistance should price breakdown and continue to move lower on a price revaluation/reversion move. We believe the impeachment investigation announced today will cause enough concern and uncertainty in the global markets to derail any real efforts by the central banks to support the global economy. At this point, consider buying consumer essentials, utilities, precious metals and dividend earning stocks for the longer term.

Monthly S&P 500 Chart

This Monthly S&P 500 chart highlights the volatility that has setup in the US markets since early 2018. It also highlights the previous two US presidential election periods on the chart in BLUE. The reality is that every US presidential election cycle is associated with price rotation in the US stock markets. This happens because the level of uncertainty and confusion about forward economic policy is heightened. Traders and investors don’t know what to expect as the political battle wages, so price rotation and volatility is normally heightened as the news cycle drives shorter-term price trend. The same thing is going to happen over the next 12+ months – but we have the added FUEL of the impeachment investigation. Get ready for some really big price swings in the global markets.

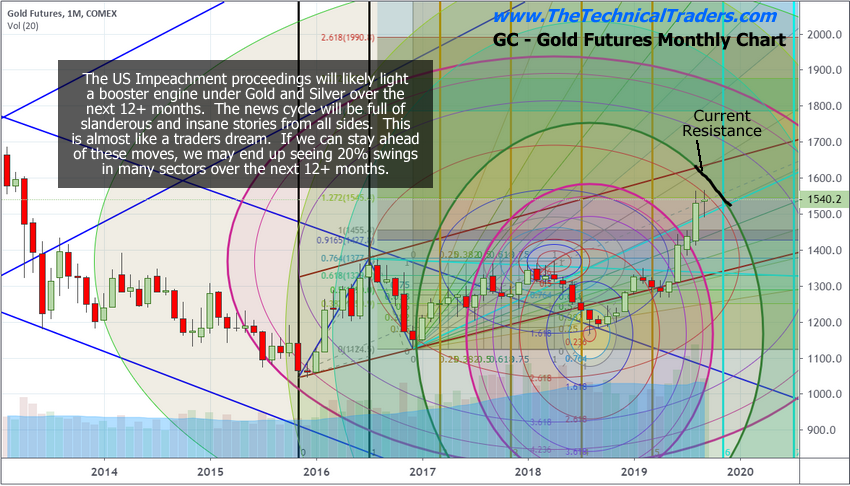

Monthly Gold Chart

Lastly, Gold – that shiny safe metal that almost everyone had forgot about 3+ years ago is now poised for a move to just below $2000 over the next 8+ months. Our initial target is just below $1800 (actually $1795) for Gold on this next upside price move. You can see our proprietary Fibonacci Price Amplitude Arcs on this chart and where we’ve drawn the “Current Resistance” line on this chart. Once gold rallies past this level, $1625, then we believe the next phase of the upside price rally towards $1800 will be very quick – possibly even settling well above $1800.

Many of our readers remember the Kuwait invasion and what happened in the US at that time. Certainly, we can’t be the only ones over 50 that remember what happened in 1990. The reality is that society reacts to these types of outside events by either becoming motivated to engage in some way or becomes more protectionist by staying home, watching the news and not taking risks. We believe the latter will be the case over the next 12+ months as more clarity is determined by the ongoing impeachment and election processes.

Our advice would be to protect everything you can right now. Don’t wait for a breakdown in prices to learn that you should have protected your assets. The new cycle will be driving prices until things settle after November 2020. Thus, this is like riding out a very violent storm with crazy winds and waves. You don’t know what to expect and where it will hit next. What we do know is there will be some really big waves, price swings and opportunities for skilled technical traders.

You don’t have to be smart to make money in the stock market, you just need to think differently. That means: we do not equate an “up” market with a “good” market and vi versa – all markets present opportunities to make money!

We believe you can always take what the market gives you, and make a CONSISTENT money.

Learn more by visiting The Technical Traders!

Chris Vermeulen

Technical Traders Ltd.

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation for their opinion.

I believe the US will see a 12% correction over the next 12 months. Due to: trade, impeachment, Democrats agenda for freebies.

There is growing risk, but it has little to do with the daily news cycle. The biggest problem for the market is that broad true money supply growth has recently slowed to a fresh 12-year low of just 1.8%.

However, this did not impact nearly as much as many thought it would. It appears that very few are paying much attention to this. Most know that there isn't going to be any impeachment. In addition, not many care about the media hype any more.

where is the silver chart, and I call BS on SLV

That's one ridiculous-looking chart for gold...