Would you say that Janet Yellen was some sort of silver tongued wizard? After this week’s rate decision the answer might be yes, because otherwise it’s close to impossible to explain how the Fed Chair was able to come across as sounding both hawkish and dovish in the same speech. On the one hand, Yellen dropped the word “patience,” suggesting that interest rates could rise within any future meeting, with most Fed members in favor of a rate hike in 2015. On the other hand, Yellen pointedly stressed that rates would rise slower than previously anticipated and outlined her concerns on low inflation and wage growth. This “impossible” combination of hawkishness and dovishness resulted in dazed and confused markets, and investors it seems are having difficulty deciding which way the wind is blowing at the Federal Reserve, with the hawks or with the doves. Given that, they’re collectively trying to gauge whether the dollar is now a buy or a sell?

Choppy Times Ahead

Soon after the Fed statement was made, it was a stampede of sellers, bulls running out of dollar positions, and the greenback in a nose dive, shedding more than 2% in less than 3 hours. Yet the following morning, as trade opened in London, everything flipped once again; the dollar was higher and ended up more or less where it is was prior to the Fed decision. Despite the dollar recovering nicely, it would be a mistake to assume that nothing had really changed. So what has changed? Volatility. After traveling pretty much in only one direction, north, of course, the dollar is about to come into a major interchange, where care should be exercised. While the combination of both dovish and hawkish comments within the same Fed statement might at first seem confusing the message is actually quite clear; the Fed is letting us know it is leaving investors at the mercy of data, which is another way of saying it’s leaving us at the mercy of volatility.

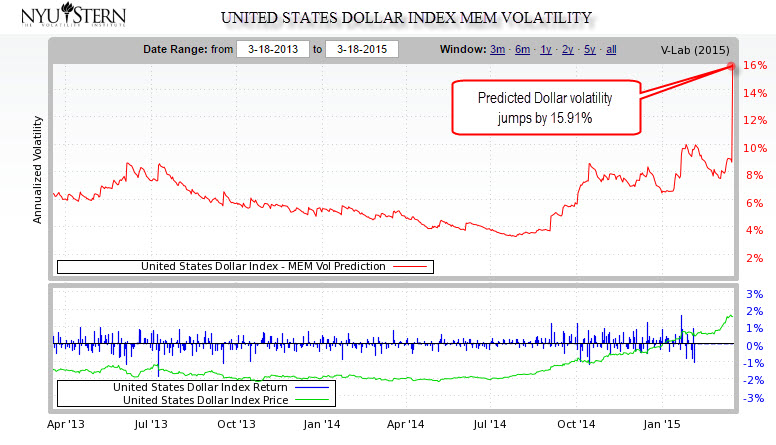

Source: NYU Stern Volatility Institute

The chart above is the US Dollar INDEX from the NYU Stern Volatility Institute and it is based on a Multiplicative Error Mode. You can see that while the dollar zigged and zagged, it essentially ended where it started, yet volatility is nowhere near where it was. The indicator, which measures implied volatility on the Dollar Index based on pricing of options, suggests that volatility on the dollar trade jumped 15.91% , a very aggressive move indeed. While this does not necessarily mean a trend change it does certainly mean that risk on dollar positions is higher. In other words, while dollar gains could continue every negative headline for the dollar could ignite aggressive profit taking and broad liquidation of buy positions. Of course, this could also mean that any positive news for the dollar could ignite another surge in the currency. Yet because the bets on a dollar rise are so crowded as a result of months of investors piling on dollar calls which pushed the dollar to a multi-year high, it is likely that upside swings will be much more tamed and moderate compared with downside corrections, making dollar bullish bets more risky though not necessarily lucrative.

Down to Practice

One might ask what does the increased level of volatility actually mean for one’s trade? That, of course, depends on your view. On the more technical aspect a long term investor should consider taking bigger stop losses if, indeed, he decides to hold a dollar long. That is because the rise in volatility could mean that, now, far more than before, an aggressive correction could throw you out of the ring. Of course, this would also mean taking on more risk, which adds up to my view that holding a dollar long is now more risky.

The second more fundamental implication of the jump in volatility is prudence around data releases. With Yellen constantly stressing low inflation, the data on US Inflation due out next week could be the first hurdle in a series of many hurdles for dollar longs. This means that if US Core CPI slides below 1.6% YoY it could tilt the Fed’s inflation projection and cause the FOMC to postpone a rate hike. And pretty much any other set of data could create extra sensitivity. In the long term, this means that every indicator that is related to consumption and demand, such as retail sales, durable goods and so on, which together could suggest more weakness from the consumer end and thus undermine the inflation outlook, is also a potential pitfall for the dollar bulls. The bottom line is that fundamentals for the dollar haven’t changed yet but they might soon, so trade the dollar carefully because the road north just got slippery.

Look for my post next week.

Best,

Lior Alkalay

INO.com Contributor - Forex

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

yes,I feel that the us $ will rollover this year still.

Thanks,rainer

i would really like to learn more.