Today's post is by Saj Karsan of BarelKarsan.com. Saj's post is on stock fluctuation and value investing. Enjoy and be sure to leave us a comment on your favorite value stock.

===================================================================

In an "efficient market", all stocks are fairly priced by the market. If the US stock markets are efficient, and many finance industry professionals believe this to be the case, one cannot generate index-beating returns except through luck. However, if we were in an efficient market, it seems hard to believe that stock prices for even the most stable of companies should fluctuate so drastically from year to year and even from week to week. Yet that is exactly what happens.

Consider Best Buy (BBY), a US-based multi-national electronics retailer. It has generated consistent returns year after year, and has a low debt to equity ratio resulting in minimal financial risk. Yet it's stock price has fluctuated dramatically, offering astute investors the opportunity to achieve enormous returns.

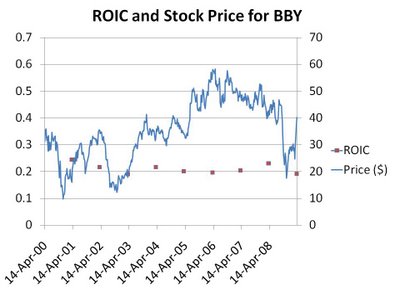

Below is a chart depicting Best Buy's annual return on invested capital (ROIC) contrasted with its stock price:

While ROIC has been predictable and consistently range bound for the last several years, the stock price has been anything but. It seems hard to believe that the market is efficiently pricing this security when its price can fluctuate wildly in relatively short periods of time while the company itself generates predictable earnings on capital. For example, if the company is worth X amount in early 2000, how does it become worth just one quarter of this amount 3 months later, and then three times this amount six months after that?

More recently, three months ago the market valued Best Buy at $7 billion, but now values it at $16 billion! Investors who recognized the mispricing have seen returns of over 100% in a 3 month period!

We've also seen other examples of this phenomenon: we've looked at graphs illustrating wild fluctuations in the historical P/E ratios of Coke and Walgreen, for example, which have allowed value investors to buy in at tremendous discounts.

Value investors willing to put psychological bias aside and instead invest at the height of the market's fear can indeed achieve above average returns.

Best,

Saj Karsan

===================================================================

Disclosure: Author owns a long position in shares of BBY

Saj regularly writes for Barel Karsan, a site dedicated to finding and discussing value investments, and applying logic to investment decisions (as opposed to falling prey to psychological biases). If this topic interests you, be sure to visit Barel Karsan.

Stock fluctuations can also occur in response to general economic or industry trends. When the economy is depressed, stock prices drop.

The above thought is smart and doesn’t require any further addition.It’s perfect thought from my side.

===========================

Harry

Price is relative to what else could be done with the money that otherwise would purchase the stock of Best Buy. For example, if interest rates jump up way high, then the relative reward/risk for buying treasuries would make sense compared to Best Buy stock and the opposite is likely true if interest rates fell to the floor. External factors account for price changes too, it's not just internal rate of return. I am not a believer in perfect efficient markets short term or long term. I believe they are sometimes nearly efficient but sometimes not and rarely just plane nuts. Why? because everything known about a stock does not necessarily result in action on price pressure. Some things known do not result in decisions to act. It is the knowledge of the actors that counts and that action is skewed as compared to the total knowledge pool. The key is to know the consensus of actionable knowledge and the capacity of the players to act on that knowledge...

I ask this - how can oil go from 50ish to 150ish and then drop back to 50ish now or lower?

the short answer - it is blatantly obvious it is MARKET MANIPULATION!!! and across the board market manipulation too in every market sector. deleveraging? perhaps is the more politically correct way of putting it.

*SHRUGS*

watch your behinds people!

The market is efficient in the long run, not in the short run. Whatever it is (greed, fear, uncertainty) that makes prices go way above, or way below the fundamental trend (which is generally up) in the short run, the market will eventually correct. If it didn't, the market might be more predictable but it would be a dull place to pass the time.