Since 2007 when Scott Andrews of MasterTheGap.com started calling out daily gap plays in a live trading room, he has been helping traders learn how to use gap trading to their own advantage. He considers gap trading the "bread and butter" of his trading and even earned the nickname, "Gap Guy" due to his successes.

Since 2007 when Scott Andrews of MasterTheGap.com started calling out daily gap plays in a live trading room, he has been helping traders learn how to use gap trading to their own advantage. He considers gap trading the "bread and butter" of his trading and even earned the nickname, "Gap Guy" due to his successes.

Today Scott is sharing tips on how to get the most out of your trades by showing you how to discern high expectancy trades from low expectancy trades. We hope you enjoy reading his guest blog post and leave a comment for him below.

-------------------------------------------------------------------------------------------------------------------------------

This past week I had the great privilege of enjoying lunch with a fellow North Carolinian, Dr. Van Tharp, the world-renown trading coach and author of some of my favorite trading books: Trade Your Way to Financial Freedom and Super Trader. While trying not to ogle over him like a star-struck teenager meeting his favorite musician for the first time, my mind raced with the many pearls of trading wisdom he has espoused over the years.

One of my favorites is his assertion that the entry technique may be the least important of the ten or so different elements of a trading system or methodology. I could not agree more. For years I have traded the opening gap by simply entering at the open of the equity and futures markets in New York and Chicago (9:30 am ET). It is simple, easily repeatable and requires zero skill. Despite my success, I used to be embarrassed by my lack of sophistication when entering gap trades. Now I realize that it may be one of the greatest strengths of my strategy.

However, many traders obsess over studying price charts. They believe that the key to success is anticipating the market’s next directional move. How many times have you waited patiently for that perfect setup and then been stopped out immediately before prices turned and hit your target? Or worse, had it trade to within pennies of your target, then reverse and stop you out? Being right directionally and entering at the right time is simply not enough. You must also determine the optimal exit for both your profit target and your stop.

But how? Many traders tinker with their target and exit strategies until they finally achieve a set of parameters that generates a psychologically acceptable win percentage. Unfortunately, this acceptable win rate rarely generates much, if any, profits, over time. Why? Because the markets are exceedingly efficient over the long term and the profit expectancy for most setups is near zero.

Profit Expectancy (PE) = (probability of winning trade * average size of winner) – (probability of losing trade * average size of loss)

I know formulas are more effective than an Ambien® sleeping aid for many, but seriously: if you do not know the PE (expectancy) of your trading strategy or technique, STOP TRADING.

To consistently extract profits from the markets, you must be able to determine the optimal stop and target placement for each trade (something I find to be very difficult due to the subjective discretion required). Or, you must be able to identify positive profit expectancy setups from negative profit expectancy setups. If not, then it is just a matter of time, before your account starts impersonating the Titanic.

But how can you discern high expectancy trades from low expectancy trades? Some truly gifted and experienced traders have perfected the art of chart reading. I am not one of those people. Instead, I analyze historical price data to identify those scenarios that have generated the greatest and most consistent profits, while avoiding the least profitable ones.

As I discussed in my prior article here at INO.com, I primarily fade the opening gap in the indices. That is, I trade in the opposite direction of the opening gap in the indices like the S&P 500 & Russell 2000. If the indices gaps “up” overnight and meets my criteria for fading, then I will short (i.e. sell) the opening price and vice versa for “down” gaps. My target is generally the gap fill area or beyond. My primary consideration for deciding whether to fade the gap or not, is where it opens relative to the prior day’s open, high, low and closing prices. These price levels create “gap zones” which greatly influence the probability of a gap filling or not on a given day.

However, as the profit expectancy equation above shows, “high probability” does not necessarily equal “high profitability.” There are many gap fade setups that have a high probability of filling, but over the long term make no money due to the size of the stop required to capture the winners. For example, had you faded the 3,000 or so opening gaps in the S&P 500 since 1998, targeted gap fill and used an end of day stop, you would have enjoyed a more than 70% win rate. Unfortunately, you would have made very little in profits since the average size loss would have been about twice as large as the size of the average win. The losses from the losers would have erased virtually all of your profits from the winners.

