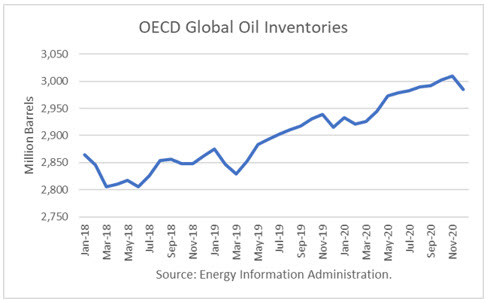

The Energy Information Administration released its Short-Term Energy Outlook for April, and it shows that OECD oil inventories likely bottomed last June at 2.806 billion barrels. It estimated stocks fell by 18 million barrels In March to 2.829 billion, 23 million barrels higher than a year ago.

However, throughout 2019, OECD inventories are expected to rise rather quickly through November. At year-end, EIA projects 2091 to be with 2.915 million barrels, 53 million more than at the end of 2018.

For 2020, EIA projects that stocks will build another 70 million barrels to end the year at 2.985 billion. That would push stocks into glut territory.

Oil Price Implications

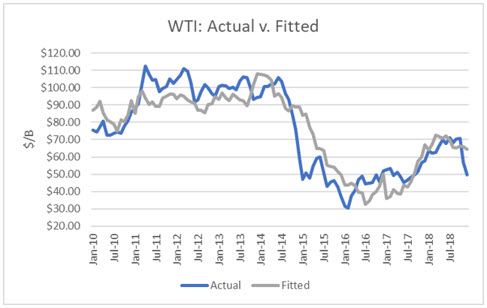

I updated my linear regression between OECD oil inventories and WTI crude oil prices for the period 2010 through 2018. As expected, there are periods where the price deviates greatly from the regression model. But overall, the model provides a reasonably high r-square result of 80 percent.

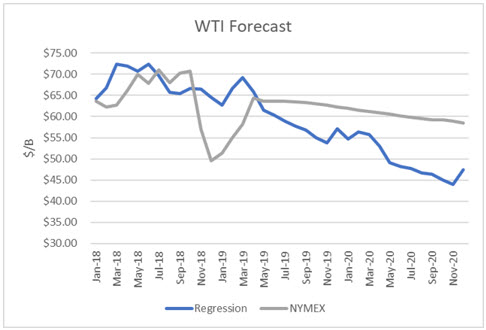

I used the model to assess WTI oil prices for the EIA forecast period through 2019 and 2020 and compared the regression equation forecast to actual NYMEX futures prices as of April 8th. The result is that oil futures prices are presently undervalued until May 2019. It also shows that crude oil prices should have peaked for 2019 and 2020. (More below on the uncertainties of a single projection.)

From July 2019 and beyond, they are overvalued. In the latter part of 2019, oil prices would drop to about $55/b, if these inventories are realized. By mid-2020, oil prices would drop below $50.

Uncertainties

The 4Q18 proved that oil prices could move dramatically based on expectations. President Trump granted waivers to eight countries to continue to buy Iranian oil, and traders had been betting that a supply crisis would ensue.

Iran stands out as another uncertainty. In early May, the Trump Administration has to decide whether or not to extend those waivers. Three of the countries did not use the waivers, and so their waivers will probably be terminated in a “show” that the Administration is getting tougher, even if it does not translate into lower Iranian exports. It is also possible that waivers to the other five may be trimmed.

Venezuela remains a key uncertainty. It was reported that production was cut by 250,000 b/d in March to 840,000 b/d as the economic crisis in that country deepens. Though the U.S. no longer imports crude oil from there, its impact is felt in world markets.

Saudi Arabia appears to be single-handedly implementing the production cuts for both OPEC and non-OPEC countries. Its production was reported at 9.85 million barrels per day for March, down 870,000 b/d from the October base. Recent reports peg Saudi output more recently at 9.2 million.

According to Saudi Energy Minister Khalid Al-Falih, May will be key to determining whether to extend the production cuts for the second half of 2019. Russian President Putin stated that Russia opposes an “uncontrollable rise in oil prices.”

Finally, President Trump has once again tweeted that oil prices have become too high. He could order a drawdown of the U.S. Strategic Petroleum Reserves at any time. He could also negotiate an end to sanctions against Iran if he gets the concessions he wants. And he could publicly back the NOPEC legislation which would break-up OPEC.

Conclusions

Based purely on the model, oil prices have likely peaked. However, it could take some key catalyst to cause them to break as they did in 4Q19.

President Trump is capable of providing such a catalyst. The question is if and when he will do so.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Trump "could also negotiate an end to sanctions against Iran if he gets the concessions he wants," for those with actual experience with Iran/Iranians how likely is that? or is it more likely Iran at the brink does something, either on oil flows, or nuclear program, to push oil prices dramatically up? why not when your sanctions busting discounted exports so low and with 70+ million pissed off Iranians? loyalty to KSA dominated OPEC???? with essentially no other country (except Israel and KSA) support, what does the US do in response? Tweet storm? actual military action/reaction? So it seems, maybe if one a pessimist (realist) as many if not more scenarios where oil prices move up more, or even blow-out, as "capable Trump" and supporting Neo-cons bullying their way to Iran capitulation and/or lower oil prices? If your key ally KSA NOPEC legislation a bridge too far? SPR release his only major "easy" response and that also not that easy with still excess world oil stocks and OPEC/ROW unlikely to be very supportive of that action! Maybe a pessimist or as they say on Fox, just saying!!!!! Without the Iran wildcard agree and even with it and possible 2Q and even into 2H 2019 unstable situation all other things equal agree longer term view.