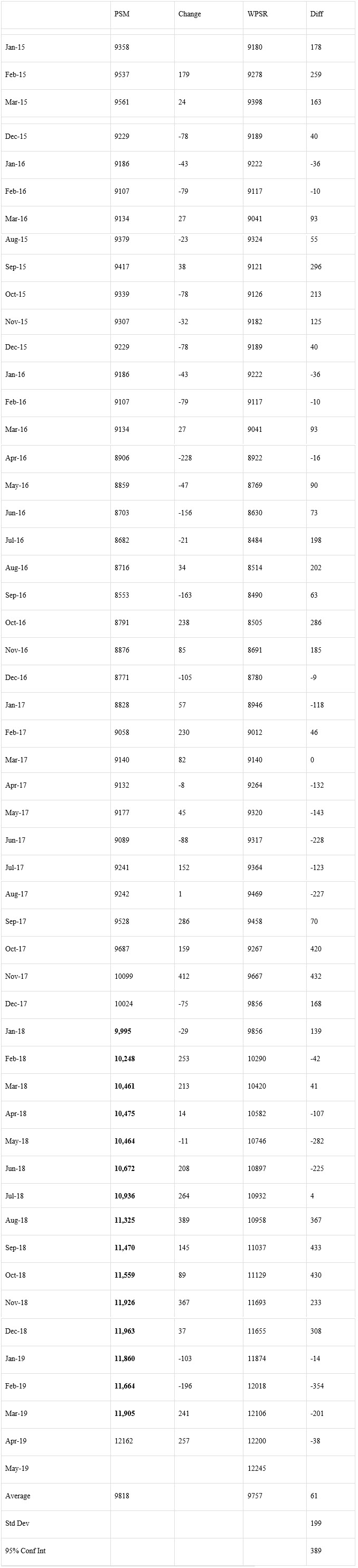

The Energy Information Administration reported that April crude oil production averaged 12.162 million barrels per day (mmbd), up 257,000 b/d from March. The rise resulted from a 107,000 b/d increase in Texas, a 77,000 b/d increase in the Gulf of Mexico (GOM), a 32,000 b/d increase in Oklahoma, a 14,000 b/d increase in Colorado, and a 13,000 b/d increase in Wyoming.

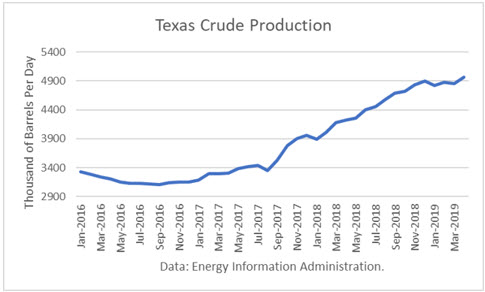

A pause in the growth rate in Texas had been expected due to pipeline constraints, which are expected to be alleviated in the second half of 2019 and the first half of 2020. Nonetheless, crude production set yet another record high in April.

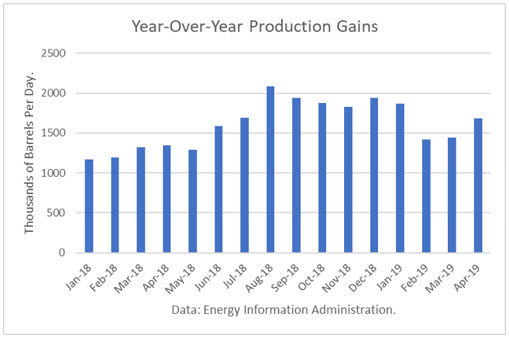

The year-over-year gains have been especially impressive with the April figure being 1.687 mmbd. And this number only includes crude oil. Other supplies (liquids) that are part of the petroleum supply add to that. For April, that additional gain is about 630,000 b/d.

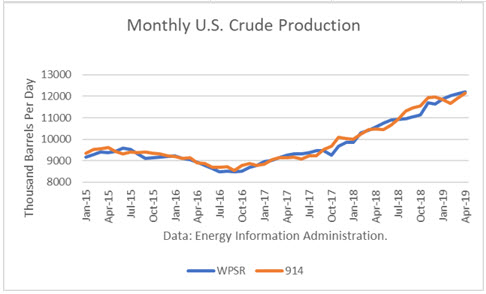

The EIA-914 Petroleum Supply Monthly (PSM) figure was 38,000 b/d lower than the weekly data reported by EIA in the Weekly Petroleum Supply Report (WPSR), averaged over the month, of 12.200 mmbd.

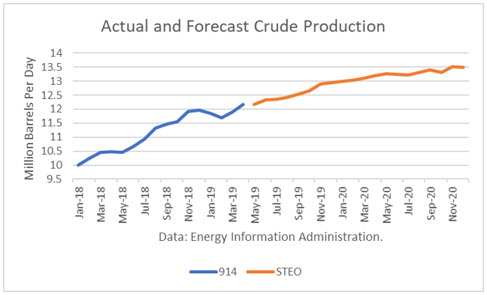

The April figure almost exactly at the 12.165 mmbd estimate for that month in the June Short-Term Outlook. That implies no need for another upward “rebenchmarking” to EIA’s model in future production levels at this time since the difference was so small.

The EIA is projecting that 2019 production will exit the year at 12.95 mmbd. For 2020, the EIA is projecting an exit at 13.5 mmbd.

According to another report, the Permian Basin is expected to add as much as 2.0 mmbd in 2019 as three new pipelines come online. And in 2020, more new pipelines are expected.

Conclusions

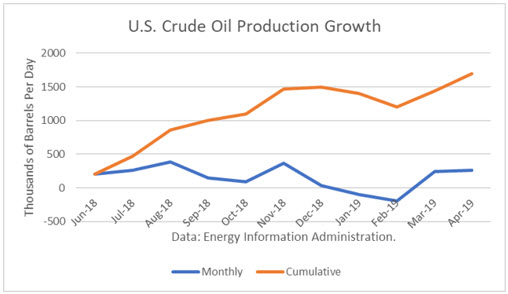

The recent lull in crude production in the first months of 2019 have been offset by two strong back-to-back gains in March and April. It appears that the precipitous price drop in the 4th quarter was not enough to dampen production growth. And the WTI in the upper $50s, the surge should continue as pipelines are completed in Texas.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

We have proudly shown how well we're doing with the production of oil. So why are we still getting charged such outrageous prices for gasoline? We are not dependent on foreign oil that much anymore. Why hasn't our government put a stop to those owners that are producing oil, stop them cheating the public? They are multi-millionaires if not Billionaires. They are cold-hearted just like other public officials in our country, shame on all of them, they are not true Americans, they do not believe in the American way.

Oil usually tracks the commodity

Supply/Demand model perfectly.

Oil is a global product and will sell to the highest bidder. China

demand is rising and will continue to do so. Don’t look now but US gasoline consumption is at all time high

so what incentive does an entity selling gasoline have to reduce prices?