Today is the day for the US Fed to announce their rate decision and we believe the 25 basis point rate cut is the only option they have at the moment that will attempt to settle foreign market fears and allow for a suitable “unwinding” of the credit/debt “setup” we highlighted in Part I of this research post.

We believe out August 19 expectation of a global market PEAK and the beginning of a price reversion move is related to multiple aspects of the timing of this Fed move and the current global economic outlook. The unwinding of this debt/credit bubble will likely take many more years to unravel. Yet, right now the US Fed is trapped in a scenario they never expected to find themselves in. Either continue to run policy that supports the US economy (where rates would likely stay between 1.75 to 2.75) over the next 5+ years or yield to the global market and attempt to address a proper exit capability for this debt/credit “setup”.

We believe global investors are expecting a massive collapse in the US stock market as a reaction to this move by the Fed and because of the expectation that another bubble has set up in the US. But we believe the actual bubble is set up in the foreign markets and not so much in the US. Yes, the US markets have extended to near all-time highs and the US consumer is running somewhat lean. It would be natural for the US economy to revert to lower price levels and for the US economy to rotate as “price exploration” attempts to find true market support. Yet, our fear is that the foreign markets are much more fragile than anyone understands at the moment and that a reversion in the US markets will prompt a potential collapse in certain foreign markets.

Weekly SPY Chart

This Weekly SPY chart highlights what we expect to transpire over the next 6 to 8+ months. We believe the August 19 peak date that we predicted months ago will likely start a process that will be tied to the US election cycle event (2020) and the US Fed in combination with global market events. We believe a reversion price process is about to unfold that could be prompted into action over the next 2+ weeks by the US Fed, trade issues and global central banks.

If the US Fed drops the FFR by 25pb, the fragility of the foreign market debt/credit issues is not really abated or resolved. It just allows for a bit of breathing room that may allow these foreign debtors enough room to wiggle out of some of their problems. The US Fed would have to decrease rates by at least 75 basis point before any real relief will materialize for these foreign debtors.

Asian Currency Custom Index

This Asian Currency Custom Index used by our research team highlights the weakness in the foreign markets. The recovery in 2018 is related to the Chinese/Asian currency market recovery that initiated in Feb/Mar 2018. The recent weakness in this custom index is related to strengthening major market currencies (USD, CAD, JPY, CHF) in relation to weakening Asian currencies. Notice how the price channels have set up to warn us that any further downside move will initiate a new “price exploration” phase that could see a -20% to -25% decrease in currency valuations – possibly much deeper.

We believe this is the real reason the US Fed is opting to decrease the FFR rate now and is not taking a more stern position related to US economic performance. We believe the US Fed is, again, donning the “Superman cape” and attempting to Save The World from their own debt/credit mess.

We are holding to our original predictions and expectations. We believe the US stock market indexes will enter a reversion price phase over the next few weeks that will prompt a downside price reversion toward recent lows (2018 levels or deeper). We believe this process will end in early 2020 and that the lows established by this move will represent incredible opportunities for skilled technical traders.

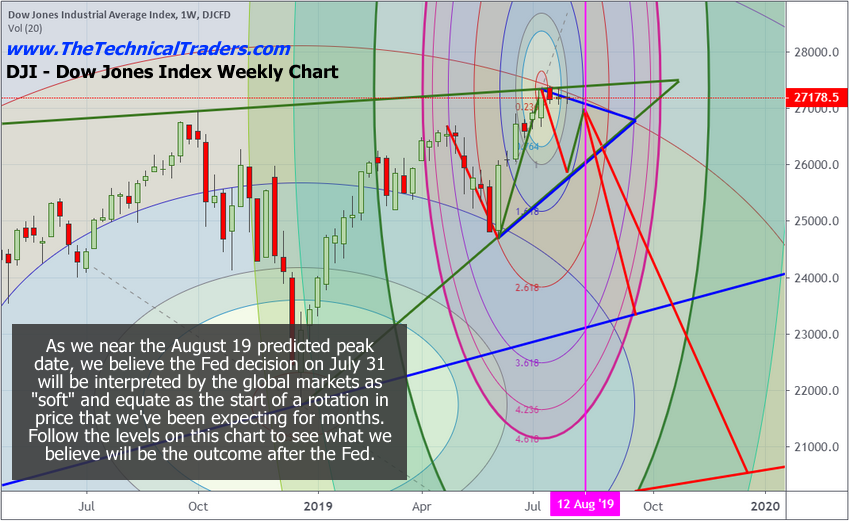

Weekly Dow Jones Chart

This Weekly Dow Jones chart highlights our expectations. We believe a mild price rotation will start this move over the next 2~4 weeks before the August 19, 2019 date prompts a breakdown move. After that date, we believe an extended downside price leg will continue to reach a price bottom near the end of 2019 or in early 2020.

This Weekly Dow Jones chart highlights our expectations. We believe a mild price rotation will start this move over the next 2~4 weeks before the August 19, 2019 date prompts a breakdown move. After that date, we believe an extended downside price leg will continue to reach a price bottom near the end of 2019 or in early 2020.

Skilled traders understand how the global markets are setting up for incredible opportunities and how to identify where and when these opportunities are ripe for profits and this is where we can help you!

You don’t have to be smart to make money in the stock market, you just need to think differently. That means: we do not equate an “up” market with a “good” market and vi versa – all markets present opportunities to make money!

We believe you can always take what the market gives you, and make a CONSISTENT money.

Learn more by visiting The Technical Traders!

Chris Vermeulen

Technical Traders Ltd.

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation for their opinion.

Some Global clues, including recent Fed's Rate cut indicates that we are on the verge of any great financial disaster, and measures like rate cuts will not provide any significant changes in overall situation.

Any noticeable Impacts or effects of Trade War yet not appeared, but at the certain stage, even any minor reason or out-come thereof will be resulted in a big big big way with spiral spread globally.

Huge unwound Derivatives exposure and linked artificial and beyond the limit inflated Money Market Instruments across the different segments or in different markets, and respective involvement of Banking Sector worldwide therein, can be assumed as "Time Bomb" However, it is quite difficult to answer any question like when? where? and how? but as per my personal view, September on wards, there will be a danger zone, and we may found one more "Black September"

Be aware and ready to face sudden Financial Market Collapse, situation is far more serious, fragile and complex then our present belief, expectations or assumptions.