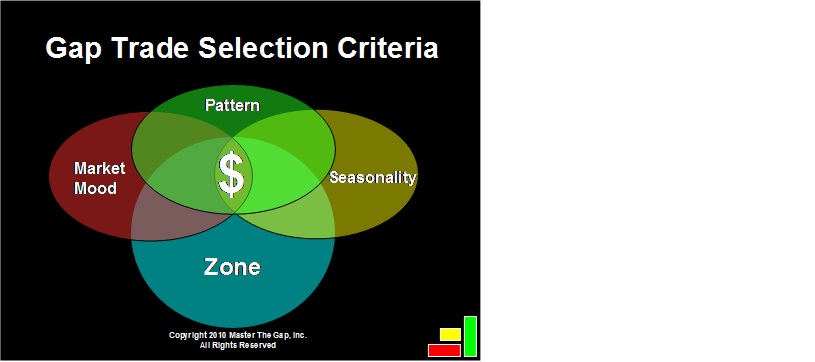

To profit from the opening gap, I use a benchmark stop size equal to 30% of the 5 day Average True Range and focus on only fading those gaps that have historically generated high enough win rates to more than compensate for the size of my stop. My selection filters for identifying the best expectancy setups consist of the opening zone, market conditions, patterns, and seasonality:

If the majority of these criteria show a compelling historical win rate and profit expectancy for fading the opening gap over the past 10 years, then I will take the trade. Otherwise, I will pass and wait for a higher expectancy setup in the coming days.

Is there any assurance that future trades will mimic those of the past? Of course not. But historical probabilities provide invaluable insights and help avoid the judgment errors that many traders make when selecting trades, taking profits or placing stops. Plus, probabilities provide the confidence I need to execute my trades properly – even when enduring a drawdown.

For every dollar made in the markets there is a dollar lost. It is a brutal zero sum game. If you are struggling, then maybe it’s time to focus on high expectancy trades and let history be your guide.

Scott Andrews

-------------------------------------------------------------------------------------------------------------------------------

Scott Andrews is a professional gap trader and president of MasterTheGap.com, an education service which provides daily probabilities and tools to help traders more profitably play opening gaps. Prior to trading, he co-founded SciQuest, Inc. and took the company public as CEO in 1999. He is the author of Understanding Gaps (published by TradersPress.com) and is a frequent speaker at trading and financial conferences. Mr. Andrews earned his MBA from the University of North Carolina, graduated from the United States Military Academy at West Point, and is a decorated aviator of the first Gulf War.

Segei, I don't believe it is manipulation in the way you suggest. I believe gaps are primarily the result of the very low volume in the overnight sessions that allows prices to move further than they would otherwise as they react to a wide range of catalysts (e.g economic reports).

As such, the large market participants don't want to pay premium prices and generally will wait for prices to retrace back to the prior daily close for a better entry price. Knowing this, a gap fader (especially of the indices) can often profit by fading the gap (trading the opposite direction of the overnight move) in anticipation of the gap filling.

Heres my questions re. gaps.

Are they caused by manipulation to take the profits of traders patiently holding a profitable trade for months, only to see profits dissapear and possibly turn into a losing trade by gapping beyond your safety stop and possibly getting you filled way below your entry price?

I clicked on the link and saw this ?affID=inomk

that's all I needed to know

enough said

It is NOT a zero-sum-game! The fees taken by the agencies are subtracted with each trade and on both sides.

The only true investors in the market are those who bought seats on the exchange the rest of us are speculators.

LOL - you are right Pierce. That's why most traders would be better served to focus only on high expectancy trades - high enough to covers the costs of commissions, slippage, and the occasional execution error and still leave ample profits over the long term.

There are opportunity costs with each trade too in terms of time, capital, and missing other higher expectancy setups that may emerge.

Okay, but the article is short on details & information. Everybody wants high probability trades but just looking at historical prices is not of much help other than at perhaps extreme situations which do not occur that often.

Thanks for the note J.

Regarding the value of historical prices - I guess it depends on your skill / interest using history as a guide. Personally, ALL of my daily gap trade decisions are based upon historical price action and results. Sometimes the fact that the market is not exhibiting unusual or extreme conditions is a big positive in itself.

Some folks struggle with reading charts and/or desire additional confirmation and that's where knowing whether a setup was historically profitable or not, and by how much, is of tremendous help for many.

This article was meant to get folks thinking in terms of the SINGLE most important criteria for any trade in any market: profit expectancy. Probabilities of winning or not is of little value. There is more info on my website of course.

this is good but plz if u send me candel chart of euro/usd then i be thankfull to u thanks