A year ago, “Bitcoin was at a crossroads” as then I spotted a triangular consolidation on the chart. The price could go both upside and downside, and I marked them as “Revival” and “Oblivion” areas accordingly. Below are your bets for the future of Bitcoin a year ago.

Crypto enthusiasts are in the majority, although haters scored a hefty 41%. This violent confrontation shows that Bitcoin again threatens the interests of the elite as there are a lot of people, including President Trump, who expresses their opposition to cryptocurrencies as a whole. And it’s a natural course of things as human beings often reject changes and the elite try to shield their ultimate position.

Bitcoin broke both the downside of the triangle and the bearish confirmation level at the $6400 entering the “Oblivion” territory. The bearish target of $1250 had not been reached as the price of crypto gold had reversed ahead of $3000 notch. So, the first move was to the downside, and those of you who chose the “Oblivion” option was right.

This year Bitcoin entered the “Revival” area. It’s time to update the chart, and I am going to start with the monthly time frame.

Chart courtesy of tradingview.com

Bitcoin completed the BC correction when it entered the “Oblivion” area. It was a quite deep retracement as the price has dived between the 78.6% and 88.6% Fibonacci retracement levels (not shown here). And this proves the old wisdom that one should reach the bottom to kick off from the ground. It is worth to mention that the first coin has been retracing around 90% all the way up, so don’t bet all your money there.

The cryptocurrency had spent a few months in hibernation between the $3000 and $4000 before it pushed up through the “roof.” Then the follow-through buying frenzy has ignited the exponential growth of the coin as it reached the $14k handle too fast as we passed the half of the entire CD segment. It has the sharper angle as these days investors know where it could potentially rocket based on early history. The conservative target for the CD segment is located at the $23100 level where the CD=AB. It was easy to calculate it as price moved from the zero to $20k in the AB segment. So, I just added that round number to the former valley of $3100 to get the target for the CD segment. I added the blue box target area on the chart as price should at least tag the former top of $20k to complete the large structure of AB/CD move.

It looks unbelievable now, but we could be in a large sideways move between the zero and the $23k with huge volatile moves up and down inside.

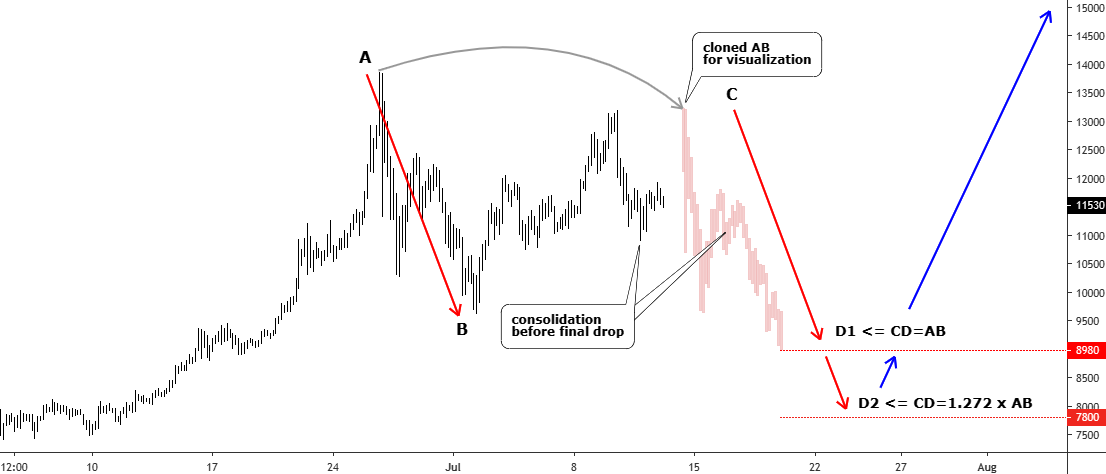

The main coin has a 10-year history already and as much it matures the more it behaves as conventional assets. It facilitates us the technical analysis as well. Now, it is even possible to go deep into the 4-hour time frame to find regular patterns there like that one I spotted below.

Chart courtesy of tradingview.com

There is a horizontal consolidation has been building on the 4-hour time frame. The AB and BC parts of it were completed. We have been moving down now in the last CD leg. The half of it could be finished already as price moves sideways in a minor consolidation ahead of the final drop down.

I cloned the AB segment and added it to the right in pink bar pattern for visualization of the possible structure in this last leg. It looks like the CD segment is less sharp in its first mini-leg, but let’s wait if the second part will unfold sharper.

The D1 target is located at the distance where the CD and AB segments are equal at the $8980. The D2 reflects the extension in case some investors would give up the coins amid panic selling. It is located at the 1.272 of the AB segment at the $7800. After that, the price could bounce to the upside unless there is a very complex correction, which would extend the consolidation.

We are living in an interesting time. Treasury bills, stock indices, gold, dollar, bitcoin are all set to rise at once, although they tend to be opponents. Is it a segmentation of investors’ choice? What do you think about it?

I am looking forward to seeing your comments below.

Intelligent trades!

Aibek Burabayev

INO.com Contributor, Metals

Disclosure: This contributor has no positions in any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.