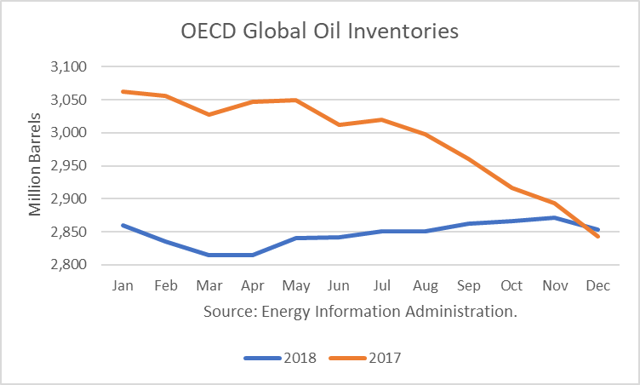

The Energy Information Administration updated its global supply/demand oil outlook for June. It shows total OECD oil inventories rising through November, ending the year about where they were last December.

This is in contrast to the rapid decline in stocks over the second half of 2017, and that enabled oil prices to rise. If this forecast is realized, it should have a moderating impact on prices, taking away some of the risk premium embedded in futures prices.

The stock projections are based on a number of assumptions:

- It projects that world oil consumption will rise 1.8 million barrels per day (mmbd) in 2018 from 2017;

- It assumes OPEC crude production will average 32.2 mmbd in 2018, off about 420,000 b/d from 2017;

- It assumes non-OPEC production will rise by 2.5 mmbd from 2017.

June Oil Outlook

The International Energy Agency’s June outlook calls for demand rising by 1.4 mmbd in 2018. But it also projects a lower growth in non-OPEC production of 2.0 mmbd. On a net basis, the two forecasts are about the same.

Based on the latest reports, Saudi Arabia and Russia are discussing lifting output. Iran and Venezuela oppose any output increase. But they could do so and still remain true to the OPEC+ deal, which put OPEC’s ceiling for the current members at 32.7 mmbd. May production was estimated at 31.93 mmbd.

Russia reportedly wants production ceilings to be lifted to their October 2016 levels. President Putin has said $60 oil suits Russia, which would mean WTI around $55/b.

President Trump has repeated his tweet that oil prices are too high. The Saudis depend on the US for their security and want help transforming their economy. They really have no choice but to appease Trump.

Based on the above, KSA and Russia will almost certainly lift output, and reports are they have already begun doing so. Saudi Arabia’s oil minister Khalid Al-Falih said its “inevitable” that the OPEC+ group will agree to increase output gradually. “I think it will be a reasonable and moderate agreement” but nothing “outlandish.”

Two wild cards are Venezuela and Iran. Venezuela needs help stabilizing its production, and China and Russia may be able to help them. It is unclear to what extent Iran’s production will drop if new sanctions are imposed. It is also possible they will give in to Trump’s conditions, and sanctions will not be imposed in 6 months.

If Venezuela’s oil production continues to plummet, the U.S. does have the option of drawing down the Strategic Petroleum Reserve to replace the lost production. This would avert a super-spike in prices. The SPR has 660 million barrels and could supply up to 4.0 mmbd, so there would be no problem replacing Venezuela’s production of about 1.5 mmbd over the short-to-medium term.

Conclusions

I expect OPEC to announce at its meeting that it will increase its production back to the 32.7 mmbd ceiling over the coming months. I also expect that it will assure consumers that it will maintain that level should there be further outages in some member countries, referring to Venezuela and Iran.

Check back to see my next post!

Best,

Robert Boslego

INO.com Contributor - Energies

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

I think u have it about right barring who knows what. US now producing 10.9 m boe soon to be 11m I don’t think anyone wants price spikes. Trump has complicated things a lot also when Permian pipeline(s) r completed late 2019 more oil will be flowing out. Daniel Yergin expects Permian production to double in 5 years to 5.4m boe. As the Chinese says we r living in interesting times boy r we ever!